Ethereum News Update: Ethereum ETFs Overtake Bitcoin, Climbing to $28.6B as Major Investors Make Bold Moves

- A major Ethereum whale increased long positions in BTC and ETH, holding $37M and $18M after exiting short bets, signaling improved market sentiment. - Ethereum ETF inflows surged to $9.6B in Q3 2025, outpacing Bitcoin, while spot ETH ETFs now hold $28.6B in assets amid rising institutional demand. - ETH price rose 5.2% to $4,160, with technical indicators suggesting potential targets up to $16,077 if bullish momentum continues. - Growing corporate adoption of Ethereum's tokenization and large exchange wi

A prominent

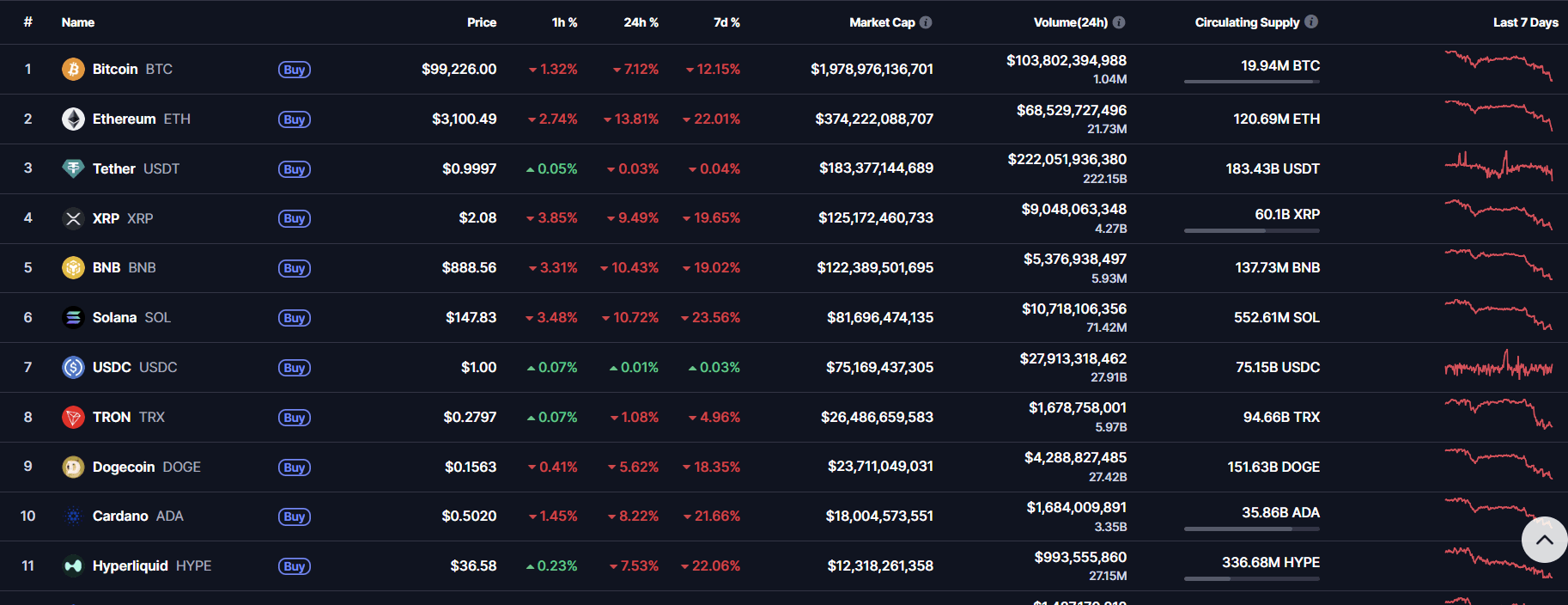

On October 31, 2025, Deribit saw the expiration of $2.6 billion in Ethereum options, with a put-to-call ratio of 1.91, signaling a bearish outlook among options traders. At that point, Ethereum was priced at $3,847, which was under the "max pain" threshold of $4,100.12—the level where the most open contracts would lose value. This expiration happened alongside a significant increase in spot ETH ETF investments, which totaled $9.6 billion in the third quarter of 2025, surpassing the $8.7 billion in Bitcoin ETF inflows during the same timeframe, according to a

Ethereum has also demonstrated strength in its price movement, climbing 5.2% to $4,160 within 24 hours as of October 31. Technical experts highlight Fibonacci retracement levels that point to possible future price targets of $6,303, $9,013, and even $16,077 if the bullish trend persists, according to a

Record-breaking ETF inflows have further boosted market optimism. U.S. spot ETH ETFs now manage $28.6 billion in assets, fueled by both institutional and retail investors, as highlighted in the TradingView piece. There has also been a notable rise in large Ethereum withdrawals from exchanges, a trend that has historically signaled accumulation phases before price surges, as noted in the TradingView report.

The whale’s decision to go long comes after a calculated move away from short positions, indicating a change in risk tolerance as market conditions improve. Although Ethereum is still trading below its recent max pain level, the combination of robust ETF inflows, increased network activity, and technical signals points to a possible breakout. Nonetheless, analysts warn that broader economic conditions and regulatory changes could still bring volatility to the market.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum News Update: Ethereum ETFs See $210M Outflows While Altcoins Gain $200M from Institutional Investors

- US Ethereum ETFs saw $210M in 5-day outflows, with BlackRock's ETHA leading $81.7M daily redemptions amid regulatory uncertainty and market shifts. - Bitcoin ETFs lost $543.59M over 3 days, while Solana's BSOL ETF attracted $197M in inflows, reflecting institutional appetite for high-performance altcoins. - Ethereum's price fell below $3,500 as ETF redemptions worsened bearish pressure, contrasting with new Solana/Hedera ETFs drawing $199M in four days. - Market analysts highlight maturing crypto dynamic

Political Stalemate on Healthcare Funding Triggers Nationwide Emergency

- U.S. government shutdown hits 36 days, nearing 1995-96 record, as Congress deadlocks over healthcare funding and political concessions. - Economic impact grows: CBO warns of 1-2% GDP loss, $7B-$14B in irrecoverable costs, and 0.4% unemployment rise from prolonged closure. - Political tensions escalate: Senate Democrats block GOP funding bills, while Trump threatens to withhold SNAP benefits until government reopens. - Human crisis deepens: Food banks report surging demand, military families face food ins

Ethereum Crash Deepens: Can the $3K Line Hold or Will It Break Next?

Bitcoin Updates: Swiss Crypto Lending Offers 14% Returns Alongside Bank-Backed Insurance

- Swiss crypto lender Fulcrum offers 14% APR on stablecoins with Lloyd's insurance and FINMA regulation. - Platform uses 50% LTV over-collateralization and institutional-grade security to mitigate market risks. - Targets inflation-hedging investors by bridging traditional finance gaps with insured crypto yields. - Competes with alternatives like Bitget's zero-interest loans but emphasizes regulatory compliance and capital preservation.