Crypto Whale Operations Record: Weekly Loss of $40 Million and Copy Trading Crash

Author: Wenser, Odaily

Original Title: Crypto Whale Operations Highlights: Insider Whale Faces $40 Million Weekly Unrealized Loss, Copy-Traders Suffer Heavy Liquidations

The crypto market has once again entered a period of downward volatility, and the well-known crypto whales, often regarded as "market trend indicators," have once again started their performances as expected. However, even for these whales with substantial capital, recent trading operations have been far from satisfactory. Among them, some chose to continue increasing their positions after the market rebound, only to suffer tens of millions of dollars in unrealized losses; some reaped gains from token surges but are still far from breaking even; others opted to sell BTC directly on exchanges to realize profits. Odaily will summarize recent crypto whale operations in this article for readers' reference.

100% Win Rate Insider Whale Faces Nearly $40 Million Weekly Unrealized Loss, Position Value Exceeds $380 Million

As the crypto whale with the highest win rate since the "10·11 Crash," and respectfully referred to by the community as the "100% Win Rate Insider Whale," the current position status is also far from optimistic.

At the end of October, the whale opened BTC and ETH long positions, with unrealized profits exceeding $10 million in three days;

On October 27, the unrealized profit on the position once exceeded $20 million;

On October 28, the whale opened a SOL long position and quickly pushed the position value to over $21 million on the same day;

On October 29, the whale closed the BTC long position, realizing a profit of $1.4 million; at that time, the whale still held ETH (5x leverage) and SOL (10x leverage) long positions, valued at $263 million, with an unrealized loss of $1.3 million; that afternoon, the whale began to reduce the ETH long position, first reducing by 3,400 ETH and realizing a profit of $186,000; then reducing by 11,000 ETH, realizing a profit of $618,000. Ultimately, that afternoon, the whale closed the ETH long position, with a cumulative profit of $1.637 million; only the SOL long position remained, valued at $74.21 million, with an unrealized loss of $1.68 million.

On October 30, the whale opened a new BTC long position, and including the SOL long, quickly accumulated a total unrealized loss of $3.33 million; subsequently, after Powell's speech triggered a market drop, the whale opened another ETH long position. By noon that day, the unrealized loss soared to around $6.5 million.

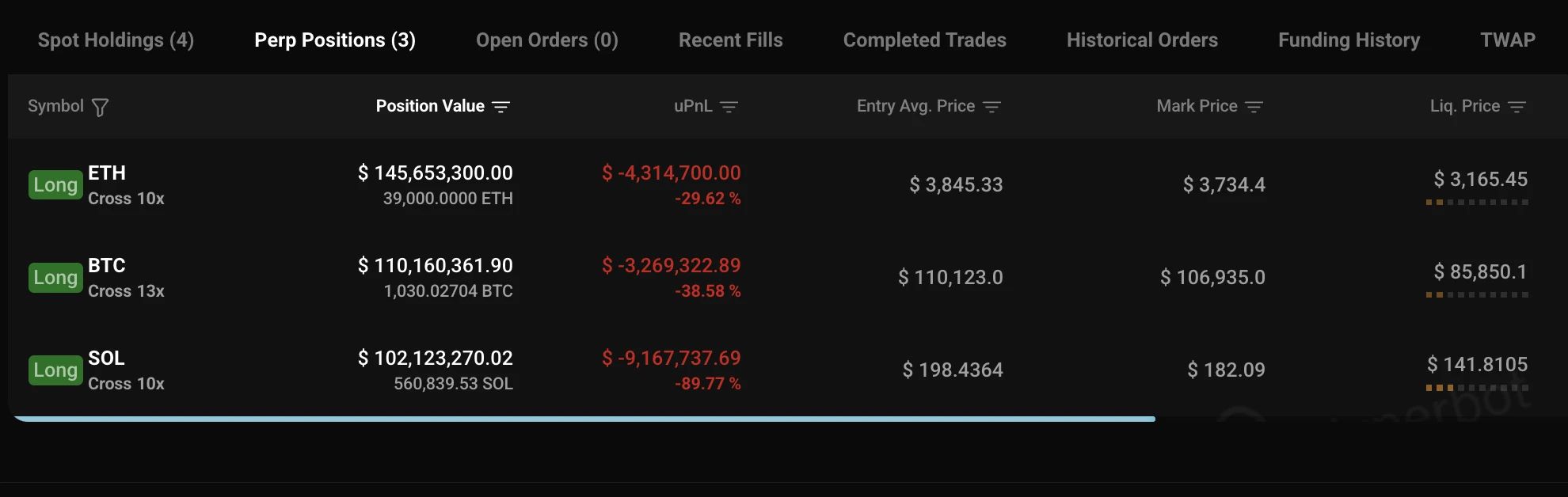

On October 31, the unrealized loss on the whale's long positions once increased to over $16 million, including:

-

ETH long position unrealized loss: $4.31 million;

-

BTC long position unrealized loss: $3.27 million;

-

SOL long position unrealized loss: $9.16 million.

