CZ openly builds a $2 million position and calls for ASTER, reigniting the battle in the decentralized derivatives arena

CZ has publicly disclosed his personal investment activities for the first time, purchasing 2.09 million Aster (ASTER) tokens, which drove the price up by 30%. As a decentralized perpetual contract exchange, Aster has quickly risen thanks to its technological advantages and CZ’s support, leading to fierce competition with Hyperliquid. Summary generated by Mars AI. This summary is produced by the Mars AI model; the accuracy and completeness of its generated content are still being iteratively improved.

This is the first time Changpeng Zhao has publicly endorsed a token with real money, and the balance in the Perp DEX sector is beginning to tilt.

"Eight years ago, I bought some BNB in the first month of TGE and have held it ever since (except for the portion used for spending)."

On the evening of November 2, Binance founder Changpeng Zhao (CZ) left this meaningful message on social media after disclosing his purchase of 2.09 million Aster (ASTER) tokens. This was not an ordinary statement. According to CZ's publicly available Binance account records, the average price of this transaction was locked at $0.913, with a total value exceeding $1.9 million.

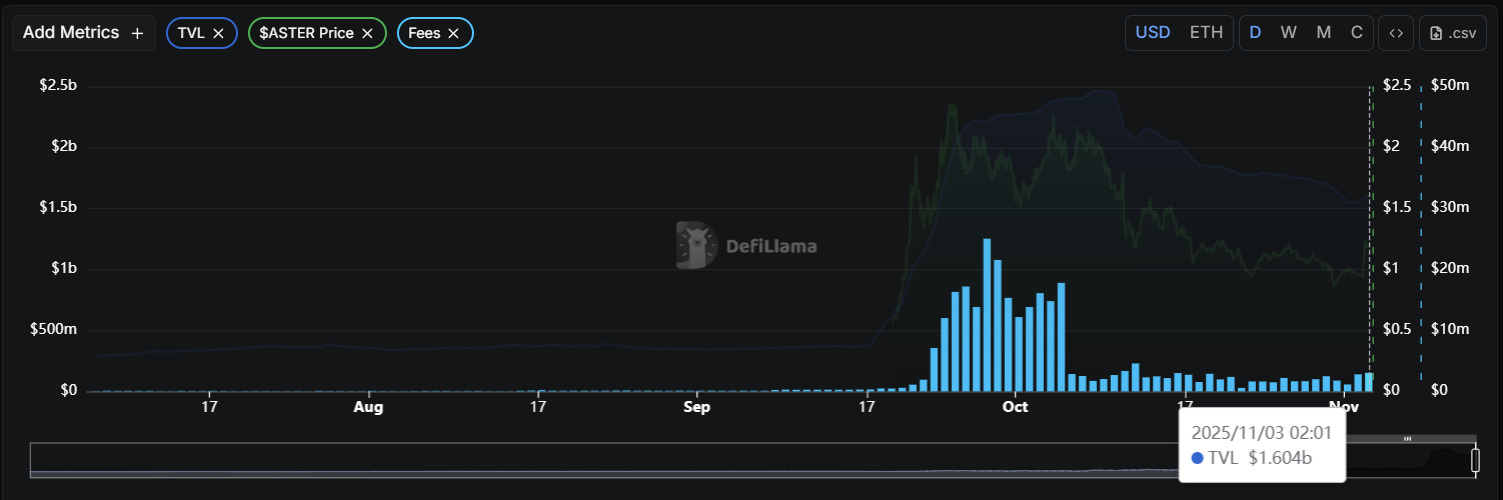

After the news was released, ASTER soared in response, quickly rising from $0.9 to around $1.25, a nearly 30% increase in one hour, with its market cap returning above $2 billion.

Unlike previous occasions when he merely retweeted project updates or liked innovative features, this is the first time CZ has publicly disclosed a personal investment since stepping down as Binance CEO. He specifically emphasized that he is not a trader, but a long-term holder, which is consistent with his usual investment style.

