- The Live Price Of XRP $ 2.53449153

- Predictions suggest XRP could reach $5.05 by the end of 2025.

- Long-term projections show XRP could hit $26.50 by 2030 and $526 by 2050.

XRP price currently stands at $2.99, with a market capitalization of $179.79 billion. Analysts and AI forecasts alike suggest that XRP could reach $5.05 by the end of 2025. Long-term XRP price predictions also place it as high as $26.50 by 2030, with an ultra-bullish target of $526 by 2050.

Ripple (XRP) remains one of the top five crypto assets in the world, gaining traction as institutional adoption ramps up and its prolonged legal battle approaches resolution. Since President Trump’s return to office, XRP has seen a resurgence in on-chain activity, investor sentiment, and speculation around potential ETF approval.

In July 2025, XRP marked a new all-time high of $3.66, coinciding with the ProShares Ultra XRP ETF launch. As more asset managers have filed for the ETF approval race, the crypto community is now asking: How high can XRP go?

| Cryptocurrency | XRP |

| Token | XRP |

| Price | $2.5345 |

| Market Cap | $ 152,341,187,524.38 |

| 24h Volume | $ 5,087,135,474.7875 |

| Circulating Supply | 60,107,199,237.00 |

| Total Supply | 99,985,774,127.00 |

| All-Time High | $ 3.8419 on 04 January 2018 |

| All-Time Low | $ 0.0028 on 07 July 2014 |

XRP initiated a strong rally after breaking a multi-month falling wedge, peaking at $3.66 in July. However, the subsequent correction formed a short-term descending triangle that ultimately failed to hold crucial support.

This support failed due to geopolitical news, which triggered a massive liquidation event, causing a swift 40% crash from the triangle’s base, driving XRP to a $1.75 low and invalidating the short-term structure.

But, at this event, the Institutional funds viewed the XRP dip as an opportunity, accumulating the asset and catalyzing a quick bounce back above $2.40 by mid-October. This crash appears to have been a significant liquidity sweep, clearing out overleveraged traders.

In late October, a rate cut was announced, which created a risk-off sentiment in the market, capping XRP’s momentum in early November.

However, a multimonth ascending trendline that has served as a long-term trend of support, originating from the November 2024 swing, has remained intact, despite strong bearish action in early November.

Now, it shows the price reversing from this trendline and aiming at the upper, resisting trendline. then it could be an indication of a rally coming, with testing $3.0 in November and potentially reaching a new level of $5 by year’s end.

However, bearish dominance rises, and then $1.63, $1.41, and $1.05 become key support lines if the fall comes. However, if it is indeed a fake-out and reverses,

| Year | Potential Low | Potential Average | Potential High |

| 2025 | $1.75 | $3.45 | $5.05 |

| Platform | Low Price | Average Price | High Price |

| Claude | $3.00 – $3.15 | $3.50 – $4.00 | $7.50 – $8.20 |

| Blackbox | $2.50 | $3.50 | $5.00 |

| Gemini | $3.00 – $4.00 | $4.50 – $6.00 | $6.50 – $8.00+ |

XRP initiated a strong rally after breaking a multi-month falling wedge, peaking at $3.66 in July. However, the subsequent correction formed a short-term descending triangle that ultimately failed to hold crucial support.

This support failed due to geopolitical news, which triggered a massive liquidation event, causing a swift 40% crash from the triangle’s base, driving XRP to a $1.75 low and invalidating the short-term structure.

But, at this event, the Institutional funds viewed the XRP dip as an opportunity, accumulating the asset and catalyzing a quick bounce back above $2.40 by mid-October. This crash appears to have been a significant liquidity sweep, clearing out overleveraged traders.

In late October, a rate cut was announced, which created a risk-off sentiment in the market, capping XRP’s momentum in early November.

However, a multimonth ascending trendline that has served as a long-term trend of support, originating from the November 2024 swing, has remained intact, despite strong bearish action in early November.

Now, it shows the price reversing from this trendline and aiming at the upper, resisting trendline. then it could be an indication of a rally coming, with testing $3.0 in November and potentially reaching a new level of $5 by year’s end.

