Tether’s Latest Gold Move Mirrors Central Banks

Tether is building a bullion desk like a central bank, signaling a shift toward gold-backed digital reserves amid global de-dollarization.

USDT stablecoin issuer Tether is deepening its exposure to physical gold as global monetary dynamics change. The company reportedly brought in two senior HSBC traders, Vincent Domien and Mathew O’Neill, to oversee its gold operations.

Both have decades of experience in metals trading and are expected to help Tether scale its bullion holdings.

Private Stablecoins, Public Strategy

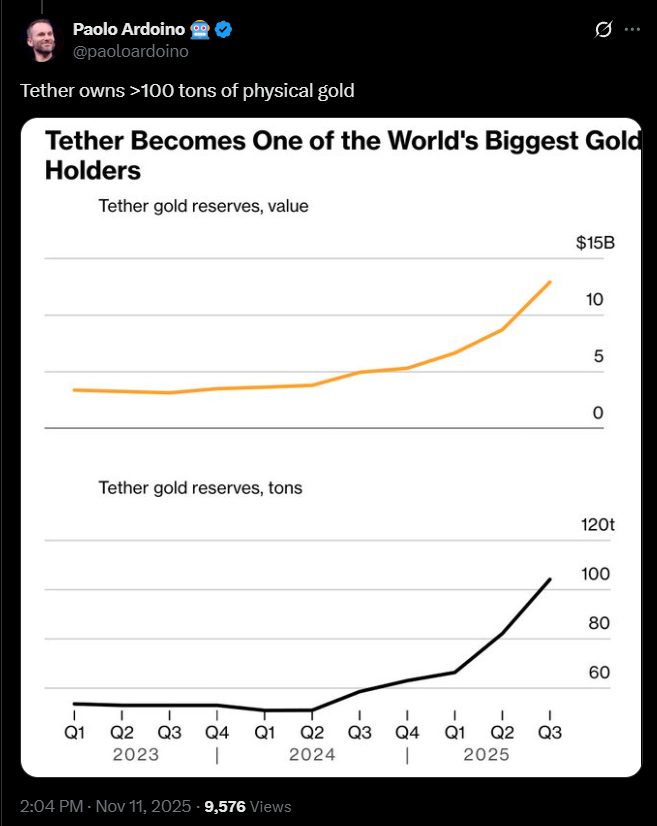

This move follows reports that Tether has already stockpiled billions in physical gold. The company is showing a strong preference for hard assets over fiat-based instruments.

Tweet From Tether CEO

Tweet From Tether CEO

The timing coincides with record central bank purchases of gold and rising global demand for non-dollar reserves.

While central banks diversify away from the US dollar, Tether appears to be following a similar path in the private sector. The company’s shift suggests it views gold as a strategic hedge—both against fiat volatility and regulatory pressure.

Unlike Circle’s USDC, which primarily holds short-term US Treasuries, Tether’s bullion reserves signal a break from dollar dependency.

Also, this divergence highlights a broader divide in stablecoin reserve philosophy: yield generation versus long-term security.

Tether’s bullion buildup could alter the perception of stablecoins from digital cash to privately managed reserve assets.

In effect, Tether is acting less like a payment processor and more like a sovereign wealth fund.

Tether isn’t stacking dollars. They’re stacking gold. $12.9B worth. If this ain’t your wake up call to go long gold I don’t know what is.

— Mr. Uppy (@MisterUppy) November 7, 2025

Tether’s Footsteps Echo of Central Bank Behavior

Central banks purchased more than 1,000 tonnes of gold in 2024, the second-highest annual total on record.

Much of that buying came from emerging economies seeking insulation from dollar-linked volatility. Tether’s accumulation of gold mirrors this pattern.

Tether’s bullion operations also introduce new logistical and security challenges. Managing physical assets within a tokenized framework demands strict custody, audit, and cyber resilience measures.

