XRP News Today: Ripple's Efforts with Institutions Meet XRP Price Fluctuations Amid Growing ETF Anticipation

- Ripple accelerates institutional finance push via XRP ETF plans, strategic acquisitions, and product innovations like Ripple Prime's cross-margining platform. - The firm secures 75+ global licenses and partners with major banks, aligning with growing speculation about SEC approval for Grayscale's GXRP ETF by late 2025. - XRP's $2.27 price and $170B market cap contrast with Ripple's infrastructure growth, as traders weigh regulatory risks against potential ETF-driven institutional demand.

Ripple, the blockchain enterprise responsible for

Ripple’s most recent initiative is the introduction of Ripple Prime, a U.S.-based digital asset spot prime brokerage, as detailed in a

The company’s institutional strategy is further highlighted by its expanding regulatory presence. Ripple now possesses more than 75 licenses worldwide and collaborates with prominent banks such as BBVA, DBS, and the crypto arm of Société Générale. These actions coincide with growing speculation about an upcoming XRP ETF. Grayscale Investments has recently submitted Amendment No. 2 for its Grayscale XRP Trust, aiming for SEC approval to list the fund under the ticker GXRP on NYSE Arca, according to a

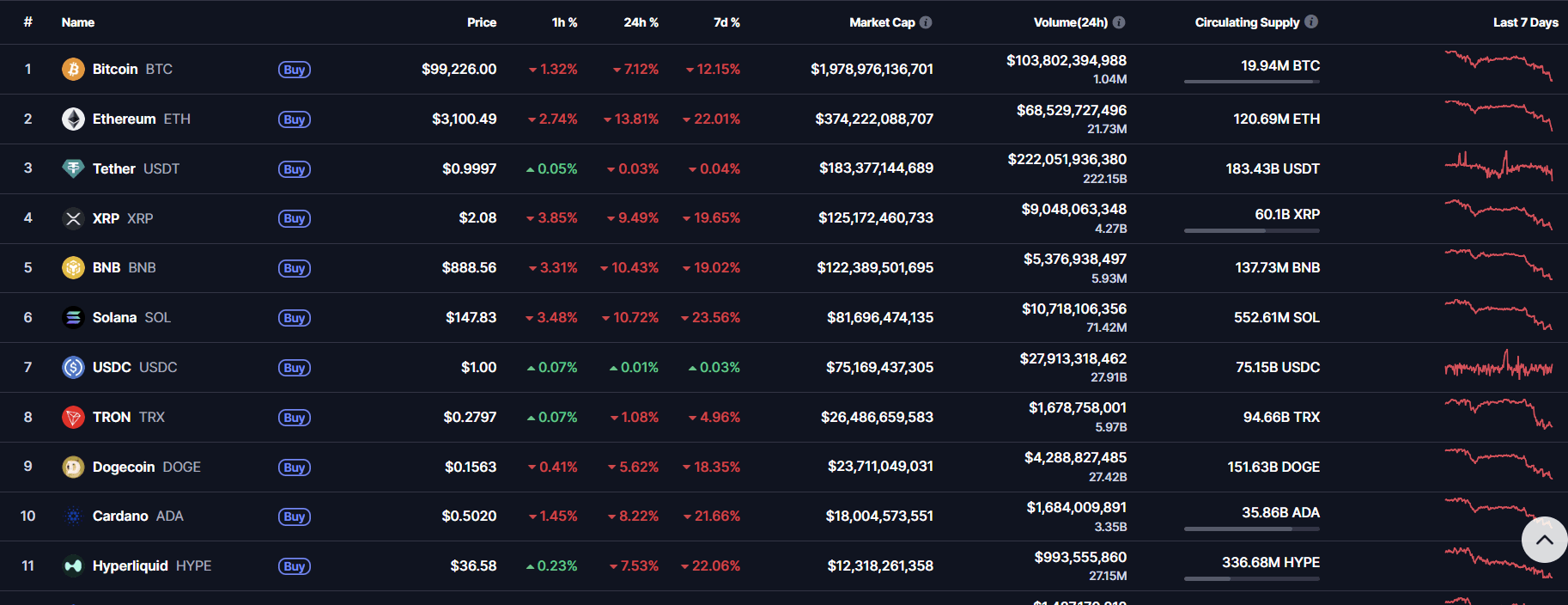

Bitwise and Grayscale have each announced ETF management fees of 0.34% and 0.35%, respectively, as the race to launch the first XRP ETF heats up. Market observers, including ETF Store President Nate Geraci, expect a regulatory verdict by the end of 2025, with a potential launch date around November 13. XRP’s total market value is currently $170 billion, placing it fifth among digital assets, though its price has ranged from $0.50 to $3.55 over the last year.

The disparity between Ripple’s business expansion and XRP’s price swings prompts debate over whether increased institutional involvement will lead to lasting demand for the token, as noted by BeInCrypto. Although Ripple’s infrastructure upgrades reflect confidence in the long-term outlook, investors remain wary, with XRP experiencing a 15% drop over the past week. The SEC’s ultimate ruling on the ETF could prove pivotal, either boosting institutional participation or underscoring the regulatory challenges facing the broader move toward tokenization.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum News Update: Ethereum ETFs See $210M Outflows While Altcoins Gain $200M from Institutional Investors

- US Ethereum ETFs saw $210M in 5-day outflows, with BlackRock's ETHA leading $81.7M daily redemptions amid regulatory uncertainty and market shifts. - Bitcoin ETFs lost $543.59M over 3 days, while Solana's BSOL ETF attracted $197M in inflows, reflecting institutional appetite for high-performance altcoins. - Ethereum's price fell below $3,500 as ETF redemptions worsened bearish pressure, contrasting with new Solana/Hedera ETFs drawing $199M in four days. - Market analysts highlight maturing crypto dynamic

Political Stalemate on Healthcare Funding Triggers Nationwide Emergency

- U.S. government shutdown hits 36 days, nearing 1995-96 record, as Congress deadlocks over healthcare funding and political concessions. - Economic impact grows: CBO warns of 1-2% GDP loss, $7B-$14B in irrecoverable costs, and 0.4% unemployment rise from prolonged closure. - Political tensions escalate: Senate Democrats block GOP funding bills, while Trump threatens to withhold SNAP benefits until government reopens. - Human crisis deepens: Food banks report surging demand, military families face food ins

Ethereum Crash Deepens: Can the $3K Line Hold or Will It Break Next?

Bitcoin Updates: Swiss Crypto Lending Offers 14% Returns Alongside Bank-Backed Insurance

- Swiss crypto lender Fulcrum offers 14% APR on stablecoins with Lloyd's insurance and FINMA regulation. - Platform uses 50% LTV over-collateralization and institutional-grade security to mitigate market risks. - Targets inflation-hedging investors by bridging traditional finance gaps with insured crypto yields. - Competes with alternatives like Bitget's zero-interest loans but emphasizes regulatory compliance and capital preservation.