Bitcoin Is Now Facing “Historical Recovery Barrier” Amid Heightened Market Churn

Bitcoin is struggling to regain strength as heightened volatility and speculative trading keep prices below $105,000. A breakout above resistance could spark recovery toward $108,000.

Bitcoin’s price has struggled to regain strength since late October, with multiple failed recovery attempts extending its decline.

The leading cryptocurrency has been oscillating near critical support levels as on-chain indicators reveal emerging signs of weakness. Rising volatility and a lack of directional conviction continue to define market behavior.

Bitcoin May Face Resistance

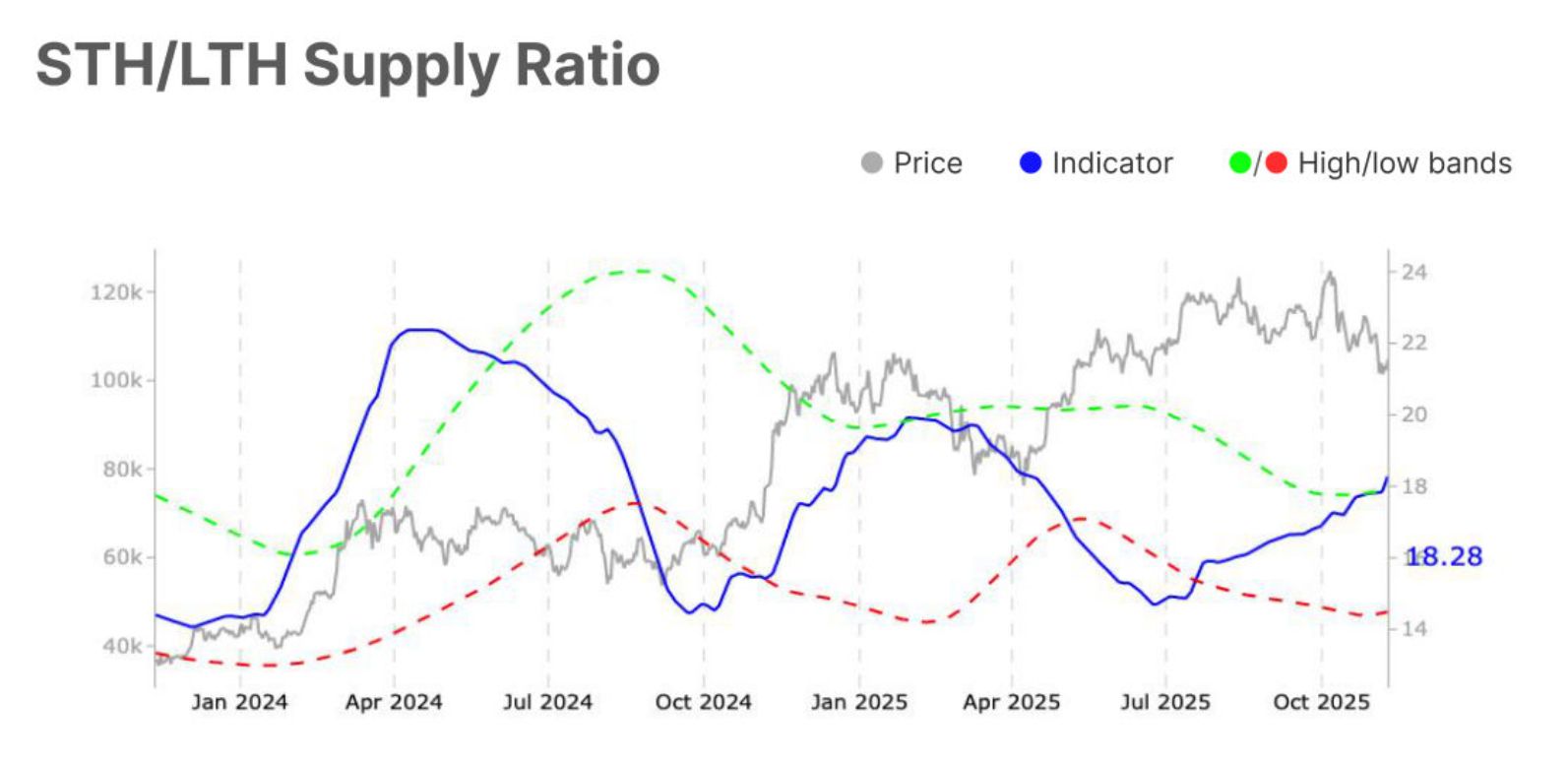

The Short-Term Holder to Long-Term Holder (STH/LTH) Supply Ratio recently rose to 18.3%, exceeding the upper band of 17.9%. This signals elevated speculative activity as short-term traders dominate market movements. Increased turnover without sustained price direction has led to heightened volatility in Bitcoin’s trading environment.

The surge in this ratio also suggests that traders are quickly shifting between profit-taking and accumulation phases. As a result, market churn has intensified, leaving Bitcoin vulnerable to sharp but short-lived price swings.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter

Bitcoin STH/LTH Supply Ratio. Source:

Glassnode

Bitcoin STH/LTH Supply Ratio. Source:

