3 Indicators Suggesting an Altcoin Season May Be Emerging This November

Analysts say weakening Bitcoin Dominance and key psychological signals hint at an altcoin rebound, though mixed technical signs keep traders divided on whether a true season is near.

The crypto market has faced heavy losses since the October crash, eroding confidence. While many analysts argue that an altcoin season remains distant, emerging signals are beginning to shift sentiment.

In November 2025, a combination of market psychology, technical indicators, and renewed liquidity inflows suggests the early formation of a potential bull cycle in altcoins.

Bitcoin Dominance Signals Potential Capital Rotation

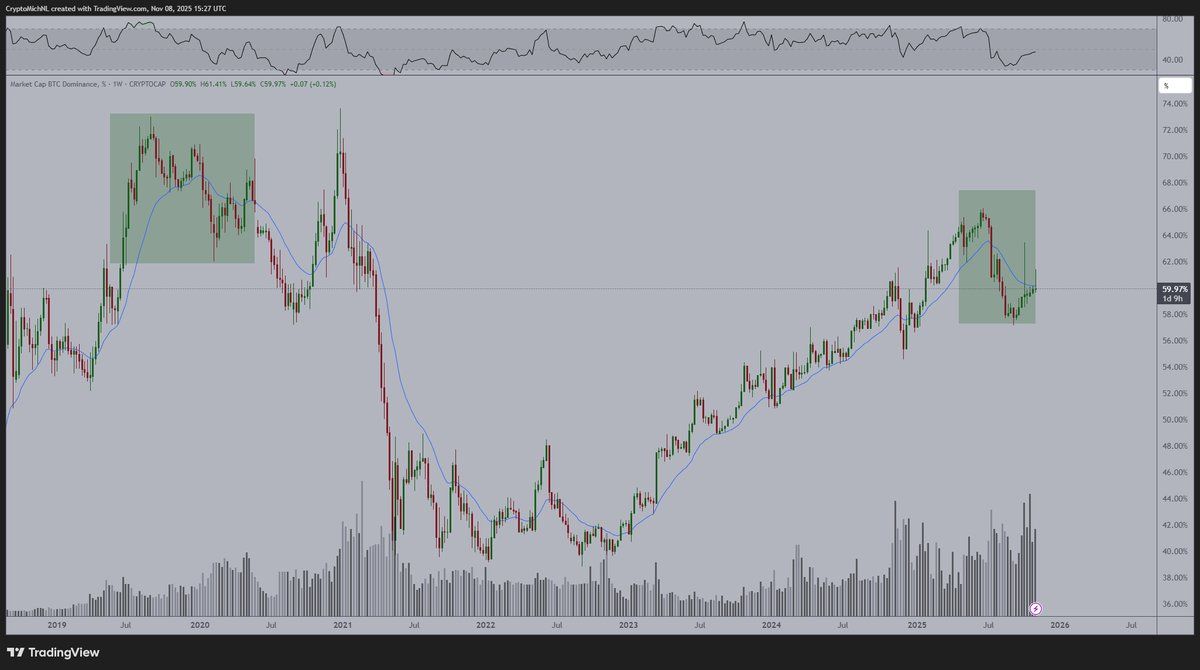

One of the most closely watched metrics in this context is the Bitcoin Dominance (BTC.D). Bitcoin’s share of total cryptocurrency market capitalization.

According to market data, BTC.D dropped in late June and continued moving downwards. It rebounded in September, though it has yet to reclaim its June highs. At press time, it stood at 59.94%

Bitcoin Dominance Chart. Source:

TradingView

Bitcoin Dominance Chart. Source:

TradingView

Despite this, analyst Matthew Hyland noted that the BTC.D chart is still bearish.

“The BTC Dominance…has looked bearish for many weeks. The downtrend is favorable to continue therefore, this relief rally has been a dead cat bounce in a downtrend,” Hyland wrote.

Analyst Michaël van de Poppe compared the current cycle to late 2019 and early 2020. At the time, Bitcoin Dominance first declined, briefly recovered, and then entered another major downward leg.

Van de Poppe suggests that today’s market may be at a similar turning point. The analyst anticipates a second drop in BTC.D this quarter.

