November 6th Market Key Insights, How Much Did You Miss?

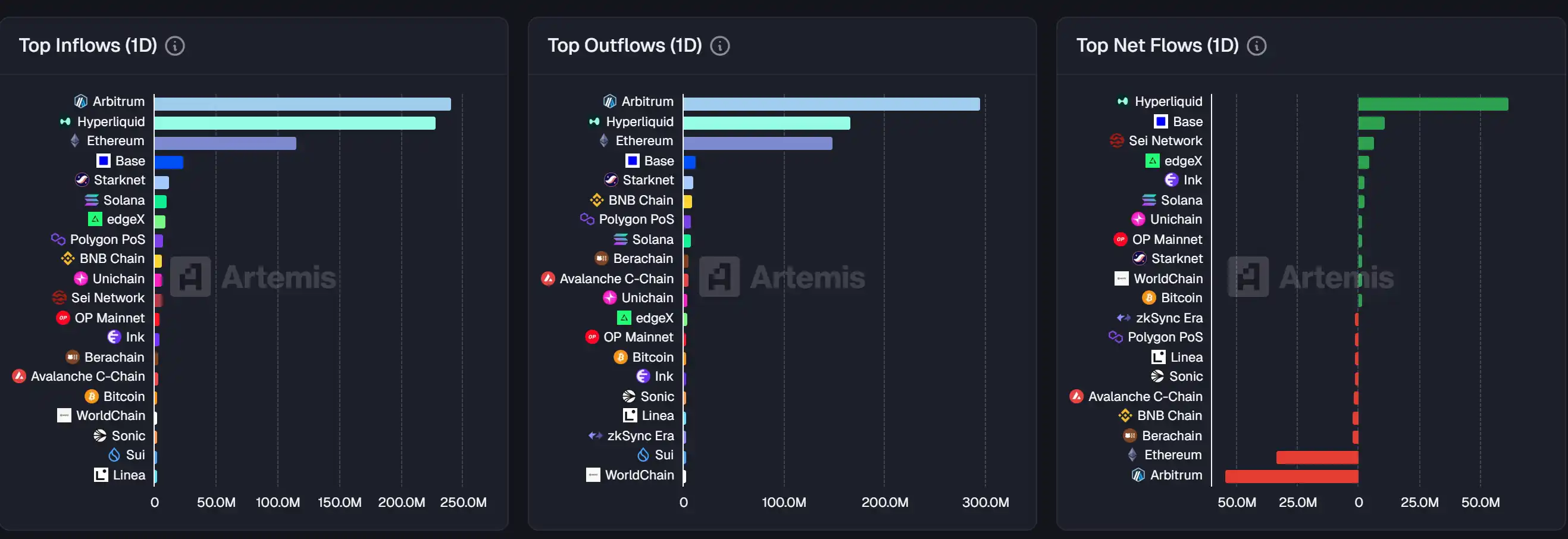

1. On-chain Volume: $61.9M inflow to Hyperliquid today; $54.4M outflow from Arbitrum 2. Largest Price Swings: $SAPIEN, $MMT 3. Top News: ZEC Surpasses $500, Naval's Shill Sees 575% Surge

Featured News

1. ZEC Surges Past $500, Naval's Call Sees 575% Gain

2. Trump Expresses Desire to Make the U.S. a "Bitcoin Superpower"

3. MON Pre-market Trading Price Briefly Exceeds $0.06, 24-hour Gain at 10.3%

4. BNB Chain Ecosystem Tokens See Significant Rebound, GIGGLE and Binance Life Lead in Market Cap

5. ASTER Has Repurchased a Total of 25.5 Million ASTER Since Public Buyback, with a Daily Average Repurchase of about 2.76 Million tokens

Trending Topics

Below is the translation of the original content:

[PIPWORLD]

Today, PIPWORLD gained attention due to its ranking on KaitoAI, as it has built the world's first AI-driven trading ecosystem. Users can create, train, and deploy PiP World intelligent agent clusters on any decentralized exchange (DEX) and blockchain. The project has been likened to an "AI hedge fund playground," and the user activity tracking leaderboard has officially launched. The addition of former Kraken executive Saad Naja and other notable figures has added credibility, and the platform's potential to innovate AI trading has garnered significant interest, with many investors expressing interest in its innovative model.