CZ's Ambition: From BNB to ASTER, Binance Ecosystem's Deep Defense

CZ's support for Aster is by no means a whim. As early as September this year, he interacted with Aster-related content on social media multiple times, praising its Hidden Order feature and noting that "it was achieved in just 18 days after launch, much faster than over 30 similar projects."

At that time, Aster had just completed its Token Generation Event (TGE), and with CZ's endorsement, its token price skyrocketed by 1,650% within 24 hours, soaring from $0.0089 to $0.78, with trading volume surpassing $310 million and user numbers surging by 330,000.

CZ's open purchase of Aster this time reflects his strategic layout for the decentralized perpetual contract (Perp DEX) sector. YZi Labs (formerly Binance Labs), founded by him, is the incubator behind Aster, making Aster truly a new force in the "Binance ecosystem." For Binance, supporting Aster is a combination of "defense + offense." On the defensive side, if Aster grows into a leading platform, Binance will benefit indirectly due to capital ties, avoiding being completely marginalized. On the offensive side, with Aster, Binance can preemptively position itself in the decentralized sector, maintaining a buffer in the competition with rivals like Hyperliquid.

The Rise of Aster: 2,500% Surge in Three Weeks, Technical Advantages Build a Moat

Aster is not a project that appeared out of nowhere; it is a decentralized perpetual contract exchange formed by the merger of Astherus and APX Finance at the end of 2024. After the merger, Aster is committed to solving the inefficiency of separating yield generation and trading activity in DeFi, aiming to create an ecosystem that seamlessly connects yield and trading.

Aster's core innovation lies in its "Trade & Earn" model, allowing users to use yield-generating assets as margin for perpetual contract trading, thus achieving multiple income streams from capital. At the same time, Aster offers 24/7 non-custodial trading, supporting both cryptocurrency and traditional stock perpetual contracts, becoming a bridge between traditional finance and DeFi.

Aster demonstrates significant advantages in its technical architecture. Its underlying structure adopts an "off-chain order book + on-chain settlement" model, with a transaction confirmation speed of just 0.3 seconds, far surpassing Hyperliquid's 1.2 seconds. Meanwhile, Aster supports leverage trading up to 1001x, much higher than the industry average.

Aster offers a dual-mode trading experience: Simple mode is one-click execution and MEV-protected, suitable for novice users; Pro mode provides advanced tools such as order books, hidden orders, and grid trading, catering to professional traders. This dual-mode design enables it to attract different user groups simultaneously. In the past three weeks, Aster's token price has surged from a low of $0.07 to $1.79, a cumulative increase of 2,500%. Its daily fee income is approaching Tether, only $3 million short of surpassing it.

Hyperliquid's Moat: Sub-Second Trading and First-Mover Advantage

In the face of Aster's strong rise, Hyperliquid, the current king of the decentralized perpetual contract sector, is no pushover.

Hyperliquid is an L1 public chain built specifically for financial trading, and like Ethereum and Solana, it is an independent blockchain. Hyperliquid's core advantage lies in its technical architecture. It uses its self-developed Hyperliquid Chain to achieve sub-second transaction confirmation, with throughput up to 200,000 TPS and liquidity depth comparable to centralized exchanges.

This extreme technical optimization makes Hyperliquid's trading experience almost indistinguishable from that of centralized exchanges. In terms of liquidity, Hyperliquid also demonstrates the strength of a market leader.

