Tether taps HSBC executives to ramp up $12b gold strategy

Tether poached two senior executives from a bank that oversees one of the world’s most extensive gold vaults.

- Tether is doubling down on its gold bet by hiring two of HSBC’s top gold traders

- HSBC operates one of the largest private gold vaults in the world

- The stablecoin issuer currently holds more than $12 billion in physical gold

As macro uncertainty fuels renewed interest in precious metals, the world’s largest stablecoin issuer is doubling down on its gold bet. On Tuesday, November 11, Tether announced the hiring of two top gold traders from London-based HSBC.

HSBC’s global head of metals trading, Vincent Domien, will join Tether in the coming months. He’ll be accompanied by Mathew O’Neill, HSBC’s head of precious metals for Europe, the Middle East, and Africa.

The two executives’ role will be to aggressively expand the firm’s physical bullion holdings, which currently total $12 billion.

These include the reserves for the Tether Gold (XAUT) token, which has a market cap of $1.56 billion. The remaining physical gold is part of the reserves that back USDT.

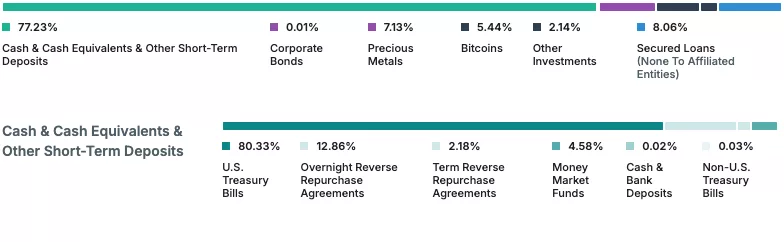

Reserves backing USDT stablecoins, as of September 30 | Source: Tether

Reserves backing USDT stablecoins, as of September 30 | Source: Tether

Tether plans major gold expansion

Tether has been adding gold to its reserves at an average pace of 1 metric ton per week during September of this year. According to Bloomberg, this makes Tether one of the largest non-state buyers of gold. For this reason, taping HBSC executives makes strategic sense for the firm.

HBSC operates a vast gold reserve in London, one of the largest in the world. The company is also one of the biggest market makers in spot gold, gold futures, swaps, and options. It is also one of the core clearing members in the London Bullion Market Association. HSBC was also one of the first companies to launch a tokenized gold offering, which went live in 2024.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

TWT’s 2025 Tokenomics Revamp: Redefining Utility and Investor Rewards on Solana

- Trader Joe's (TWT) 2025 tokenomics prioritizes utility over speculation, offering gas discounts, DeFi collateral, and governance rights. - A deflationary model with 88.9B tokens burned creates scarcity, while loyalty rewards redistribute existing tokens to avoid dilution. - Community governance allows holders to vote on platform upgrades, aligning token value with ecosystem growth and user participation. - This Solana-based approach redefines DeFi incentives by linking price appreciation to real-world ut

HYPE Token: Evaluating Immediate Price Fluctuations and Speculative Dangers in the Meme-Based Cryptocurrency Sector

- HYPE token, a meme-driven crypto, relies on social media hype and influencer endorsements rather than traditional financial metrics. - The $TRUMP meme coin example highlights extreme volatility, with large profits for top wallets and massive losses for retail investors. - Institutional products like CMC20 exclude meme coins, signaling limited recognition of their market utility despite growing crypto infrastructure. - Regulatory scrutiny intensifies as SEC targets influencer promotions, while foreign inv

PENGU Token Value Soars: An In-Depth Technical and On-Chain Examination of Market Trends

- PENGU token's 12.8% 24-hour surge driven by Bitcoin's 4.3% rally and altcoin rebound. - Technical indicators show short-term bullish momentum conflicting with long-term bearish trends. - Whale activity and $8.91M in exchange inflows contrast with 2B token outflows and leveraged shorts. - NFT sales decline and DeFi innovations like CMC20 index token add downward pressure. - Analysts urge caution due to structural weaknesses despite short-term trading opportunities.

Banks Transform Finance: Cryptocurrency Adoption Sparks Fundamental Shifts

- LevelField Financial secures state approval to acquire Burling Bank, aiming to integrate crypto services into traditional banking with $70M deal. - Post-2023 crypto bank collapses, regulators adopt cautious openness, enabling LevelField's renewed acquisition bid amid Trump's "crypto capital" agenda. - SGX Derivatives launches Bitcoin/Ethereum futures targeting institutions, aligning with $187B daily crypto derivatives volume in Asia. - Grab and GoTo struggle to consolidate Southeast Asian fintech despite