Fake News Floods Pi Network Community as Exchange Supply Hits a New High

Pi Network faces a surge of misinformation about an alleged Global Consensus Value launch and ISO 20022 ties. While the Pi Core Team continues fighting fake news, rising exchange supply signals growing investor unease.

In November 2025, the Pi Network community has been buzzing with exciting and promising updates about the project’s development. However, behind the enthusiasm lies a wave of fake news circulating on X, aimed at manipulating sentiment and Pi’s perceived value.

The Pi Core Team (PCT) has not confirmed or officially announced these reports. Instead, influential Pioneers with large followings mainly spread them, fueled by investors’ tendency to believe what they want to hear.

What Fake Stories Are Circulating in the Pi Network Community This November?

In early November, Pioneers began spreading news that the Global Consensus Value (GCV) would officially launch on November 22, 2025, with participation from major financial institutions. This rumor quickly captured attention.

🌍🔥 THE PI REVOLUTION HAS BEGUN – GCV GOES LIVE ON NOVEMBER 22, 2025!November 22, 2025 marks a historic milestone as GCV officially goes live and the ISO 20022 standard switches on, launching a new era where Pi Network connects directly with major global banking…

— Learn everything (@dannamviet) November 2, 2025

As GCV supporters claim that each PI token should be valued at $314,159. The mathematical constant π inspires this number. However, the project’s core team has never mentioned or acknowledged the existence of GCV.

The rumor originated from earlier speculation that Pi Network was moving closer to ISO 20022 compliance, and might connect with Stellar (XLM) and Ripple (XRP) to bridge crypto with traditional finance.

Based on this narrative, some Pioneers interpreted that a middleware system would soon allow Pi to connect with traditional institutions, making Pi transactions interoperable with banks.

However, the account Pi Network argued that such claims are unreliable, explaining:

- The Pi Core Team has neither announced nor recognized GCV nor confirmed an official launch date of November 22.

- Assigning a specific date is a hallmark of fake news, used to plant hope in investors and manipulate price expectations.

- The story about Pi’s alignment with ISO 20022 did not originate directly from the PCT; most community discussions are interpretations that are favorable to Pi Network.

- The idea of a simple middleware connecting Pi and banks is oversimplified. Research from Stellar shows that such integration is highly complex and typically requires a stablecoin bridge.

“For reference, November 22nd is the date when the SWIFT network stops routing old-style MT messages. This only applies to members of the SWIFT network, which is a private cooperative. SWIFT is a messaging network, while Pi is a blockchain — blockchains transmit value, not messages,” X Account Pi Network said.

In August, the Pi Core Team launched a campaign encouraging the community to report misinformation.

However, many investors still choose to believe information that benefits their portfolios, even when it lacks verification or credible sources.

“Remember: Only what Pi Core Team says is real,” Pi Network added.

