Will Crypto Markets Rebound When the US Government Shutdown Ends?

As the US government shutdown drains liquidity and weakens markets, analysts expect a reversal once it ends.

Despite a worrying dip on Friday, Bitcoin has survived the $100,000 crash test. Now, attention turns to Washington. The longest US government shutdown in history has drained liquidity from financial markets — and by extension, from crypto.

Analysts argue that when the fiscal gridlock ends, the same mechanism that pulled liquidity out will push it back in, setting the stage for a recovery.

US Shutdown Standoff and Its Economic Impact

The government shutdown, which began on October 1, 2025, entered its sixth week after Congress failed to pass new funding.

The deadlock stems from disputes over healthcare subsidies and spending levels. Both parties are refusing to pass a “clean” budget bill.

The US government shutdown has now lasted for 36 days, making it the longest on record. Some welfare payments, including those that allow low-income families to buy food, have been halted. The shutdown means more than a million government employees are not being paid. pic.twitter.com/fF4ORTrg6V

— Al Jazeera English (@AJEnglish) November 5, 2025

The economic toll has been measurable. The Congressional Budget Office (CBO) estimates losses between $7 billion and $14 billion.

In fact, the US GDP growth in Q4 is likely trimmed by up to two percentage points.

Consumer sentiment is near record lows, air travel is disrupted due to air-traffic shortages, and state programs face funding stress.

The prolonged cash freeze has become a significant drag on the economy.

How Did the US Government Shutdown Impact Crypto?

In financial terms, the shutdown has frozen hundreds of billions of dollars inside the Treasury General Account (TGA) — the government’s cash reserve. Every dollar parked there is a dollar not circulating in the financial system.

Since the US debt ceiling was raised in July, the TGA balance has swelled above $850 billion, draining liquidity by about 8%. Bitcoin mirrored the move, sliding roughly 5% in the same period.

This correlation, long observed by on-chain analysts, highlights crypto’s deep sensitivity to dollar liquidity.

Since the U.S. government shutdown began on October 1, Bitcoin has been in a clear decline.The market trend has shown oscillations between price phases, with no clear direction other than downward.The deleverage event was the first hit, followed by a weak rebound and… pic.twitter.com/OdLYVb1h7s

— Bitcoin Vector (@bitcoinvector) November 7, 2025

Arthur Hayes calls this dynamic a “stealth QE in reverse.” As the Treasury hoards cash, liquidity tightens, risk assets fall, and Bitcoin corrects.

But once the government reopens and resumes spending, that liquidity will flood back through banks, money markets, and stablecoin systems — effectively reversing the drain.

$BTC (yellow) -5%, $ liq (white) -8% since US debt ceiling raised in July. TGA build up sucked $ out of the system. When US gov shutdown ends, TGA will fall +ve for $ liq, and $BTC will rise … and $ZEC will go up MOAR! pic.twitter.com/A9tflGuBHH

— Arthur Hayes (@CryptoHayes) November 5, 2025

Will Crypto Markets Recover When the Government Shutdown Ends?

The short answer is yes, the crypto market is very likely to recover or rally once the US government shutdown ends.

However, the timing and magnitude will depend on how liquidity is released back into the system.

Crypto — and Bitcoin in particular — trades as a liquidity-sensitive risk asset. When dollar liquidity tightens, crypto prices fall; when liquidity expands, they rise.

This pattern has repeated across multiple cycles:

- March 2020: Global liquidity injections drove the start of the COVID bull run.

- March 2023: The Fed’s balance-sheet expansion during the US banking crisis triggered a Bitcoin rebound from $20,000 to $30,000.

- 2025: The correlation between Bitcoin and dollar liquidity (as measured by the USDLiq Index) remains near 0.85, one of the strongest among all asset classes.