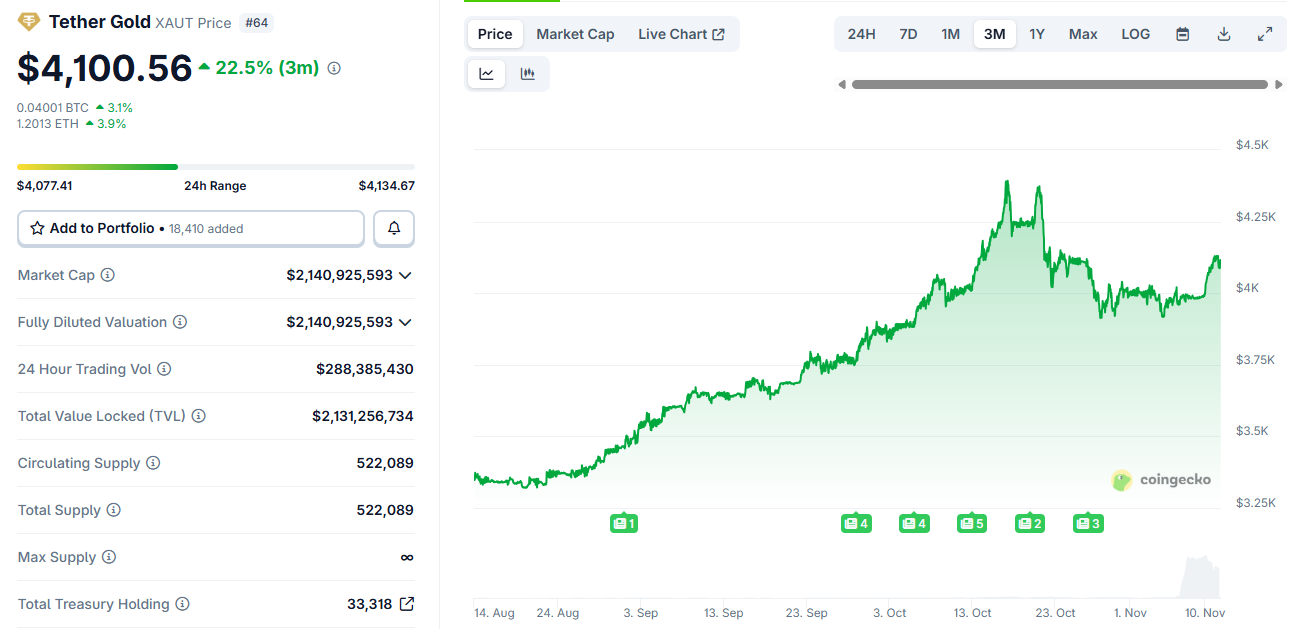

Tether Gold Token Price Chart. Source:

Tether Gold Token Price Chart. Source:

With HSBC veterans now on board, the company appears focused on building that institutional backbone.

However, transparency remains a concern. Critics argue that without frequent independent audits or full reserve disclosure, Tether’s gold strategy could face the same scrutiny that long surrounded its stablecoin reserves.

Overall, the move hints at a coming era where private entities hold diversified, multi-asset reserves rivaling national central banks.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

TWT’s 2025 Tokenomics Revamp: Redefining Utility and Investor Rewards on Solana

- Trader Joe's (TWT) 2025 tokenomics prioritizes utility over speculation, offering gas discounts, DeFi collateral, and governance rights. - A deflationary model with 88.9B tokens burned creates scarcity, while loyalty rewards redistribute existing tokens to avoid dilution. - Community governance allows holders to vote on platform upgrades, aligning token value with ecosystem growth and user participation. - This Solana-based approach redefines DeFi incentives by linking price appreciation to real-world ut

HYPE Token: Evaluating Immediate Price Fluctuations and Speculative Dangers in the Meme-Based Cryptocurrency Sector

- HYPE token, a meme-driven crypto, relies on social media hype and influencer endorsements rather than traditional financial metrics. - The $TRUMP meme coin example highlights extreme volatility, with large profits for top wallets and massive losses for retail investors. - Institutional products like CMC20 exclude meme coins, signaling limited recognition of their market utility despite growing crypto infrastructure. - Regulatory scrutiny intensifies as SEC targets influencer promotions, while foreign inv

PENGU Token Value Soars: An In-Depth Technical and On-Chain Examination of Market Trends

- PENGU token's 12.8% 24-hour surge driven by Bitcoin's 4.3% rally and altcoin rebound. - Technical indicators show short-term bullish momentum conflicting with long-term bearish trends. - Whale activity and $8.91M in exchange inflows contrast with 2B token outflows and leveraged shorts. - NFT sales decline and DeFi innovations like CMC20 index token add downward pressure. - Analysts urge caution due to structural weaknesses despite short-term trading opportunities.

Banks Transform Finance: Cryptocurrency Adoption Sparks Fundamental Shifts

- LevelField Financial secures state approval to acquire Burling Bank, aiming to integrate crypto services into traditional banking with $70M deal. - Post-2023 crypto bank collapses, regulators adopt cautious openness, enabling LevelField's renewed acquisition bid amid Trump's "crypto capital" agenda. - SGX Derivatives launches Bitcoin/Ethereum futures targeting institutions, aligning with $187B daily crypto derivatives volume in Asia. - Grab and GoTo struggle to consolidate Southeast Asian fintech despite