Chainlink ETF Nears Reality — But Holders Keep Selling LINK

Bitwise Chainlink ETF secures DTCC listing as retail sellers exit but institutional interest grows.

The Bitwise Chainlink ETF has been listed on the Depository Trust and Clearing Corporation (DTCC) platform under ticker CLNK. This move marks a key step toward institutional access to LINK.

Yet, on-chain data shows LINK holders have continued selling throughout the past month, even as institutional confidence grows.

Bitwise Chainlink ETF Listed on DTCC

The long-awaited Bitwise Chainlink ETF (CLNK) has been listed on the DTCC platform, marking a significant step toward institutional access to the LINK token.

The listing does not yet signify regulatory approval, but it indicates progress toward eventual trading readiness.

Bitwise Chainlink ETF is now listed on the DTCC platform$LINK ETF IS IMMINENT 🚨

— Quinten | 048.eth November 12, 2025

This listing is part of the standard clearing and settlement preparation process before a potential SEC approval.

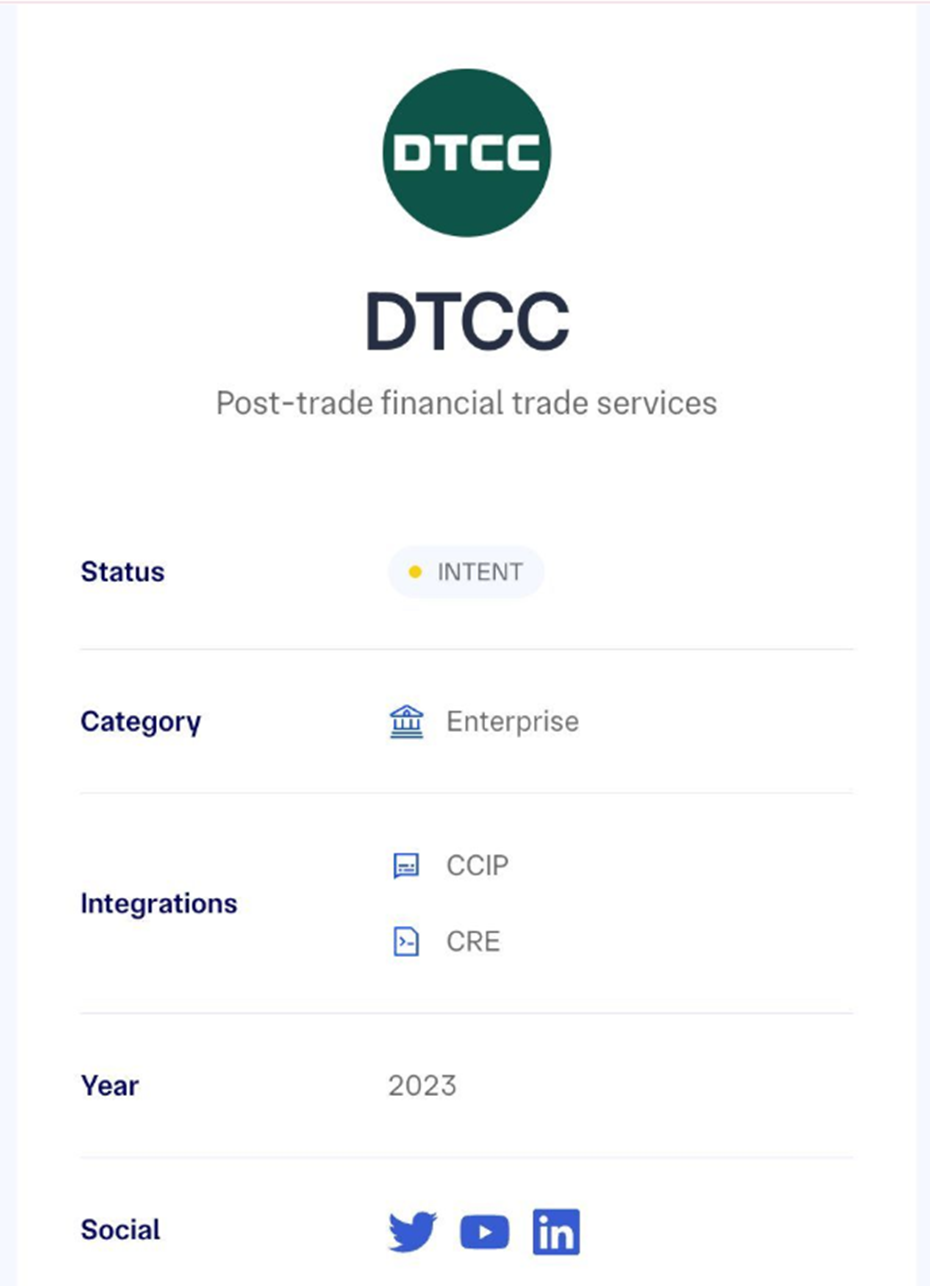

However, DTCC’s integration with Chainlink’s CCIP and CRE suggests the project’s expanding role in financial infrastructure.

