JELLYJELLY Hits $500 Million Market Cap Amid Crypto Crash, Attracts Manipulation Scrutiny

As the crypto market tumbles, Solana-based meme coin JELLYJELLY has defied gravity with a massive surge — but analysts warn its rally may not be organic, citing suspicious wallet activity and signs of coordinated manipulation.

The cryptocurrency market is facing a sharp downturn as major assets continue to tumble. However, Jelly-My-Jelly (JELLYJELLY), a Solana-based meme coin, has bucked the trend, soaring to a new all-time high.

The record-breaking rally has drawn suspicion from blockchain analytics platform Bubblemaps, which raised concerns about coordinated trading and possible market manipulation.

JELLYJELLY Soars to Record High as Crypto Market Plunges

The cryptocurrency market suffered a sharp decline on November 4. Bitcoin (BTC) briefly fell below $100,000. Meanwhile, Ethereum (ETH) slipped to as low as $3,000, a low last seen in July.

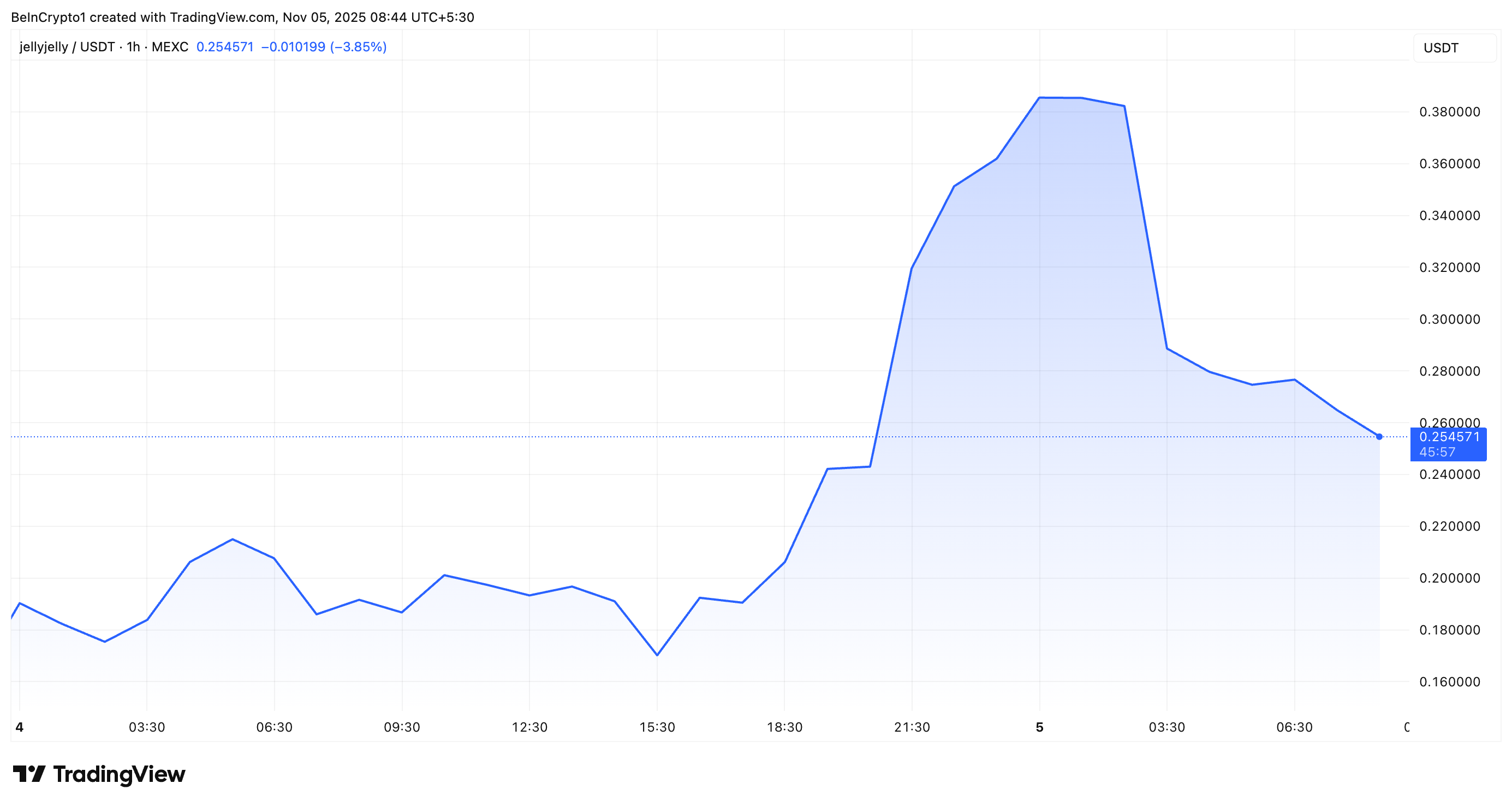

Despite the turmoil, JELLYJELLY emerged as a standout performer. The token reached an all-time high of $0.5 on November 4. With this rise, its market capitalization also surged to $500 million.

Nonetheless, the meme coin faced a modest correction after. At the time of writing, JELLYJELLY traded at $0.25, still up 31.7% in the past 24 hours.

Jelly-My-Jelly (JELLYJELLY) Price Performance. Source:

Jelly-My-Jelly (JELLYJELLY) Price Performance. Source:

The meme coin’s market value also adjusted to around $250 million. Still, trading activity remained strong. CoinGecko data showed that the daily trading volume rose by 96% to reach $462 million.

Is the JELLYJELLY Token Rally Another Case of Coordinated Trading?

The price spike attracted Bubblemaps’ attention. The blockchain analytics platform noted that seven wallets with no prior activity pulled out 20% of JELLYJELLY’s supply from Gate.io and Bitget over the past four days.

“Shortly after these CEX withdrawals, JELLYJELLY jumped +600%…. after dropping 80% from previous highs,” Bubblemaps posted.

This suggested possible market manipulation, as the coordinated withdrawal of a significant portion of the token’s supply likely constrained liquidity on centralized exchanges, making it easier to push prices upward. Such moves can create a false sense of market momentum.