Glassnode

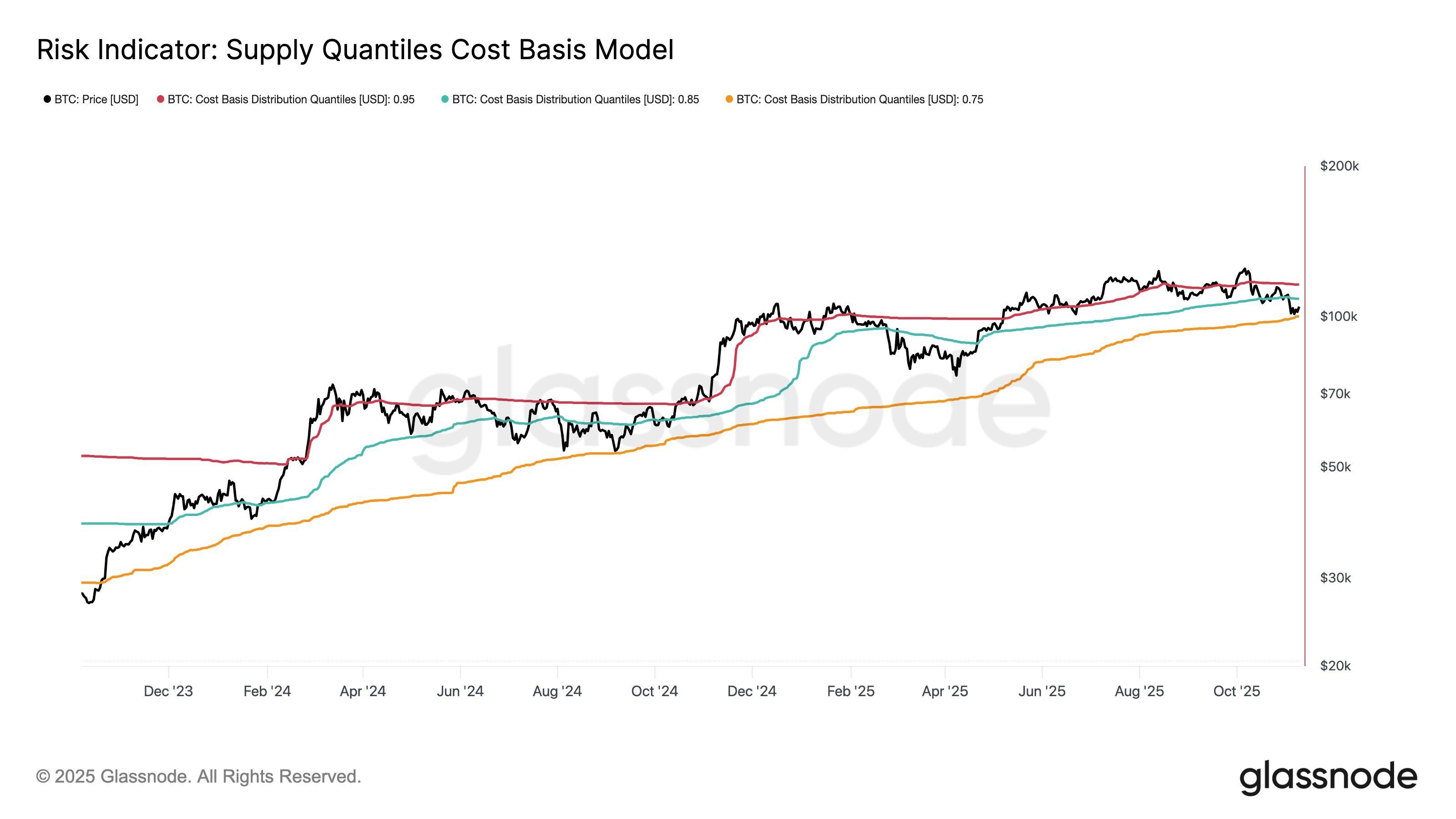

According to the Supply Quantiles Cost Basis model, Bitcoin has rebounded from the 75th percentile cost basis near $100,000 and is consolidating around $106,200. This area reflects a critical psychological and technical zone for traders, marking a temporary stabilization following weeks of selling pressure.

The next resistance lies at the 85th percentile cost basis of $108,500, which has historically capped recovery attempts during similar phases. The model’s data suggests Bitcoin’s upside may remain limited in the short term.

Bitcoin Supply Quantiles Cost Basis Model. Source:

Glassnode

Bitcoin Supply Quantiles Cost Basis Model. Source:

Glassnode

BTC Price Breakout Awaited

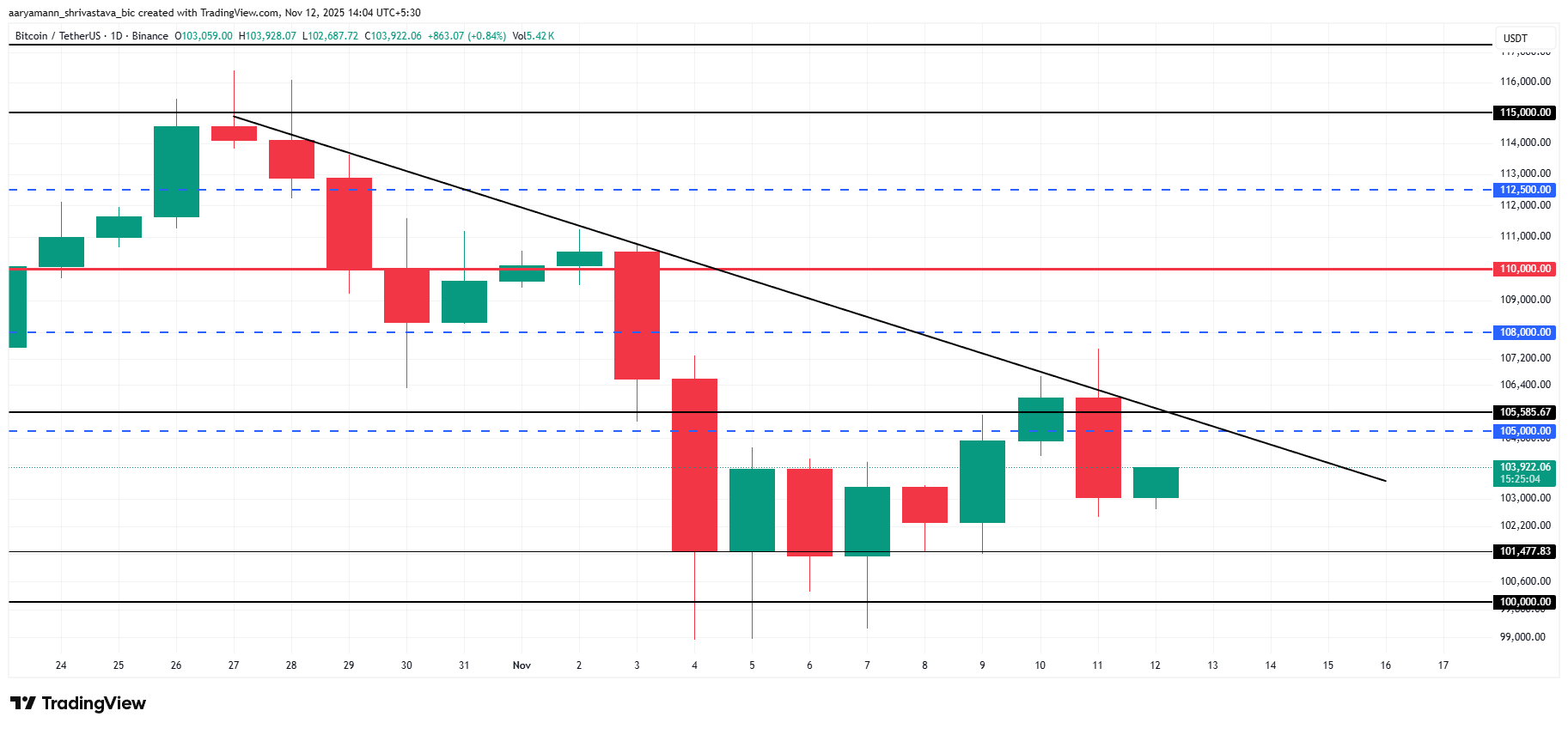

Bitcoin’s price is currently at $103,922, struggling to overcome the downtrend that has been active for nearly two and a half weeks. The cryptocurrency has failed twice to breach this resistance, reinforcing the strength of bearish market sentiment.

At present, Bitcoin trades below $105,000 but remains above the $101,477 support zone. This area is likely to form a consolidation base amid persistent volatility and cautious investor behavior.

Bitcoin Price Analysis. Source:

TradingView

Bitcoin Price Analysis. Source:

TradingView

If bullish momentum strengthens, Bitcoin could break past $105,000 and challenge resistance near $108,000. Successfully flipping this level would mark the first significant recovery since October, signaling renewed optimism across the broader crypto market.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin News Update: Crypto Market Finds "Fertile Ground" Post-Drop as Buyers Take in Capitulation Sales

- Bitcoin fell below $95,000 in late November 2025, triggering panic as the Fear & Greed Index hit a nine-month low of 10. - Waning institutional demand, macroeconomic uncertainty, and $600M in forced liquidations accelerated the selloff, with spot ETFs losing $1.1B in outflows. - XWIN Research warned the correction could persist until mid-2026 if key $92,000–$94,000 support levels fail, while 96 of top 100 cryptos declined. - Political tensions emerged after Trump pardoned Binance's Zhao, who received a $

Bitcoin News Update: "Institutions' Confidence or Meme Frenzy: Crypto Faces the $110,000 Turning Point"