DTCC integration with CCIP and CRE. Source:

Chainlink Ecosystem Website

DTCC integration with CCIP and CRE. Source:

Chainlink Ecosystem Website

Chainlink Steps into the Fed’s Circle

Further strengthening its institutional credibility, Chainlink Co-founder Sergey Nazarov recently joined executives from JP Morgan and Amazon at the Federal Reserve Fintech Conference. The panel focused on the convergence of global payment systems and digital assets.

NEW: CHAINLINK AT THE FEDERAL RESERVEJust now, @SergeyNazarov joined key decision makers from J.P. Morgan & Amazon at the Federal Reserve Fintech Conference to discuss how global payment systems & digital assets are converging.Full video ↓

— Chainlink November 12, 2025

It signals that Chainlink’s interoperability solutions are gaining traction among major financial players. Such appearances at top-tier policy forums typically boost institutional trust and visibility, key catalysts for large-scale adoption.

Despite Positive News, LINK Holders Keep Selling

Nonetheless, even as Chainlink edges closer to ETF approval and institutional integration, on-chain data shows persistent selling among LINK holders.

10/10 REALLY fucked up $LINK. Things were in a good place otherwise before that event. I think it will be ok but it might take longer than people think before we crawl out of this hole.

— CRP Survival Mode November 13, 2025

Based on the above post, sentiment mirrors a broader investor trend of disillusionment during accumulation phases. ClairHawk Capital explained that such patterns often accompany sideways, illogical, and bearish price action even when fundamentals are strong.

“They all do the same exact behavior when in accumulation…big money can’t just buy all at once and they also raise money by pumping distractions and memes and use that money to continue accumulating the asymmetric plays with the extra money as long as the public and retail are oblivious…once enough has accumulated, price action will start breaking out and enter price discovery,” the analyst explained.

Whales Accumulate as Exchange Balances Hit Record Low

While retail investors appear cautious, whales are steadily accumulating. According to on-chain analyst Ali, large holders have added over 4 million LINK tokens in the past two weeks, which has pushed the Exchange Supply Ratio to its lowest level ever.

Whales have accumulated more than 4 million Chainlink $LINK over the past two weeks!

— Ali November 7, 2025

Arca Research also observed that LINK on exchanges [is] in freefall, reaching a 2+ year low. This suggests long-term holders are moving tokens off exchanges in anticipation of higher prices.

LINK Exchange Balance. Source:

Arca on X

LINK Exchange Balance. Source:

Arca on X

With the Bitwise Chainlink ETF now on the DTCC platform, Chainlink’s path toward mainstream exposure is clearer than ever. Institutional integration, combined with whale accumulation, could soon shift market sentiment.

Chainlink (LINK) Price Performance. Source:

BeInCrypto

Chainlink (LINK) Price Performance. Source:

BeInCrypto

As of this writing, LINK token was trading for $15.93, up by almost 3% in the last 24 hours.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Crypto and Technology Industries Undergo Transformation Amidst Evolving Laws, Regulations, and Leadership Changes Reshaping Industry Norms

- Coinbase faces legal and strategic challenges, including a $1B insider trading lawsuit and a Delaware-to-Texas "DExit" migration to reduce tax burdens. - Bermuda positions itself as a crypto regulatory leader by licensing DerivaDEX, a DAO-governed derivatives exchange with institutional-grade security and sub-5ms trade speeds. - C3.ai's founder-CEO Thomas Siebel resigns unexpectedly, creating leadership uncertainty and prompting speculation about a potential sale amid competitive AI market pressures. - T

Bitcoin Updates Today: Czech National Bank's Groundbreaking Crypto Experiment: Opening Doors to Token-Based Finance

- Czech National Bank invests $1M in crypto portfolio including Bitcoin for testing operational, regulatory impacts. - The pilot aims to explore blockchain's role in future finance without conflicting with ECB policies. - Global central banks increasingly experiment with digital assets, reflecting evolving monetary strategies.

FAA Halts Reduction of Flights to Support Safety and Stabilize Air Travel During Delicate Recovery

- FAA freezes U.S. flight cuts at 6% for 40 major airports to balance safety and capacity recovery amid improved air traffic controller attendance. - Decision halts planned 10% reductions after 43-day government shutdown caused staffing crises, with 3,500 controller shortages still unresolved. - Over 10,100 flights canceled since cuts began, disproportionately impacting hubs like Atlanta and New York as airlines prioritize high-demand routes. - Analysts warn full recovery depends on resolving back-pay disp

Bitcoin News Update: Concerns Over Regulations Prompt Seasoned Bitcoin Holders to Offload 815,000 BTC

- Bitcoin veteran holders dumped 815,000 BTC recently, signaling market uncertainty amid a $100,000 price stall. - Long-term holders now control 12.3% of supply (down from 15.7% in January), marking a potential end to 2024's accumulation phase. - Analysts cite profit-taking and SEC lawsuits as key drivers, with regulatory fear outweighing macroeconomic risks like delayed Fed cuts. - Technical indicators show weakening momentum (RSI below 50), while open interest in futures fell 18% as traders brace for vol