HBAR Fails at $0.20 Again as Traders Stay Split on Direction

HBAR is struggling to gain traction despite increasing inflows and a positive Chaikin Money Flow. The token faces persistent resistance near $0.194, with consolidation expected unless market sentiment strengthens.

Hedera (HBAR) has struggled to gain meaningful momentum this week, facing repeated rejections at the $0.20 barrier.

Despite brief attempts at recovery, the altcoin continues to move within a narrow range, reflecting uncertainty in investor sentiment. The recent price action shows a lack of conviction from traders, even as inflows begin to pick up.

Hedera Inflows Rise, But Not Investors’ Optimism

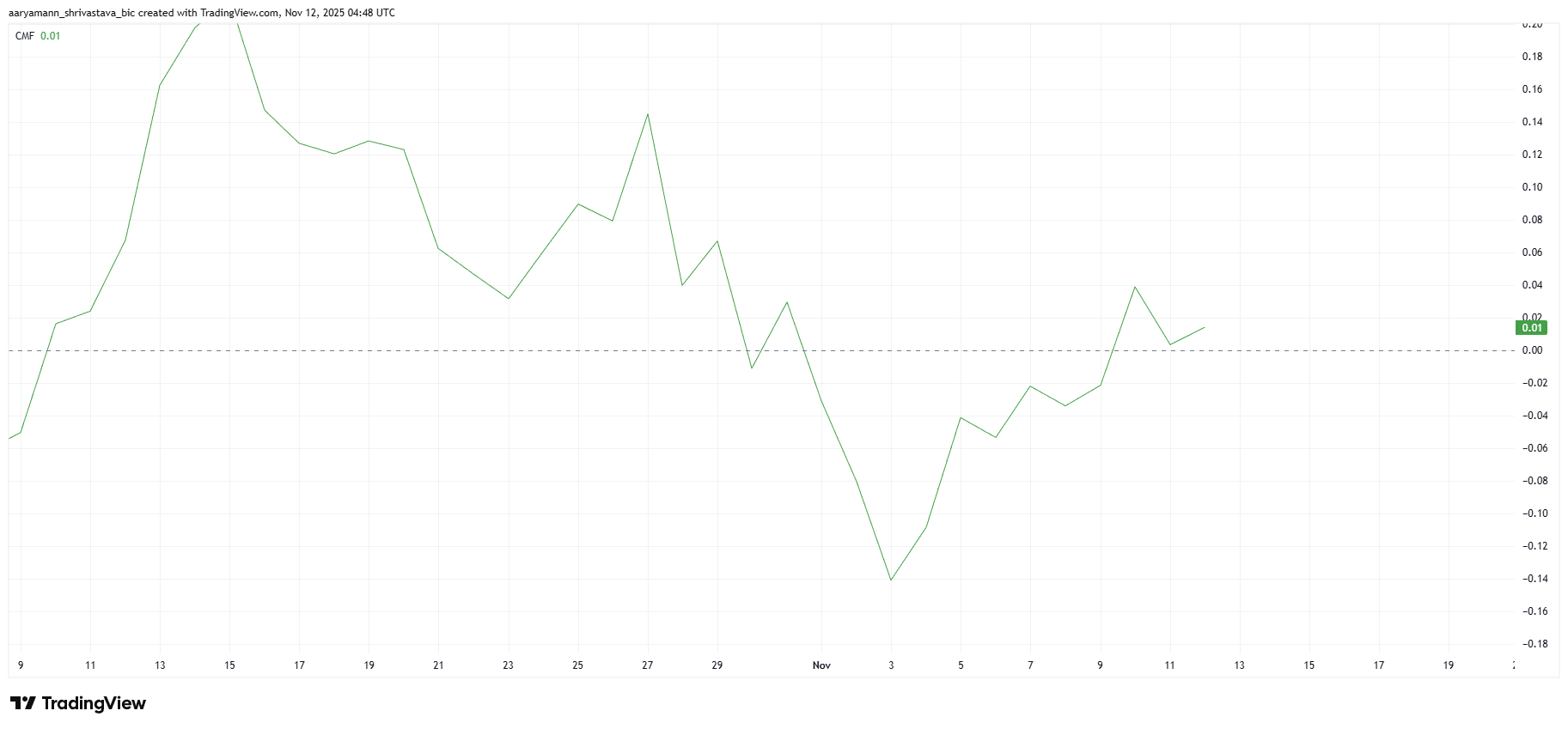

The Chaikin Money Flow (CMF) indicator shows a slight uptick, climbing into the positive zone above the zero line. This shift suggests that inflows are currently outpacing outflows, indicating growing buying activity. Rising inflows typically support price recovery, a much-needed boost for HBAR after several days of subdued movement.