However, bearish dominance rises, and then $1.63, $1.41, and $1.05 become key support lines if the fall comes. However, if it is indeed a fake-out and reverses,

| Year | Potential Low | Potential Average | Potential High |

| 2025 | $2.05 | $3.45 | $5.05 |

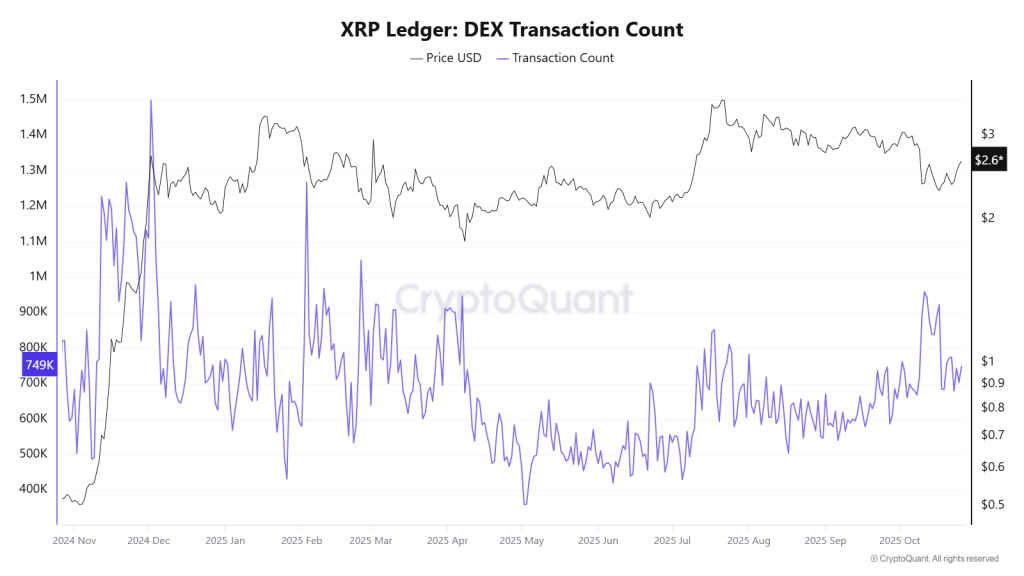

The XRP Ledger: DEX Transaction Count chart indicates a significant bullish divergence starting from May 2025. While the price is consolidating, the activity in decentralised exchanges (DEX) is increasing sharply.

The high transaction volume, which includes both orders placed and cancelled, shows that experienced traders are actively positioning themselves and adding liquidity in anticipation of a future price movement.

As a result, this on-chain metric suggests that the market is preparing for a powerful and sustainable rally in the XRP price.

| Year | Potential Low ($) | Potential Average ($) | Potential High ($) |

| XRP Price Prediction 2026 | 5.50 | 6.25 | 8.50 |

| Ripple Price Prediction 2027 | 7.00 | 9.0 | 13.25 |

| XRP Price Prediction 2028 | 11.25 | 13.75 | 16.00 |

| XRP Price Prediction 2029 | 14.25 | 16.50 | 21.50 |

| XRP Price Prediction 2030 | 17.00 | 19.75 | 26.50 |

This table, based on historical movements, shows XRP price prediction 2030 to reach $26.50 based on compounding market cap each year. This table provides a framework for understanding the potential XRP price movements. Yet, the actual price will depend on a combination of market dynamics, investor behavior, and external factors influencing the cryptocurrency landscape.

Based on historic price sentiments and XRP’s rising popularity, here are the XRP future price projections beyond 2030, where Ripple price forecasts suggest that it has become more speculative. Therefore, assuming continued adoption and dominance, XRP may see aggressive valuations in the decades ahead.

| Year | Potential Low ($) | Potential Average ($) | Potential High ($) |

| 2031 | 25.00 | 29.50 | 35.25 |

| 2032 | 31.50 | 36.75 | 41.25 |

| 2033 | 35.75 | 42.25 | 47.75 |

| 2040 | 97.50 | 135.50 | 179.00 |

| 2050 | 219.25 | 331.50 | 526.00 |

A look at this table, highlights the XRP price prediction 2040 and XRP price prediction 2050 potential high ambitious targets but this reflect a transformative vision for XRP as a dominant global payment player.

| Firm Name | 2025 | 2026 | 2030 |

| Changelly | $2.05 | $3.49 | $17.76 |

| Coincodex | $2.38 | $1.83 | $1.66 |

| Binance | $2.16 | $2.27 | $2.76 |

| Name | 2025 |

| Standard Chartered | $5.50 |

| Sistine Research | $33 to $50 |