Evernorth’s unrealized XRP losses expose mounting pressure on DATs: CryptoQuant

The month-long slide in crypto prices hasn’t just hit major assets like Bitcoin (BTC) and Ether (ETH) — it’s also dealing heavy losses to digital asset treasury companies that built their business models around accumulating crypto on their balance sheets.

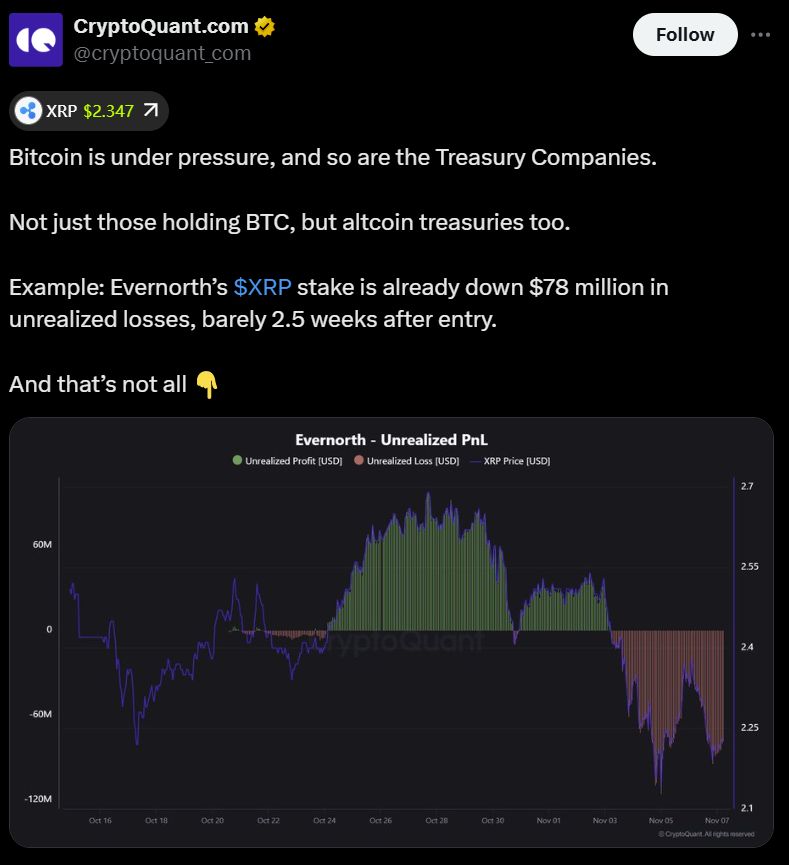

That’s one of the key takeaways from a recent social media analysis by onchain data company CryptoQuant, which cited XRP-focused treasury company Evernorth as a prime example of the risks in this sector.

Evernorth has reportedly seen unrealized losses of about $78 million on its XRP position, mere weeks after acquiring the asset.

The pullback has also battered shares of Strategy (MSTR), the original Bitcoin treasury play. The company’s stock has dropped by more than 26% over the past month, as Bitcoin’s price has slumped, according to Google Finance data. CryptoQuant noted a 53% drop in MSTR shares from their all-time high.

However, Strategy still holds a sizable unrealized gain on its Bitcoin reserves, with an average cost basis of roughly $74,000 per BTC, according to BitcoinTreasuries.NET.

Meanwhile, BitMine, the largest Ether-holding corporation, is now sitting on approximately $2.1 billion in unrealized losses tied to its Ether reserves, according to CryptoQuant.

BitMine currently holds nearly 3.4 million ETH, having acquired more than 565,000 over the past month, according to industry data.

Digital asset treasury companies: Echoes of the dot-com bubble

Digital asset treasury companies, or DATs, have come under mounting valuation pressure in recent months, with analysts cautioning that their market worth is increasingly tied to the performance of their underlying crypto holdings.

Some analysts, including those at venture capital firm Breed, argue that only the strongest players will endure, noting that Bitcoin-focused treasuries may be best positioned to avoid a potential “death spiral.” The risk, they say, stems from a collapse in the companies’ market net asset value (mNAV) — a metric comparing enterprise value to the market value of their cryptocurrency investments.

Others have compared the rise of digital asset treasury companies to the dot-com boom and bust of the early 2000s, a period driven by long-term visionaries and innovators, as well as opportunists chasing quick gains.

Ray Youssef, founder of peer-to-peer lending platform NoOnes, predicted that most digital asset treasuries will ultimately fade out or collapse as market realities set in.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Updates: Crypto Market Divides as Pessimism Clashes with Institutional Confidence in Ethereum

- US stocks closed mixed on Nov 7, 2025, as Bitcoin fell below $100,000 amid $711.8M in crypto liquidations. - ARK Invest boosted Ethereum exposure by buying $9M of BitMine shares, signaling institutional confidence in ETH treasuries. - UK aligns stablecoin rules with US by Nov 10, while crypto firms form consortium to standardize cross-border payments. - Coinbase and Block underperformed revenue forecasts, with Block down 9% despite $6.11B revenue. - Market remains divided between Bitcoin bearishness and

Bitcoin Updates: Cango Utilizes Energy-Efficient Infrastructure to Connect Bitcoin Mining with the Future of AI Computing

- Cango Inc. transitions from auto platform to Bitcoin mining and AI HPC, leveraging global infrastructure and energy expertise. - Achieves 50 EH/s mining capacity in 8 months, with Q2 2025 revenue of $139.8M and $656M in Bitcoin holdings. - Acquires 50 MW Georgia facility to optimize energy costs and expand dual-purpose infrastructure for AI workloads. - Plans direct NYSE listing to enhance transparency amid regulatory scrutiny and industry shifts toward hybrid AI-mining models. - Aims to refresh 6 EH/s e

XRP News Today: MoonBull Secures Liquidity While Solana Holds $160—Can XRP Spark the 2025 Bull Market?

- MoonBull ($MOBU) gains traction with Ethereum-based presale, projecting 9,256% ROI if it hits $0.00616 listing price. - Solana (SOL) consolidates near $160 support level amid $323M institutional inflows, while XRP sees 15% price drop but rising wallet growth. - Ripple's Palisade acquisition boosts institutional focus, yet XRP's price divergence raises questions about adoption vs. valuation. - Analysts highlight MoonBull's 2-year liquidity lock and structured 23-stage presale as differentiators in crowded

Solana News Update: Institutional Trust in Solana Strengthens as Retail Markets Fluctuate

- Solana leads blockchain payment standardization efforts as Ripple acquires Palisade and invests $4B in crypto infrastructure expansion. - Forward Industries authorizes $1B Solana-backed share buyback, signaling institutional confidence in blockchain treasury systems. - Market volatility highlighted by $22.7M whale loss contrasts with SOL Strategies' 6.68% APY, showing diverging risk profiles between retail and institutional players. - Solana Company shifts regulatory focus to U.S. compliance to optimize