However, the gains in inflows have yet to translate into strong price action. While investors are beginning to show interest, HBAR has not fully benefited from this trend. The improvement in liquidity signals optimism, but without stronger demand or higher trading volumes, the altcoin may continue to struggle near its upper resistance zones.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

HBAR CMF. Source:

HBAR CMF. Source:

HBAR CMF. Source:

HBAR CMF. Source:

The funding rate for HBAR has fluctuated over the last few days, revealing indecision among traders. Market participants appear unsure about the cryptocurrency’s next move, alternating between long and short positions to capitalize on short-term volatility. This uncertainty has prevented HBAR from building consistent bullish momentum.

Such inconsistent sentiment has historically hindered sustained rallies. When traders hesitate to commit to a clear direction, price movements often remain rangebound. For HBAR, this ongoing tug-of-war could limit upside potential.

HBAR Funding Rate. Source:

HBAR Funding Rate. Source:

HBAR Funding Rate. Source:

HBAR Funding Rate. Source:

HBAR Price Might Consolidate

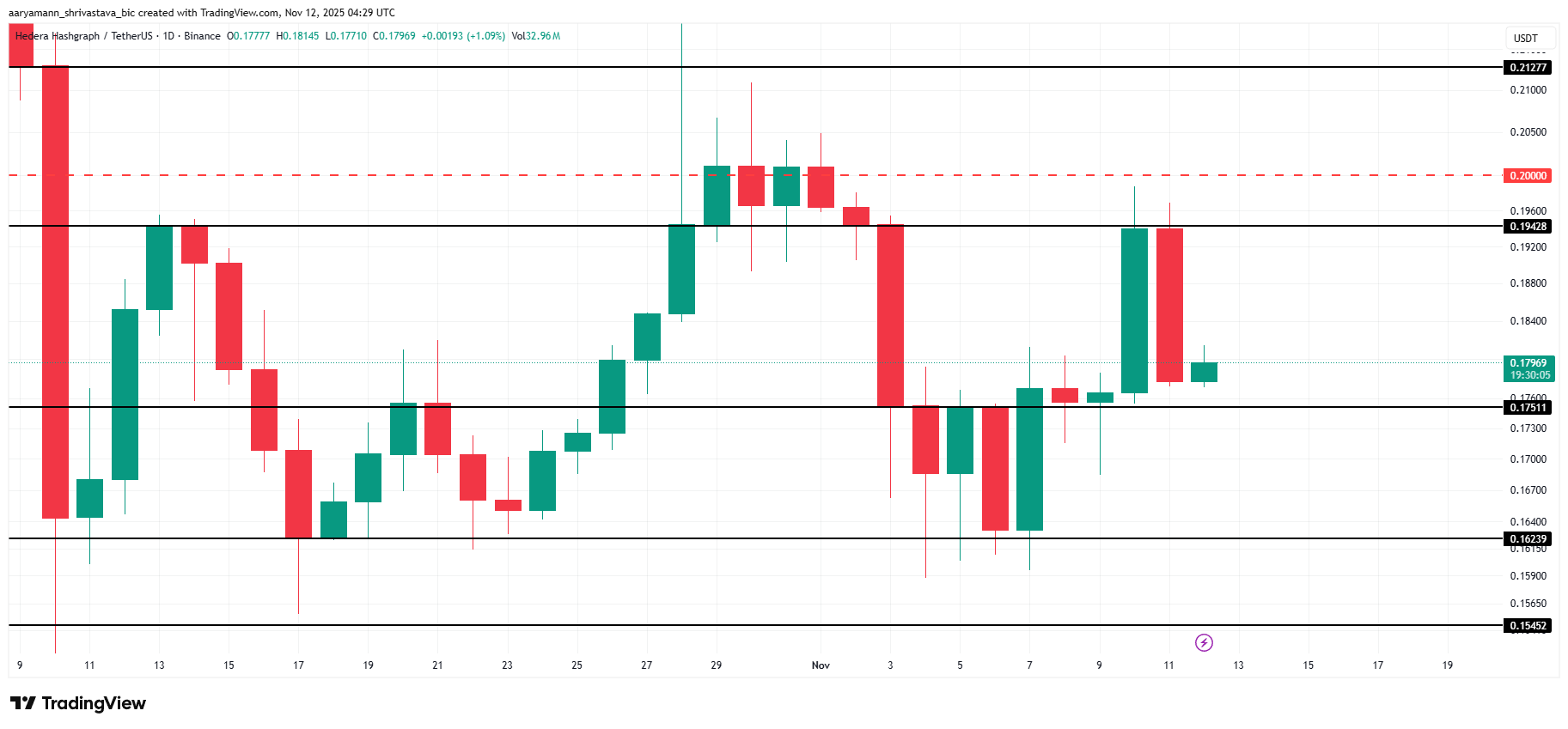

HBAR price is down 8% over the past 24 hours, currently trading at $0.179. The token recently failed to breach the $0.194 resistance level, which would have allowed it to challenge the critical $0.200 barrier. The rejection reinforces the prevailing weakness in market confidence.

This $0.200 resistance has acted as a significant ceiling for nearly a month. Considering the current technical signals, HBAR will likely consolidate within the $0.175 to $0.194 range in the near term.

HBAR Price Analysis. Source:

HBAR Price Analysis. Source:

HBAR Price Analysis. Source:

HBAR Price Analysis. Source:

If bearish momentum takes over, HBAR could fall through its $0.175 support level, potentially declining to $0.162. A drop below this level would invalidate the mild bullish outlook and extend the ongoing downtrend.

Read the article at BeInCryptoDisclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Aster DEX’s Latest Protocol Update and What It Means for DeFi Liquidity Providers

