Biopharma raises $100M for crypto treasury to back cancer treatment

Australia-based Propanc Biopharma has announced that it has secured $100 million from a crypto-focused family office to launch a crypto treasury — a move its CEO described as “transformative” as its cancer therapy product enters human trials next year.

The private placement, structured through convertible preferred stock, provides Propanc with an initial $1 million investment and up to $99 million in follow-on funding over the next 12 months from Hexstone Capital, a family office that invests in several crypto treasury companies.

The cancer-treating biotech company stated that the proceeds will be used to build a digital asset treasury and accelerate the development of its lead cancer therapy, PRP, which aims to enter first-in-human trials in the second half of 2026.

Propanc CEO James Nathanielsz said the crypto treasury would assist a “transformative phase” for the company by strengthening its balance sheet and advancing its proenzyme-based oncology platform.

“We can target not only patients suffering from metastatic cancer from solid tumors, but several chronic diseases based upon the mechanism of action of proenzyme therapy.”

While Propanc didn’t say which digital assets it plans to buy for its crypto treasury, Hexstone’s clients have invested in everything from Bitcoin (BTC), Ether (ETH), Solana (SOL), Injective (INJ) as well as some lesser-known cryptocurrencies.

Biotech companies adopting a crypto strategy

Propanc joins Sonnet BioTherapeutics, Sharps Technology and other biotech companies that have turned to crypto to reignite investor interest.

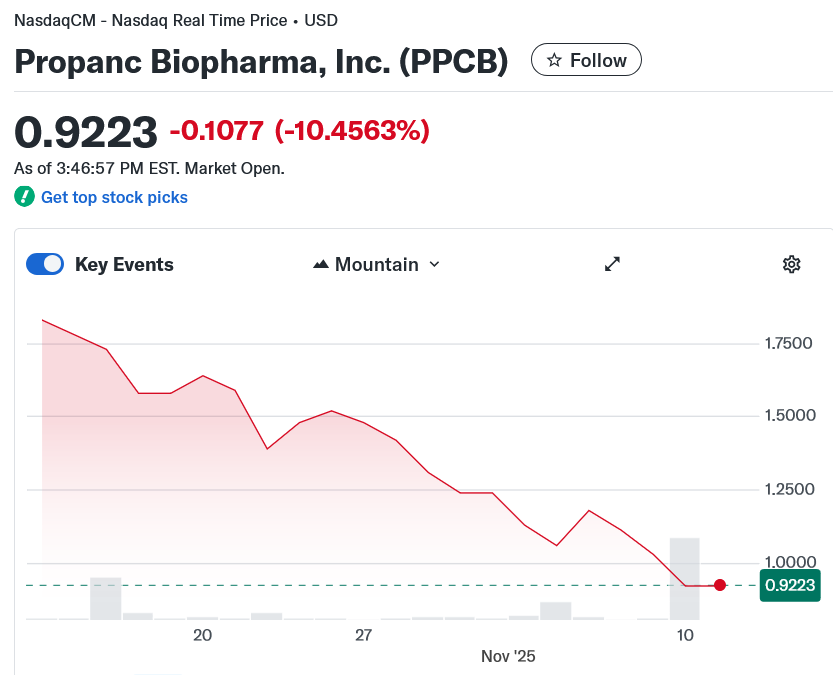

However, Propanc’s move was not received well by its investors, with PPCB shares diving 10.5% on the Nasdaq on Monday, according to Yahoo Finance data.

Crypto treasury strategies haven’t fared well lately

Bitcoin treasury holding companies have lost some of their sheen over the last few months as more companies flood into the space.

Related: ‘Most hated bull run ever?’ 5 things to know in Bitcoin this week

Even Strategy, the largest corporate Bitcoin holder, has seen its market cap slide over 43% from $122.1 billion in July to $69.1 billion today.

Metaplanet, one of the best-performing stocks on the Tokyo Stock Exchange to start the year, has been hit even harder, falling around 55% since late June, while other Bitcoin treasury companies have even had to offload some of their BTC holdings to pay outstanding debt.

Magazine: Bitcoin OG Kyle Chassé is one strike away from a YouTube permaban

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum Updates Today: MoonBull’s Unique Ethereum Foundation Distinguishes It in the Competitive Meme Coin Space

- MoonBull ($MOBU) surges in Stage 6 presale with 7,244% ROI potential, leveraging Ethereum's security and deflationary tokenomics. - A structured referral system offers 15% extra tokens and USDC bonuses, driving $600K+ raised and 2,000+ holders. - Unlike meme coins, MoonBull's Ethereum-based model with staking and governance aims for sustainability, contrasting with volatile alternatives like TRUMP and XRP . - Analysts caution about crypto volatility, emphasizing ROI projections depend on market condition

From Pharmaceuticals to Blockchain: Lite Strategy's $100 Million LTC Reserve Disrupts Traditional Finance

- Lite Strategy (LITS) becomes first U.S. publicly traded company to adopt Litecoin as primary reserve asset after $100M private placement. - Partnership with crypto firm GSR and Litecoin creator Charlie Lee on board aims to institutionalize digital treasury management amid volatile markets. - $12.21M working capital and 12.39 current ratio highlight liquidity strength despite 18% YTD stock decline and mixed institutional investor reactions. - Strategic shift from pharmaceuticals to crypto reserves challen

Malaysia’s Broad Trade Approach Counters Trump Tariffs, Fuels 5.2% Economic Expansion

- Malaysia navigated Trump's 2025 tariffs via trade diversification and diplomacy, avoiding panic amid global market shocks. - U.S. reduced tariffs to 19% in October 2025 after Malaysia opened markets, coinciding with 5.2% Q3 GDP growth driven by exports and fiscal discipline. - Strategic trade ties with China, Singapore, and U.S. mitigated protectionist impacts, supported by ASEAN coordination and non-retaliatory policies. - Malaysia's $250M investment in semiconductor design and renewable energy reflects

Lite Strategy’s Balancing Game in Crypto-Pharma: Is It Possible to Manage Instability and Tradition Together?

- Lite Strategy (LITS) rebranded from MEI Pharma to focus on Litecoin , acquiring 929,548 LTC via a $100M PIPE in July 2025. - The company partners with GSR for crypto treasury management and launched a $25M share repurchase program in October 2025. - LITS holds $12.21M in working capital with no debt, while balancing pharmaceutical asset sales (e.g., ME-344) with crypto investments. - Despite strong liquidity (current ratio 12.39), the stock faces volatility risks and regulatory uncertainties in its crypt