BlackRock Just Gave the XRP Community What It’s Been Waiting For

At Ripple’s Swell 2025 event, BlackRock’s Maxwell Stein said Ripple’s blockchain could move trillions in institutional capital, marking a turning point for XRP advocates. His remarks signaled growing TradFi confidence in tokenized finance, though legal experts urged caution over whether this reflected BlackRock’s official stance.

Ripple’s Swell 2025 conference in New York may have delivered one of the most defining moments in the digital asset industry’s relationship with Wall Street. The XRP community, in particular, got its long-awaited validation.

During a keynote session, Maxwell Stein of BlackRock’s digital assets team told the audience that “the market is ready for large-scale blockchain adoption” and that infrastructure from Ripple could soon move trillions of dollars on-chain.

BlackRock Validates Ripple at Swell 2025 — XRP Community Cheers

Stein praised early industry builders like Ripple for proving blockchain’s real-world utility, not just as a speculative concept but as a functioning layer of financial infrastructure.

“They’ve already tokenized fixed income, bonds, stablecoins… that’s where it started. But this is the rails for trillions in capital flows,” said Stein.

A BlackRock executive publicly crediting Ripple for helping prove blockchain’s real-world functionality marked a milestone in the narrative XRP holders have championed for years.

For a community that has long argued Ripple’s technology will underpin institutional liquidity, the comment landed like a thunderclap.

For the longest time, the XRP community has clung to the belief that Ripple’s technology will serve as the bridge between traditional finance and the decentralized economy.

Upon Stein’s statement, the XRP supporters across social networks saw the remark as long-awaited validation from the world’s largest asset manager.

🚨BREAKING: BlackRock Exec at Ripple Swell: “The Market Is Ready — Trillions Are Coming On-Chain” 💥This might’ve been the most electric moment of Ripple Swell 2025.Maxwell Stein, a representative from BlackRock, took the stage and straight-up said what everyone’s been…

“We’ve seen what early adopters of crypto have done — they’ve shown us what’s possible. And now, the market is ready for broader adoption,” he added.

His statement highlighted a shift in tone from TradFi, that blockchain is no longer an experiment. Rather, it is an emerging standard.

Legal Caution and Institutional Clarity Temper the Hype

However, the excitement that followed was tempered by legal caution. Australian lawyer and renowned XRP advocate Bill Morgan was among the first to raise questions about Stein’s remarks. He wondered whether they reflected an official BlackRock position or were simply Stein’s personal opinion.

“Very interesting, but… was he speaking in a personal capacity or for BlackRock?” Morgan posted on social media.

The question resonated deeply because of what’s at stake. If Stein’s statement signals BlackRock’s strategic confidence in tokenized finance, it could mark one of the clearest indications yet that institutional adoption is imminent.

If personal, it remains a powerful, but unofficial endorsement of Ripple and blockchain’s direction by extension.

In the same event, Nasdaq President and CEO Adena Friedman said the digital asset market is clearly maturing. However, she also acknowledged that regulatory clarity is essential for full-scale institutional participation.

“To get them really engaged in the market, there has to be regulatory clarity,” she emphasized, noting that banks are already experimenting with tokenized bonds and stablecoin frameworks.

Together, the remarks from Stein and Friedman painted a picture of convergence, where TradFi, blockchain, and regulation are aligning.

Ripple’s Swell 2025 conference, once an industry event primarily for crypto insiders, became a stage where some of the most influential voices in global finance signaled readiness for integration.

Despite these developments, along with the network’s growing institutional deals and exploding XRP adoption, the Ripple price remains lull.

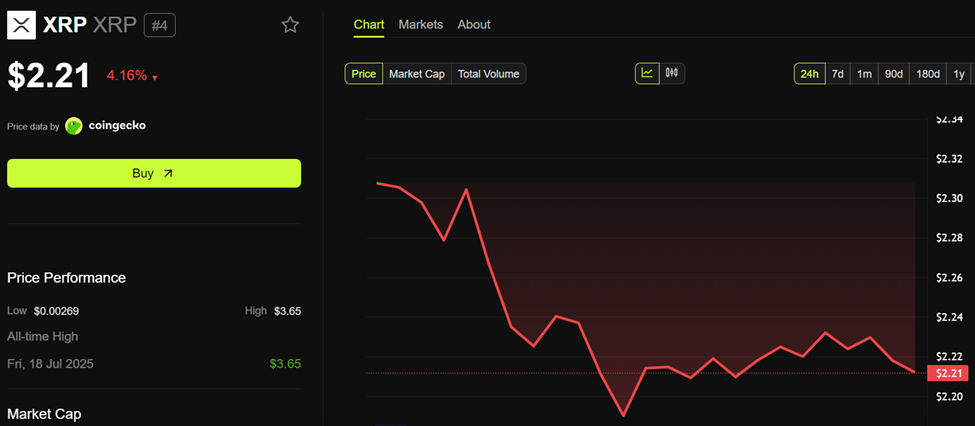

Ripple (XRP) Price Performance. Source:

Ripple (XRP) Price Performance. Source:

In the last 24 hours, the XRP price has been down by over 4%. It was trading for $2.21 as of this writing.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum Updates Today: MoonBull’s Unique Ethereum Foundation Distinguishes It in the Competitive Meme Coin Space

- MoonBull ($MOBU) surges in Stage 6 presale with 7,244% ROI potential, leveraging Ethereum's security and deflationary tokenomics. - A structured referral system offers 15% extra tokens and USDC bonuses, driving $600K+ raised and 2,000+ holders. - Unlike meme coins, MoonBull's Ethereum-based model with staking and governance aims for sustainability, contrasting with volatile alternatives like TRUMP and XRP . - Analysts caution about crypto volatility, emphasizing ROI projections depend on market condition

From Pharmaceuticals to Blockchain: Lite Strategy's $100 Million LTC Reserve Disrupts Traditional Finance

- Lite Strategy (LITS) becomes first U.S. publicly traded company to adopt Litecoin as primary reserve asset after $100M private placement. - Partnership with crypto firm GSR and Litecoin creator Charlie Lee on board aims to institutionalize digital treasury management amid volatile markets. - $12.21M working capital and 12.39 current ratio highlight liquidity strength despite 18% YTD stock decline and mixed institutional investor reactions. - Strategic shift from pharmaceuticals to crypto reserves challen

Malaysia’s Broad Trade Approach Counters Trump Tariffs, Fuels 5.2% Economic Expansion

- Malaysia navigated Trump's 2025 tariffs via trade diversification and diplomacy, avoiding panic amid global market shocks. - U.S. reduced tariffs to 19% in October 2025 after Malaysia opened markets, coinciding with 5.2% Q3 GDP growth driven by exports and fiscal discipline. - Strategic trade ties with China, Singapore, and U.S. mitigated protectionist impacts, supported by ASEAN coordination and non-retaliatory policies. - Malaysia's $250M investment in semiconductor design and renewable energy reflects

Lite Strategy’s Balancing Game in Crypto-Pharma: Is It Possible to Manage Instability and Tradition Together?

- Lite Strategy (LITS) rebranded from MEI Pharma to focus on Litecoin , acquiring 929,548 LTC via a $100M PIPE in July 2025. - The company partners with GSR for crypto treasury management and launched a $25M share repurchase program in October 2025. - LITS holds $12.21M in working capital with no debt, while balancing pharmaceutical asset sales (e.g., ME-344) with crypto investments. - Despite strong liquidity (current ratio 12.39), the stock faces volatility risks and regulatory uncertainties in its crypt