[MEMEMAX]

Today, MEMEMAX's discussion is centered around its integration with Kaito and the ongoing MaxPack event (which rewards on-chain transactions). Users are actively participating in trading to receive higher-value gift packages, with some users reporting generous rewards. The community is also actively discussing MEMEMAX's platform potential and future development, including its onboarding process and fee structure. The high return potential and strategic partnerships established by the platform are core reasons for the market excitement.

[MEGAETH]

Today's discussion on MEGAETH mainly revolves around the public distribution strategy and process transparency. The team has been praised for detailing the allocation method (including a scoring system based on on-chain activity, social interactions, and MEGAETH-specific signals). The community's response has been mixed, with some users celebrating their selection in the core community list, while others express disappointment for not being included. The discussion also touches on MEGAETH's potential as a leading platform for crypto applications, with some users having strong confidence in its future development.

[MONAD]

Today's core discussion on MONAD focuses on the upcoming mainnet launch scheduled for November 24th and the accompanying airdrop activity. This news has triggered strong excitement and anticipation in the crypto community, with multiple tweets highlighting the mainnet launch, airdrop details, and the support from major platforms and wallets. Additionally, the market is also focusing on Monad's strategic partnerships, ecosystem development, and comparative analysis with other blockchain projects.

[INTUITION]

INTUITION, with the trading symbol $TRUST, is receiving attention today due to its mainnet launch and subsequent listings on major exchanges such as Binance, KuCoin, and Kraken. The project focuses on decentralizing information and turning data into assets, with its airdrop activity and staking opportunities receiving positive market feedback. The community actively engages in project interactions, celebrating its potential to innovate the knowledge economy through decentralized trust and reputation systems.

Featured Articles

1.《Market Volatility Intensifies, Why Bitcoin Still Has a Chance to Reach $200,000 in Q4?》

This article was first published on October 27, 2025. On November 6, Tiger Research published another article stating that amid intensified market volatility, they still maintain the $200,000 target price. The article elaborates on the reasons.

2.《Crypto Market Macro Research Report: U.S. Government Shutdown Causes Liquidity Contraction, Crypto Market Sees Structural Turning Point》

In November 2025, the crypto market is experiencing a structural turning point. The overall market capitalization decline corresponds to mid-term turnover and value layout in the fear index. Key risks lie in regulatory uncertainty, on-chain complexity and multi-chain fragmentation, information asymmetry, and emotional turmoil. The next 12 months will be a "structural bull" instead of a comprehensive bull, with a focus on mechanism design, distribution efficiency, and attention operations; seize early-stage distribution and execute a closed loop, prioritizing disciplined allocations around the long curve theme of AI×Crypto, DAT, and others.

On-chain Data

On-chain Fund Flow for the Week of November 6

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

JPMorgan is unwilling to cover the legal expenses of Frank founder Charlie Javice

Ethereum Updates: Arthur Hayes Sells $2.45M ETH/DeFi Holdings, Indicating Negative Market Sentiment

- Arthur Hayes sold $2.45M in Ethereum and DeFi tokens, including 260 ETH and 2.4M ENA, signaling potential bearish sentiment. - Blockchain analysts highlight risks of price dips as large ETH sales often trigger short-term market declines, with $3,000 support levels under scrutiny. - Simultaneous offloading of AAVE, UNI, and LDO tokens suggests profit-taking amid rising traditional finance rates and DeFi liquidity shifts. - Zcash (ZEC) whale activity and leveraged ETH short positions further amplify crypto

Anthropic Claims Cyberattack Involved AI, Experts Express Doubts

- Anthropic claims Chinese state hackers used AI to automate 80-90% of a cyberattack targeting 30 global entities via a "jailbroken" Claude AI model. - The AI-generated exploit code, bypassed safeguards by fragmenting requests, and executed reconnaissance at unprecedented speed, raising concerns about AI's dual-use potential in cyber warfare. - Experts question the validity of Anthropic's claims while acknowledging automated attacks could democratize cyber warfare, prompting calls for stronger AI-driven de

AAVE Drops 13.95% Over 7 Days Amid Strategic Changes Triggered by Euro Stablecoin Regulatory Approval

- Aave becomes first DeFi protocol to secure EU MiCA regulatory approval for euro stablecoin operations across 27 EEA states. - The Irish subsidiary Push Virtual Assets Ireland now issues compliant euro stablecoins, addressing ECB concerns about USD-dominance in crypto markets. - Aave's zero-fee Push service generated $542M in 24-hour trading volume, contrasting with typical 1-3% fees on centralized exchanges. - With $22.8B in borrowed assets, the platform's regulatory milestone is expected to accelerate a