HBAR Price Continues To Survive, Holds Above Month-Long Support

Hedera’s HBAR remains resilient above critical support levels, but weak inflows and bearish momentum suggest continued consolidation until investor participation strengthens.

Hedera’s native token, HBAR, has shown remarkable resilience despite enduring repeated market crashes and failed recovery attempts.

The altcoin continues to hold above a key support level, maintaining investor confidence even as bearish market sentiment persists. However, questions remain about how long HBAR can sustain this stability.

Hedera Needs Stronger Market Support

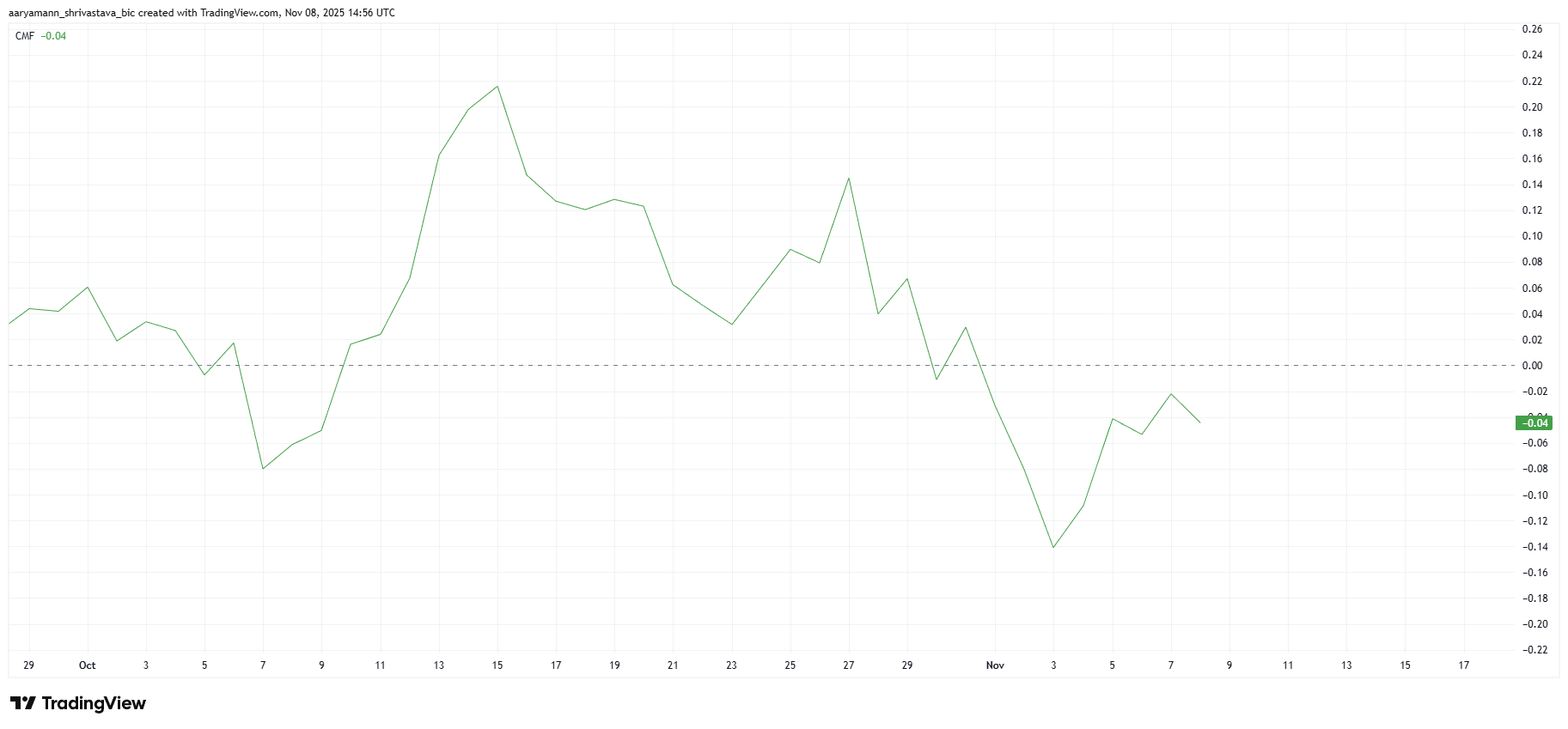

The Chaikin Money Flow (CMF) indicator shows HBAR sitting in the bearish zone below the zero line, reflecting ongoing outflows. Although there has been a modest uptick recently, inflows are still insufficient to reverse the trend. This suggests that sellers maintain control of the market.

Until consistent inflows surpass outflows, the HBAR price will likely remain under pressure. The gradual increase in inflows indicates that investor interest is slowly returning, but it is not yet strong enough to dictate price direction.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter

HBAR CMF. Source:

HBAR CMF. Source:

HBAR CMF. Source:

HBAR CMF. Source:

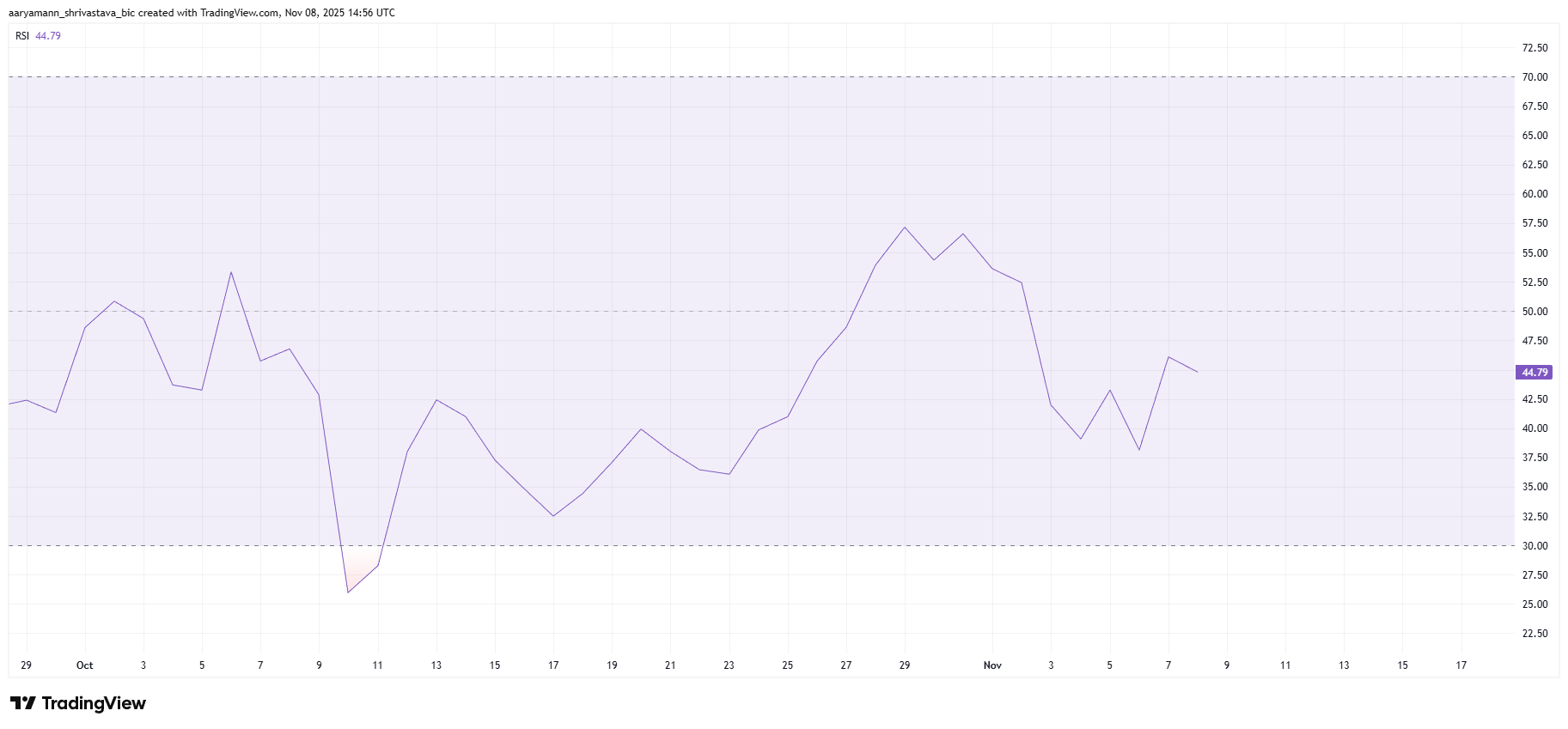

The Relative Strength Index (RSI) reinforces this bearish sentiment. Currently positioned below the neutral 50.0 mark, the RSI signals that market conditions are not favorable for recovery.

The lack of upward momentum reflects broader market weakness and hesitancy among traders to re-enter bullish positions.

This bearish momentum poses a challenge for HBAR’s price performance. Without support from the overall market, any potential bounce could be limited or short-lived. For HBAR to regain strength, the RSI must rise toward neutral levels.

HBAR RSI. Source:

HBAR RSI. Source:

HBAR RSI. Source:

HBAR RSI. Source:

HBAR Price May Remain Consolidated

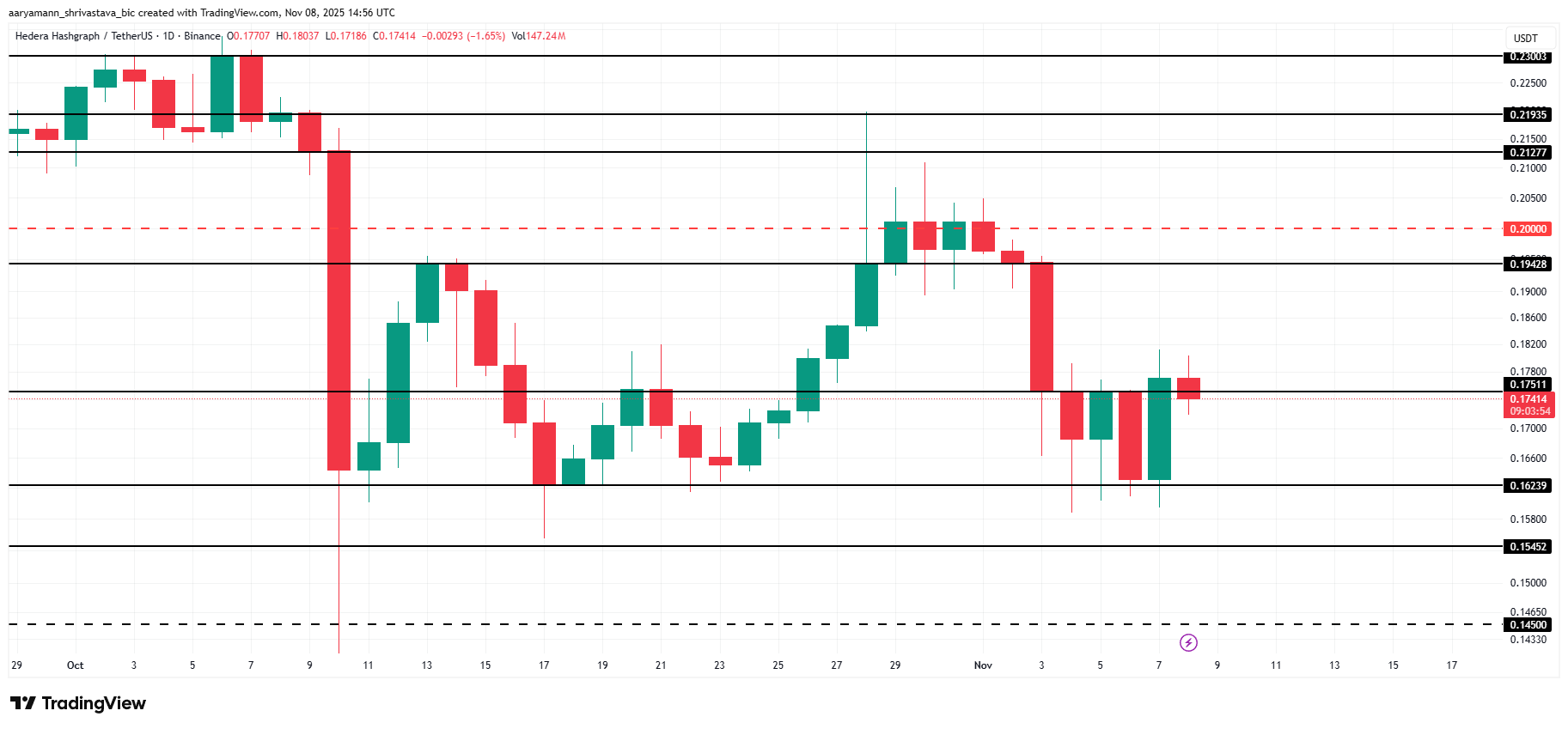

HBAR is trading at $0.174 at the time of writing, hovering just below the $0.175 resistance level. Despite several setbacks, the token has managed to hold above its critical $0.162 support level, showcasing its resilience.

This support has been pivotal for HBAR over the past month, preventing a deeper decline toward $0.154. Even under current bearish conditions, the token will likely continue consolidating above this zone, providing a stable base for potential recovery.

HBAR Price Analysis. Source:

HBAR Price Analysis. Source:

HBAR Price Analysis. Source:

HBAR Price Analysis. Source:

If broader market conditions improve and inflows strengthen, HBAR could flip the $0.175 resistance into support. This could trigger a rally toward $0.194, paving the way for another attempt to breach $0.200 and potentially invalidate the bearish thesis.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Uniswap News Today: Uniswap's Burn Event, Inspired by Bitcoin Halving, Triggers Explosive Bull Rally

- Uniswap's UNI token surged 30% in 24 hours as the "UNIfication" governance overhaul introduced fee-switch mechanisms and token burns to create deflationary pressure. - The proposal, led by founder Hayden Adams, redirects trading fees to UNI holders and burns 100 million tokens, drawing comparisons