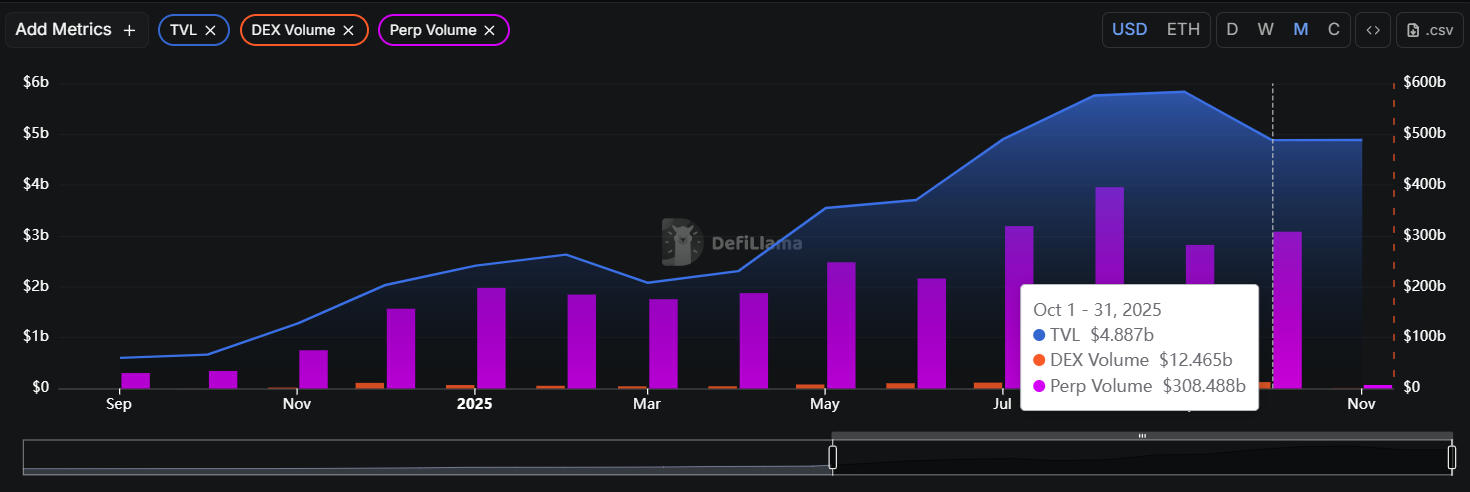

As of October 2025, the platform's total value locked (TVL) is about $4.8 billion, accounting for 80% of the Perp DEX market share, with cumulative trading volume exceeding $2.3 trillion and open interest reaching $15.2 billion.

Hyperliquid's tokenomics are also cleverly designed. HYPE token stakers can enjoy up to 40% annualized returns and fee discounts. The platform injects 93% of fees into the Assistance Fund (AF) to buy back and burn HYPE tokens, forming a positive feedback loop.

However, Hyperliquid is facing internal challenges. According to its tokenomics, HYPE will enter a 24-month linear unlocking period on November 29, with about $500 million worth of tokens released each month, which may create sustained selling pressure.

Fierce Competition: The Battle Behind the Data

Looking at core metrics, the competition between Aster and Hyperliquid is in full swing. In terms of trading volume, Aster has performed strongly since its launch, with the highest daily trading volume reaching $42 billion, while Hyperliquid's average daily trading volume is about $7.9 billion.