The rest of the story is well known—

On November 1, the unrealized loss narrowed to around $7 million;

On November 2, the whale increased the SOL long position again, adding 23,871.83 SOL at a cost of about $4.39 million, narrowing the unrealized loss to $6.3 million.

As of this writing, this insider whale has given back all previous contract trading profits from this address; the unrealized loss over the past week has increased to nearly $40 million.

On-chain information details:

Copy-Trading Insider Whale Also Hit Hard by Market, 2 Whales Lose Over $1.2 Million

Ironically, perhaps due to the past stellar performance of the 100% win rate insider whale, there is no shortage of copy-traders in the market. As the market continued to decline, these copy-traders quickly learned a harsh lesson.

Address 0×955…396A8 opened a BTC long position on the morning of October 30 during a BTC rebound, but panic-closed the position during a rapid midday pullback, losing about $217,000 in just four hours;

Address 0×960…0e2Ee chased BTC and ETH longs on October 27 when BTC price hit a high of $115,372.8, with a total position once reaching $36.87 million, but ultimately closed all positions during the downturn, losing about $1.061 million in 24 hours.

It is worth noting that whales who suffered heavy losses by longing BTC are not limited to the above three.

40x BTC Long, Whale Liquidated for $6.3 Million Loss in One Day

On October 30, a whale used 40x leverage to long $107 million worth of BTC, but the position was liquidated during the evening's continuous decline; in the end, the entire $143 million long position was liquidated, resulting in a $6.3 million loss.

After being liquidated, the whale continued to use the remaining $470,000 to open another 40x BTC long, with a position value of $19 million, and the liquidation price was only $1,200 away from the current price.

Currently, this whale address is using 5x leverage to long ASTER, VIRTUAL, and ZEC, all of which are in a loss state.

On-chain information:

Two Whales Long ZEC, One Once Profited Over $4 Million, Another Lost Over $6 Million

On November 1, according to OnchainLens monitoring, as ZEC's market cap surpassed XMR, two whales holding positions on HyperLiquid made significant profits from their long positions, including:

New address 0x519c held a 5x ZEC long, with an unrealized profit of about $2.2 million at the time; this address has now closed all positions, with a cumulative profit of over $1.58 million.

On-chain information:

Address 0x549e also held a 5x ZEC long, with an unrealized profit of about $1.8 million at the time; current profit has retraced to around $1.14 million;

Meanwhile, the 10x HYPE long position, which once had an unrealized profit of about $2.3 million, has now retraced into a loss.

Currently, this whale's overall account is still in an unrealized loss of over $6 million.

On-chain information:

Insider Whale Quietly Takes Profits, Long-Term Holder Gains Over $14.4 Million

Some choose to fight on the battlefield, while others choose to take profits when the time is right.

Long-Term Whale Sells 5,000 ETH, Profits $14.43 Million

On October 29, according to The Data Nerd monitoring, a whale (0×742…ede) deposited 5,000 ETH worth about $19.91 million to Kraken.

It is reported that these funds were purchased by the whale six months ago at an average price of $1,582, resulting in a profit of about $14.43 million for this transaction, with a return on investment of 152%. In addition, this address accumulated 8,240 ETH at an average price of $1,195 three years ago and sold them last year at an average price of $2,954.

Insider Whale Dumps 1,200 BTC Worth $132 Million

On November 2, according to on-chain analyst Ai Yi, the whale (1E2…ZRpQ), who previously made huge profits by opening short positions before the 10·11 flash crash, has transferred a total of 1,200 BTC worth $132 million to Kraken over the past week.

The most recent transfer was 500 BTC, and this address has now closed all positions.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Can BlackRock's Bitcoin ETF prevent a Bitcoin crash?

Bitcoin has fallen below $105,000, despite BlackRock launching a new Bitcoin ETF in Australia. Can institutional adoption prevent Bitcoin from dropping below $100,000?

Ethereum Staking Weekly Report November 4, 2025

1️⃣ Ebunker ETH staking yield: 3.32% 2️⃣ stETH (Lido) 7-day average annualized yield...

XRP price flashes classic ‘hidden bullish divergence.’ Is $5 still in play?

Bitcoin falls under $101K: Analysts say BTC is ‘underpriced’ based on fundamentals