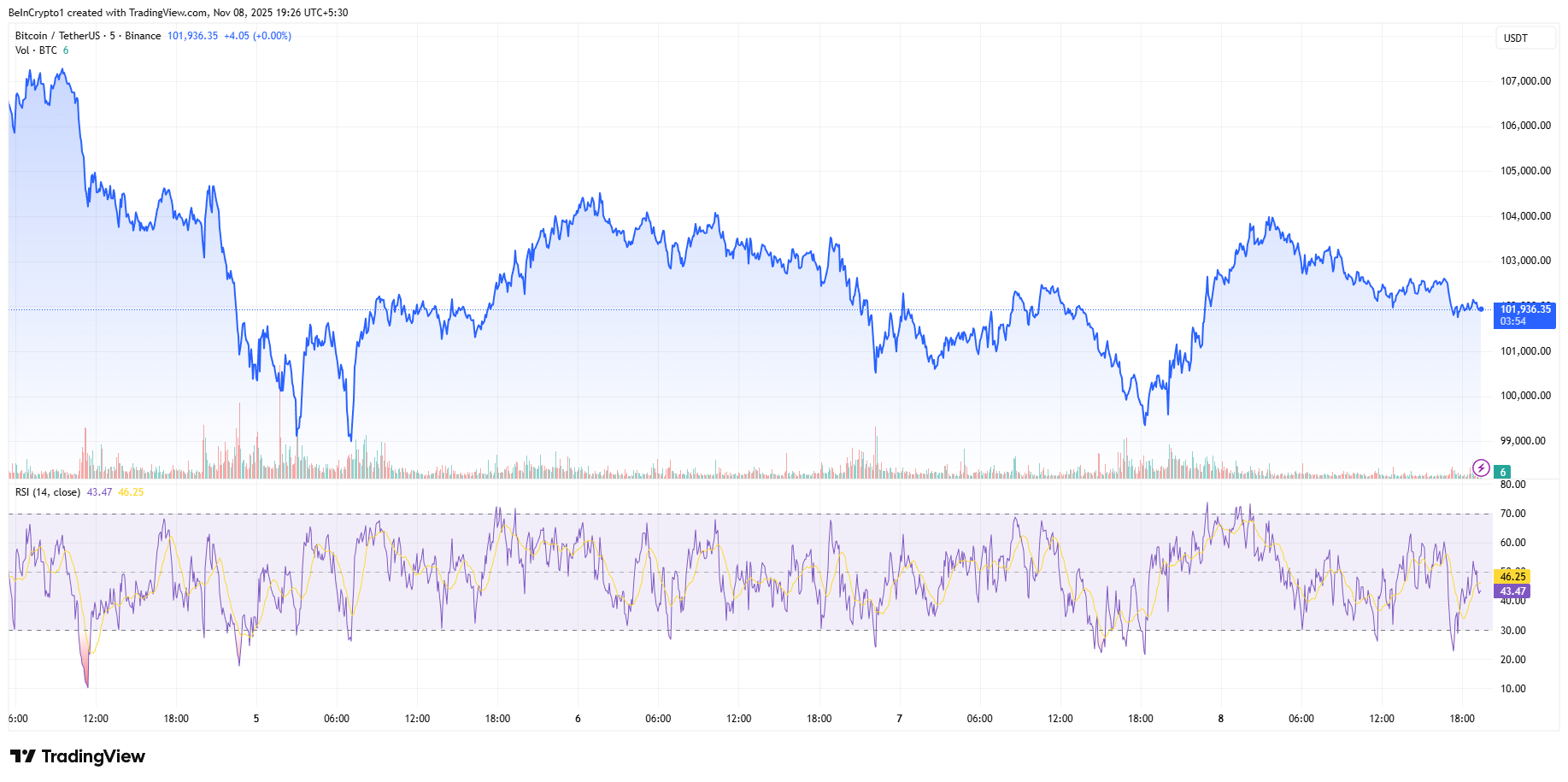

Bitcoin has closed above $100,000 for six straight months, and the RSI remains around 46, far below euphoric levels. Analysts call the current phase a “window of pain,” driven by temporary fiscal tightening.

Bitcoin Price Chart and RSI. Source:

TradingView

Bitcoin Price Chart and RSI. Source:

TradingView

The broader macro picture supports their case.

- Rate-cut expectations for early 2026 are growing as fiscal paralysis weakens short-term growth.

- Global liquidity from China and Japan is rising, offsetting US tightening.

- Speculative leverage in crypto has been flushed out, leaving a healthier market base.

Together, these factors create conditions for Bitcoin to recover toward the $110,000–$115,000 range in the next quarter, provided no new shocks emerge.

Outlook: When Dollars Flow, Bitcoin Follows

The crypto correction has less to do with fading enthusiasm and more with frozen liquidity.

Once the US government reopens, Treasury spending and Fed support mechanisms — such as the Standing Repo Facility — will reintroduce cash into the system.

The general expectation is that crypto fell because dollars stopped moving. It will rise when they start flowing again.

In practical terms, the end of the shutdown could mark the start of a liquidity-driven rebound across crypto markets.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

MMT Token's Token Generation Event and Its Impact on Blockchain Capital Utilization

- MMT Token's 2025 launch on Sui blockchain redefines DeFi capital efficiency through ve(3,3) tokenomics and CLMM liquidity mechanisms. - TGE allocated 204.1M tokens with vesting schedules, generating 1330% price surge on Binance via exchange listings and cross-chain integration. - Ve(3,3) model locks tokens for governance rights and fee-sharing, aligning incentives while reducing short-term selling pressure. - Protocol's $12B 30-day volume and institutional-grade roadmap contrast with traditional MFS fund

Gold’s Audit Problem Resurfaces as CZ Challenges Its Verifiability

Stablecoins Surpass Bitcoin as Go‑To Cryptocurrency for Illicit Transactions

Algorand (ALGO) To Rally Higher? This Emerging Bullish Fractal Saying Yes!