Uniswap News Today: Uniswap’s UNIfication Proposal Sparks Debate Between Liquidity Incentives and Protocol Security in a Crucial Trial

- Uniswap's UNI token fell 20% to $8.246 after a whale deposited 1.19M tokens on Binance, incurring a $914k loss from $11.45M accumulated in 2025. - The UNIfication proposal aims to redirect trading fees to token holders, burning 100M UNI ($800M) and restructuring governance to boost protocol growth. - UNI surged 48% to $10.30 post-proposal but underperformed broader crypto markets, while Binance launched an ALLO AI coin airdrop for HODLers.

Uniswap's own token

UNI's broader price trends have been influenced by Uniswap's pivotal "UNIfication" initiative, which proposes activating a fee switch to direct trading fees to token holders and support protocol growth. This proposal, jointly put forward by

This proposal has already fueled a 48% jump in UNI's value, lifting it from $7.00 to above $10.30 in early November. Experts attribute this surge to rising confidence in Uniswap's shift from a passive governance asset to one with tangible economic benefits, along with the possibility of annual protocol revenue surpassing $2.75 billion. Nonetheless, there are still concerns, such as potentially lower rewards for liquidity providers and ongoing regulatory ambiguity, especially given the SEC's previous attention to Uniswap during Gary Gensler's tenure

Looking forward, Uniswap's governance community is set to vote on the UNIfication proposal by the end of November, with the voting period expected to wrap up by mid-December after 22 days. If the changes are approved, they could transform DeFi economics by establishing a sustainable model for token value growth. The result will also

Meanwhile, Binance has added to the crypto market's activity by launching the Allora (ALLO) AI coin airdrop. As the 58th project in Binance's HODLer Airdrops series, ALLO will be available for trading on November 11 against

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Quantum Computing Could Break Bitcoin Security — Here’s What You Can Do Now to Secure Your BTC

Hyperliquid (HYPE) Price Rally: Increased On-Chain Engagement and Institutional Interest Drive Expansion Prospects

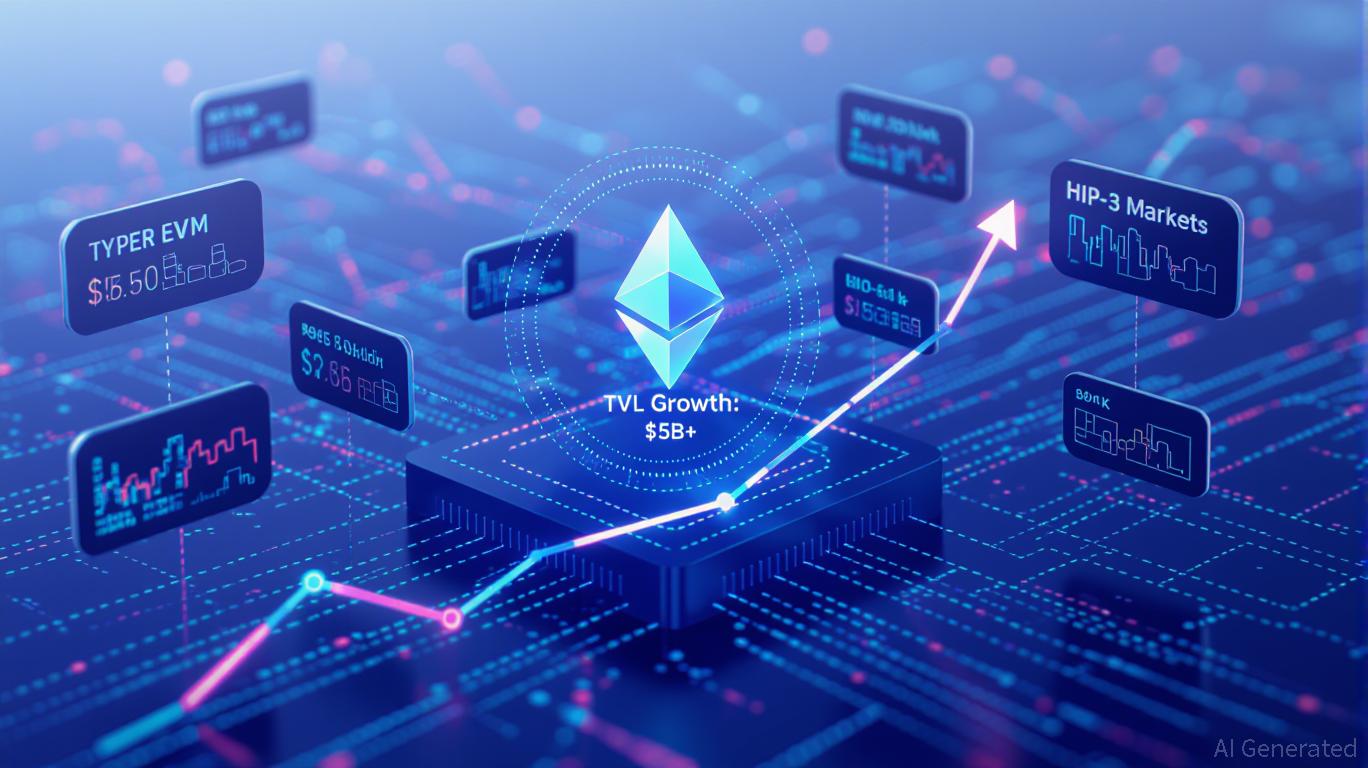

- Hyperliquid's HYPE token surged 32% driven by whale trading and institutional adoption via HIP-3 framework. - Whale activity shows $9M UNI short vs. $3.1M long positions, highlighting platform's speculative role in volatile assets. - Institutional partnerships with RedStone and Felix, plus 21Shares' ETF application, signal growing market confidence. - TVL reached $5B with 73% decentralized trading share, but regulatory gaps and leadership changes pose sustainability risks.

The Growing Fascination with Hyperliquid: Is This the Next Evolution in Cryptocurrency Trading?

- Hyperliquid dominates decentralized trading in 2025 with $303B Q3 volume, 62% perpetual DEX open interest, and $5B TVL growth. - Ecosystem expansion includes HyperEVM (100+ protocols, $2B TVL) and USDH stablecoin (backed by BlackRock , $2.2M trading volume). - Institutional adoption grows via 21Shares' ETF application, but risks include regulatory scrutiny, 16-validator security vulnerabilities, and HYPE token volatility. - Competitors like Aster (near-$30B daily volume) challenge Hyperliquid's dominance

YFI drops 2.95% over 24 hours as market experiences turbulence

- Yearn.finance (YFI) fell 2.95% in 24 hours to $4,851 amid crypto market volatility. - Despite short-term gains (0.96% weekly, 2.52% monthly), YFI has dropped 39.62% over one year. - Traders analyze technical indicators and on-chain data to assess if the dip is a correction or deeper trend. - A backtest evaluates moving averages and volume signals to test strategies for mitigating losses during volatility.