Meanwhile, Pi Supply on Exchanges Hits a Record High

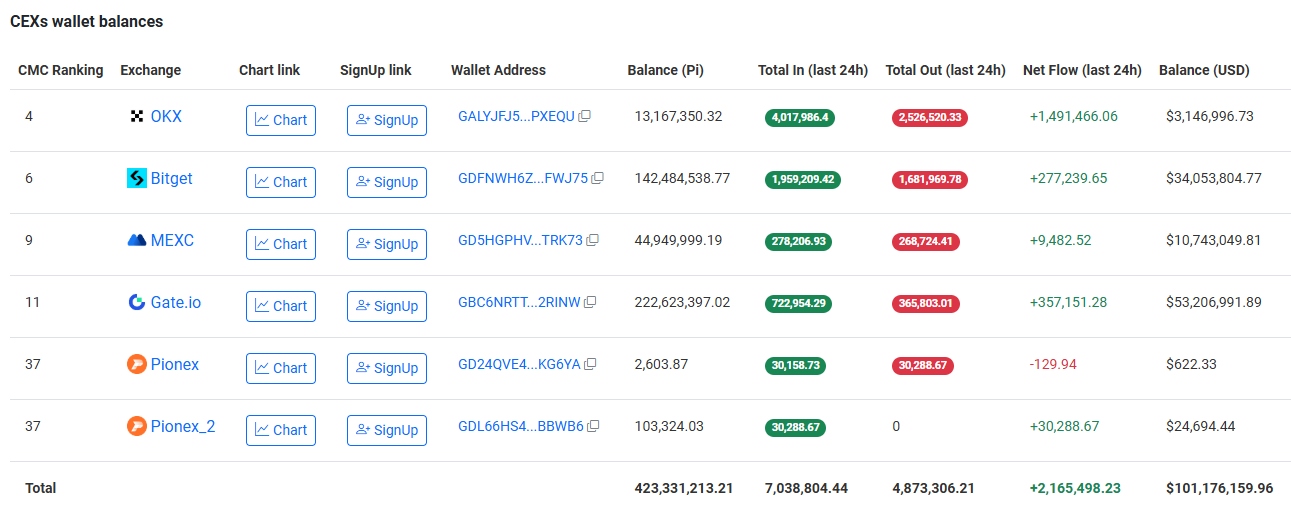

In the first week of November, the Pi exchange balance reached a new all-time high of over 423 million PI, increasing by more than 13 million PI compared to previous reports. In the past 24 hours alone, more than 2 million PI tokens have been transferred to exchanges.

Despite some positive developments — such as the AI-based KYC system upgrade and Pi Network Ventures’ first investment in OpenMind — many holders continue to sell. The overall market sentiment remains dominated by fear.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

AI-Generated Algorithms and Human Interaction: The Internet's Trustworthiness Dilemma

- The "Dead Internet Theory" resurfaces as AI-generated content dominates online platforms, blurring human engagement metrics. - Pixalate's Q3 2025 data reveals 37% non-human traffic in Brazilian mobile app ads, highlighting ad viewability crises. - C3.ai's 19% revenue drop and $117M loss underscore AI sector risks from high costs and competitive pressures. - Advertisers face unreliable metrics as algorithmic noise grows, prompting calls for stricter regulations and advanced analytics.

Ethereum Latest Updates: Major Institutions Support Ethereum's Supercycle, While Technical Experts Raise Concerns

- Tom Lee predicts Ethereum's "supercycle" driven by institutional adoption and DeFi growth, sparking market debate over valuation risks. - SharpLink Gaming's 1,100% revenue surge and $200M ETH allocation to Linea highlight bullish institutional strategies amid price volatility. - Technical analysts warn ETH's $3,500 support is critical after breaking below key channels, with $37B daily volume reflecting mixed momentum. - Growing institutional demand contrasts with critics' concerns over centralization ris

The Rapid Rise of ZEC (Zcash) Value: An In-Depth Technical and Strategic Analysis

- Zcash (ZEC) surged 66.55% in November 2025, peaking at $683.14, driven by treasury initiatives, privacy innovations, and institutional investments. - Cypherpunk Technologies' $50M treasury and Zashi Wallet's privacy swaps boosted demand, while Winklevoss Capital and Grayscale added $72.88M in institutional backing. - Technical indicators show overbought conditions (RSI 94.24) but bullish momentum persists, with derivatives markets holding $1.13B in open interest and a 1.06 long-to-short ratio. - Zcash's

ICP Caffeine AI's Rising Popularity: Ushering in a New Age for Blockchain Investors and AI-Powered DeFi

- Dfinity's ICP Caffeine AI bridges blockchain and AI in 2025, enabling non-technical users to build dApps via natural language prompts. - The platform saw 30% ICP token price growth and $237B TVL in Q3 2025, but faced 22.4% dApp usage decline amid market saturation. - Investors prioritize infrastructure projects like ICP Caffeine AI for AI-driven DeFi scalability and security, contrasting with speculative token trends. - Regulatory scrutiny and user retention challenges persist, but enterprise adoption of