- Bitcoin rebounds from $100k lows amid U.S. government reopening, with analysts eyeing $110k as potential target driven by regulatory clarity and ETF optimism. - MoonBull ($MOBU) emerges as high-risk speculative play, projecting 7,244% ROI through Ethereum-based tokenomics including liquidity locks and 2% holder reflections. - Market duality highlighted by institutional-grade BTC consolidation vs. community-driven meme tokens, with $MOBU's 23-stage presale raising $600k and 1,900+ holders. - Technical ind

Ethereum News Update: Ethereum’s Unsteady Recovery: Weighing Optimism Against Ongoing Downward Pressures

- Ethereum rose 2.36% to $3,533 on Nov 13, 2025, with $37B trading volume, showing a rebound from $3,373 lows amid crypto market volatility. - Technical analysis warns of fragile recovery, with key support at $3,053 holding but bearish signals from MACD and a broken upward channel. - Broader crypto pressure persists as Bitcoin and Ethereum ETFs face outflows, while macroeconomic uncertainties like U.S. government shutdown risks dampen institutional participation. - Analysts advise caution below the 200-day

Uniswap News Today: Uniswap's UNIfication Launches a New Era of DeFi Leadership for the Next Decade

- Uniswap's UNIfication proposal introduces protocol fees, token burns, and buybacks to transform UNI into a deflationary asset. - The plan drives UNI's 63% weekly price surge and allocates 0.3% trading volume to liquidity providers and buybacks. - Whale accumulation and $38M/month buyback projections signal strong market confidence in Uniswap's governance overhaul. - The proposal unifies Uniswap's ecosystem, introduces fee discounts, and launches CCA for institutional-grade liquidity infrastructure. - DeF