- Aster DEX's November 2025 upgrade enhanced DeFi capital efficiency by enabling $ASTER as 80% margin collateral and reducing ARUSDT tick sizes to 0.001. - The update introduced 300x leverage, yield-generating collateral (asBNB/USDF), and a 5% fee discount for ASTER holders to boost liquidity and token utility. - While trading volume surged 800% to $2B and TVL reached $1.16B, protocol fees stagnated below $20M and open interest halved, highlighting adoption challenges. - LPs face dual risks: leveraged vola

Dogecoin Latest Updates: Meme Tokens Surge on Trump’s Economic Pledges While Epstein Scandal Sparks Investor Uncertainty

- Trump's tariff-driven $2,000 dividend pledge boosts Dogecoin (DOGE) 5.2% as investors bet on populist economic policies. - Resurfaced Epstein emails alleging Trump's awareness of abuse claims threaten his credibility and market stability. - Analysts link Trump's "Liberation Day" rhetoric to increased risk appetite in meme coins, despite fiscal and legal uncertainties. - Congressional scrutiny of Epstein ties and Trump's trade policies could amplify volatility as 2025 election approaches.

Bitcoin News Update: 21Shares Connects Conventional and Crypto Markets Through 40 Act ETFs

- 21Shares launched first U.S. crypto index ETFs under the 1940 Act, offering diversified exposure to top 10 cryptocurrencies including Bitcoin and Ethereum . - The TTOP and TXBC ETFs charge 0.5%-0.65% fees, rebalance quarterly, and exclude Bitcoin in TXBC to focus on smaller altcoins. - These ETFs leverage stricter 1940 Act standards over the 1933 Act, attracting institutional investors amid growing regulatory clarity for crypto products. - The launch signals maturing crypto markets, with 21Shares partner

Why Are Zero-Knowledge (ZK) Cryptocurrencies Gaining Momentum in 2025

- Zero-knowledge (ZK) cryptocurrencies surged in 2025 due to scalability breakthroughs like ZKsync's 15,000 TPS Atlas upgrade and StarkNet's ZK-native application ecosystem. - Institutional adoption accelerated as Deutsche Bank and Sony leveraged ZK for confidential settlements and digital rights management, reducing gas fees by 70% for high-frequency trading. - Regulatory clarity from U.S. GENIUS/CLARITY Acts and Ethereum's zkEVM roadmap boosted institutional confidence, with crypto allocations projected