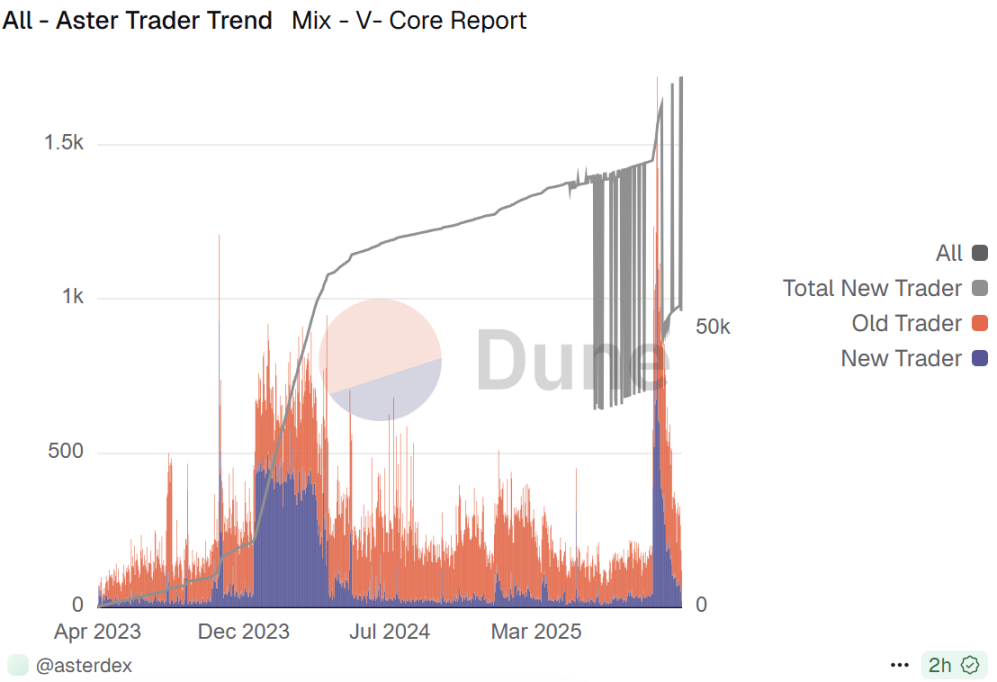

However, in terms of user base, Hyperliquid still maintains a lead.

As of the end of October, Hyperliquid had 688,000 users, while Aster, despite rapid growth, had 1.848 million users (including airdrop users), but its actual active trading users still lag behind Hyperliquid. Fees are a key dimension of competition between the two.

Aster's base fee rate is slightly lower than Hyperliquid's (Aster maker 0.01%/taker 0.035%, Hyperliquid maker 0.01%/taker 0.045%), a pricing strategy that is highly attractive to high-frequency trading users.

In terms of asset coverage, Aster supports 40 types of cryptocurrency perpetual contracts, 15 more than Hyperliquid, and has added popular tokens such as SOL and APT.

More importantly, Aster also offers stock perpetual contracts, such as Apple and Tesla, further expanding its product boundaries.

In terms of technical architecture, the two represent different development paths: Hyperliquid focuses on building its own L1, pursuing ultimate trading speed; Aster excels at multi-chain routing, emphasizing cross-chain liquidity aggregation. The former is a representative of performance supremacy, while the latter pays more attention to borderless liquidity connection.

Risks and Challenges: Hidden Concerns Facing Aster

Despite Aster's strong performance, the risks behind it cannot be ignored.