Meanwhile, this is not the first time JELLYJELLY has experienced coordinated activity. In March 2025, the token was central to an incident on decentralized exchange HyperLiquid.

A whale manipulated the price, creating a short squeeze that threatened up to $230 million in losses in HyperLiquid’s HLP vault. In the aftermath of this incident, the perp DEX delisted JELLYJELLY, refunded traders, and boosted security with stricter delisting and open interest caps.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

ZK Atlas Enhancement: Transforming DeFi with Zero-Knowledge Powered Scalability

- ZKsync's October 2025 Atlas Upgrade introduces modular Layer 2/3 infrastructure, achieving 15,000 TPS and slashing proving costs via RISC-V-based Airbender prover. - The upgrade enables zero-fee DeFi transactions and real-time asset tokenization, with ZK token surging 50% and $19M in institutional funding for integration. - By unlocking RWA tokenization and addressing trust gaps through ZKP protocols, ZK infrastructure is redefining DeFi scalability while navigating regulatory and integration challenges.

Bitcoin Updates: Overcoming the $112K Barrier—How Global Trends and Institutional Players Intersect

- Bitcoin faces critical $112K threshold amid U.S. government shutdown-induced liquidity crunch, pushing Treasury General Account above $1 trillion. - Institutional demand wanes as BlackRock's BTC ETF inflows drop 90%, while Cathie Wood cuts 2030 price forecast by $300K due to stablecoin competition. - On-chain data reveals weak buying pressure below $100K support, though technical indicators suggest potential rebound if shutdown resolves. - Ledger plans New York IPO amid $2.17B crypto hack losses, while B

Kindness Meets Blockchain: $HUGS Demonstrates How Fan Communities Drive the Future of Crypto

- $HUGS token, linked to Milk Mocha's fanbase, sold out its whitelist rapidly, signaling community-driven crypto trends. - The 40-stage deflationary model features 23,000% price growth, token burns, and 60% APY staking to drive scarcity and liquidity. - DAO governance (HugVotes) lets holders shape NFTs, charity, and game features, blending fandom with decentralized decision-making. - Analysts highlight its Bitcoin-like scarcity strategy and real-world utility, positioning it as a 2025 crypto launch with 15

Uniswap (UNI) To Rally Higher? Key Bullish Pattern Formation Suggest So!