to Bitcoin's halving events. - BitMEX co-founder Arthur Hayes invested $244,000 in UNI post-hiatus, amplifying market confidence while analysts predict potential $50 price targets if the proposal passes. - UNI'

Noomez's Scarcity Engine: Creating Value for Crypto's 2025 Bull Market

- Noomez ($NNZ) gains traction with a 28-stage presale using escalating prices, permanent token burns, and liquidity locks to create scarcity and 1000x return potential. - The deflationary model includes 280B fixed supply, 50% allocated to presale, with Vault Events at stages 14/28 triggering additional burns and airdrops. - Transparency features like the Noom Gauge dashboard and 15% liquidity locks, plus 66% APY staking rewards, differentiate it from speculative meme coins. - Stage 3 shows 51% price growt

Public Company's $IP Token Reserve Marks the Beginning of a Programmable IP Economy Era

- Crypto.com partners with IP Strategy, first public company to use $IP tokens as primary reserve asset. - Agreement includes custody, trading, and staking for 52.5M $IP tokens valued at $230M, boosting institutional IP token adoption. - Partnership enables regulated exposure to $80T programmable IP economy via Story Protocol's blockchain infrastructure. - Executives highlight infrastructure's role in securing IP assets while risks like liquidity and custody execution remain critical concerns.