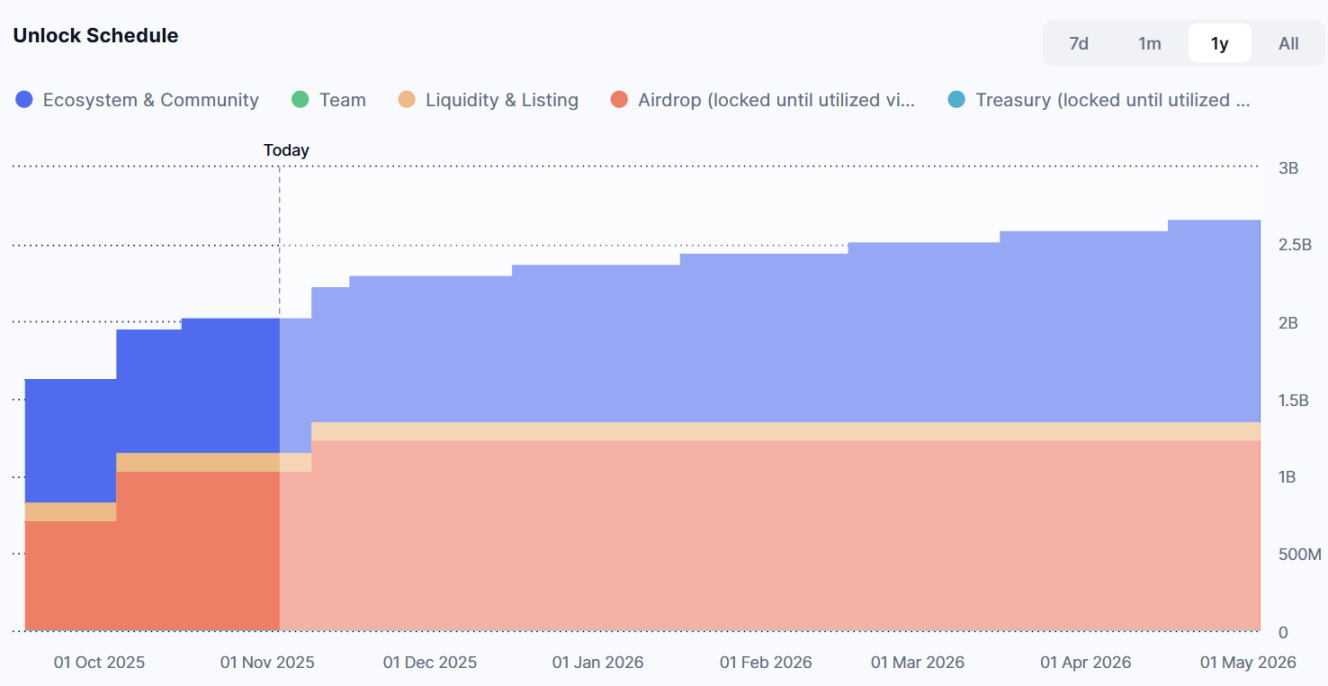

In terms of tokenomics, ASTER has a total supply of up to 8 billion tokens, with two cliff unlocks coming in November: about 200 million tokens (2.5% of total supply) worth about $240 million will be unlocked on November 10; about 72.73 million tokens (0.91% of total supply) worth about $87.276 million will be unlocked on November 17.

Large unlocks in an environment of scarce market liquidity may create significant selling pressure. To address this challenge, Aster has launched the S3 buyback program, promising to use 70%-80% of trading fees to buy back ASTER on the open market, with daily execution until the cumulative amount reaches the target range.

According to DefiLlama data, Aster's recent average daily fees exceed $2 million, so the daily buyback amount is about $1.35 million to $1.54 million.

On October 31, the official team further announced that 50% of all buyback funds would be used for burning, to reduce supply and consolidate ASTER's long-term value.

Reshaping the Market Landscape: The Future Direction of the Perp DEX Sector

Aster's strong rise is changing the competitive landscape of the decentralized derivatives market.

Previously, Hyperliquid dominated, occupying 80% of the market share, leading to stagnation in sector innovation and persistently high fees.

Aster's entry has forced the industry to iterate technologically. To cope with the competition, Hyperliquid has announced the launch of a "0.02% fee package" in October and is accelerating the development of cross-chain trading features. This healthy competition ultimately benefits the entire decentralized perpetual contract ecosystem.

The essence of competition in the Perp DEX sector is a contest between ecosystem synergy and technological idealism. Aster, leveraging Binance's ecosystem resources, has rapidly expanded and achieved astonishing growth data in the short term.

Meanwhile, Hyperliquid relies on its technical advantages and first-mover position to maintain a large user base and deep liquidity. This competition has also attracted more capital to the decentralized contract field.

Since the beginning of this year, more than $500 million in venture capital has flowed into this sector, and it is expected that more than 10 new projects will be launched in the next six months, with the sector's scale likely to exceed $50 billion.

From a more macro perspective, decentralized derivatives trading is still in its early stages of development. Currently, the entire decentralized perpetual contract market's trading volume accounts for only about one-tenth of that of centralized exchanges, leaving huge room for growth.

Especially from September to October this year, a large number of new users poured in, with the daily increase even surpassing the bull market level at the beginning of 2024. Facing the large unlocks in November, Aster is trying to ease selling pressure through its on-chain buyback mechanism. However, Hyperliquid, with its solid technical foundation, deeper liquidity, and more mature tokenomics, still maintains strong competitiveness.

In the long run, whether Aster can surpass Hyperliquid remains to be seen. When the market refocuses on fundamentals, projects like Hyperliquid, which have real technical advantages and stable cash flow, are more likely to win in long-term competition.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

From Mascot to On-Chain Carnival: How Warplets Ignited Farcaster's NFT Season

The Warplets NFT series has sparked a frenzy on the Farcaster platform, generating unique NFTs based on users' FIDs and avatars. Part of the proceeds is used to burn tokens, driving a surge in platform activity and trading volume. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively updated by the Mars AI model.

Crypto Whale Operations Record: Weekly Loss of $40 Million and Copy Trading Crash

Is the bear market scenario playing out again?