Bitcoin Dominance Patterns in 2019-2020 Vs. November 2025. Source:

X/CryptoMichNL

Bitcoin Dominance Patterns in 2019-2020 Vs. November 2025. Source:

X/CryptoMichNL

Adding to this, trader Don pointed to a head-and-shoulders structure on the Bitcoin Dominance chart, a bearish reversal signal. If confirmed, this would likely drive dominance even lower and shift capital toward altcoins.

“Rotation season might be closer than most think,” the trader wrote.

Market Psychology and Retail Participation

From a psychological perspective, an analyst Merlijn emphasized that altcoin seasons begin during market disbelief, when sentiment is at its lowest.

“ALTCOIN SEASON STARTS WHERE EVERYONE GIVES UP. Same base. Same wedge. Same disbelief. Every previous altseason was born here. Bitcoin cools. Liquidity rotates. It’s time for the real fireworks,” he stated.

Additionally, recent weekend rallies across altcoins indicate a renewed interest from retail investors. Such activity is often a bullish short-term sign, with sentiment shifting from apathy to cautious optimism.

New Liquidity, New Rally

Lastly, new sources of liquidity could become crucial catalysts for an upcoming wave of altcoin gains. The Federal Reserve is set to restart its quantitative easing program on December 1, a policy shift that could inject significant liquidity into financial markets.

Historically, such moves have lowered borrowing costs, boosted investor confidence, and redirected capital toward higher-risk assets, such as cryptocurrencies, potentially setting the stage for renewed momentum across the altcoin sector.

Despite several bullish signals, some analysts warn that a broader altcoin rally may still be far off.

We are not in Altseason.Selective alts pumping isn't a sign of Altseason.Until Altcoin MCap excluding stables breaks a new ATH, we won't see any prolonged rally in alts.

— Ted (@TedPillows) November 8, 2025

Thus, the weeks ahead will reveal whether November 2025 launches a lasting altcoin rally or only a brief surge in speculation.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

AllScale Invests $120K: Driving Innovation During Market Uncertainty

- AllScale launches $120K Global Creator Program to boost digital innovation and attract creators. - Astar Network’s EVM compatibility and decentralized governance plans reflect industry trends toward democratizing platforms. - Mixed Q3 results across education and tech sectors highlight balancing profitability with innovation. - Challenges like Riskified’s revenue drop and Snail Inc.’s losses underscore market volatility, making AllScale’s incentives critical for stability.

Ethereum Latest Update: Large Investors Acquire $1.37 Billion During Price Drop While Ethereum Challenges $3,300 Support Level

- Ethereum's price fell 3.46% to $3,417.77 on Nov. 11, its largest drop since Nov. 4, with a 11.44% monthly decline despite a 2.18% year-to-date gain. - Institutional investors accumulated $1.37B worth of ETH during the $3,247–$3,515 pullback, but failed to reclaim $3,350 resistance, intensifying bearish concerns. - Technical indicators show deteriorating momentum below key EMAs, with $3,300–$3,200 as critical support levels and 138% above-average selling volume confirming institutional participation. - De

Ethereum Updates: Shodai Network Secures $2.5M in Seed Funding to Address Crypto’s Capital Challenges

- Shodai Network raised $2.5M in seed funding led by ConsenSys to address crypto's "toxic capital" misalignment issues. - The platform aims to align incentives between developers and investors through open-source tools and community-driven structures. - Backed by Ethereum co-founder Joseph Lubin, Shodai faces regulatory risks but gains credibility through ConsenSys' technical expertise. - This initiative reflects growing institutional demand for sustainable crypto fundraising solutions amid intensified reg

Ark Invest Turns to Circle Amid Growing Regulatory Certainty in Stablecoin Industry

- Ark Invest boosts Circle stake by 353,300 shares, signaling confidence in stablecoin growth amid market volatility and regulatory clarity. - Circle reports $740M Q3 revenue (66% YoY) and $73.7B USDC circulation, but faces margin pressures and a $482M net loss despite strong cash flow. - Ark shifts focus from Tesla to Circle and Alibaba , selling $30. 3M in Tesla shares amid China sales concerns and AI-driven tech bets. - Regulatory progress like the U.S. GENIUS Act and Circle's strategic partnerships (e.