NFT sales drop 28% to $98m, Bored Ape Yacht Club sales surge 100%

According to CryptoSlam’s data, NFT (non-fungible token) sales volume has declined by 28.42% to $98.18 million, down from last week.

However, market participation has bucked the trend, with NFT buyers surging by 22.86% to 626,341 and sellers climbing by 13.54% to 469,316.

NFT transactions fell by 5.08% to 1,458,311. The global crypto market cap has also dropped and now stands at $3.71 trillion, down from last week’s $3.75 trillion.

- NFT sales fell 28% to $98.18M, but buyers surged 22.86% to 626,341.

- BAYC sales jumped 108%, while DMarket and DX Terminal saw declines.

- Ethereum led networks with $41.72M in NFT sales, up nearly 20% weekly.

DMarket’s decline, BAYC’s comeback

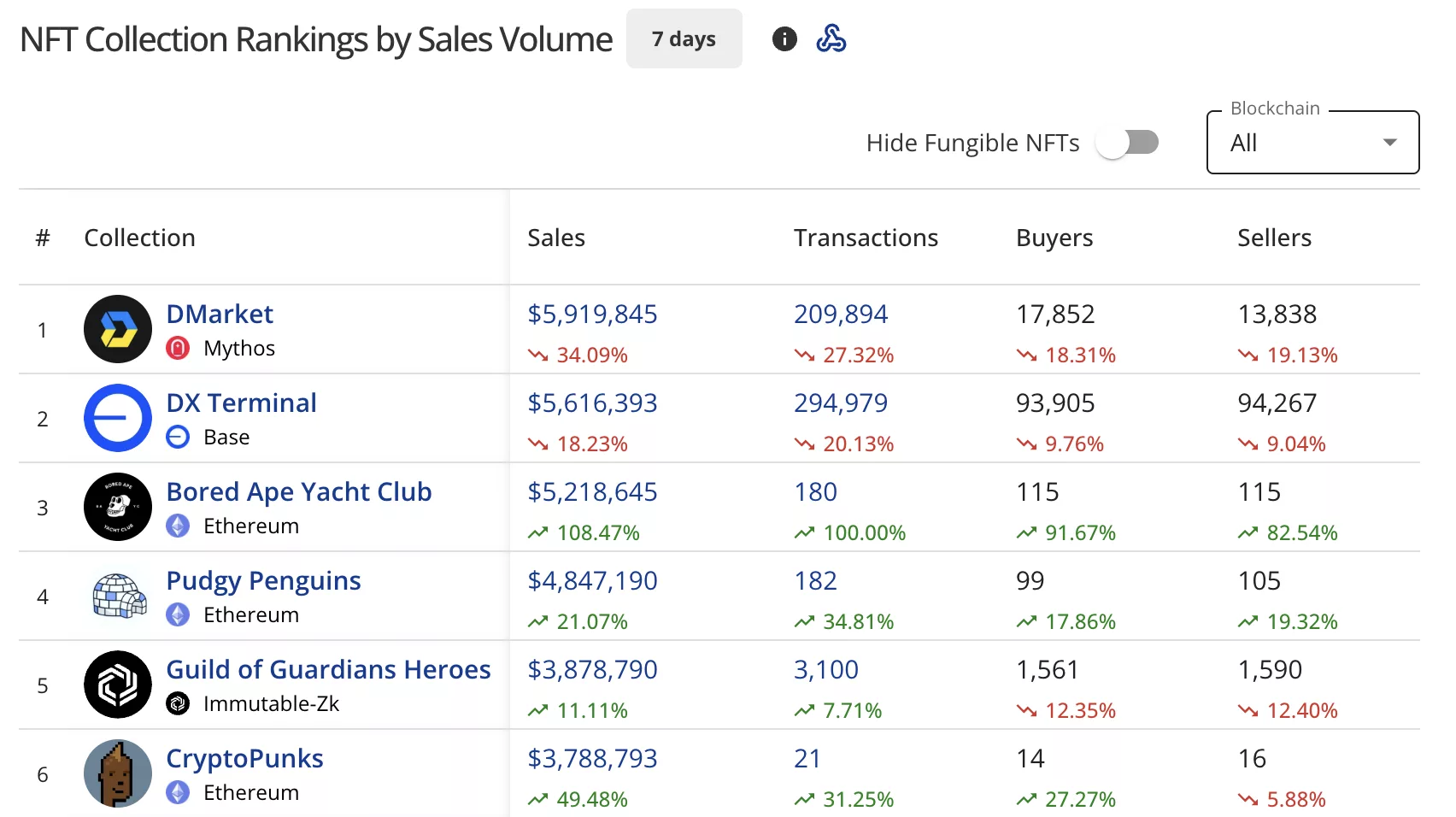

DMarket, on the Mythos blockchain, is down 34.09% from last week’s $9.05 million. Yet it still maintains first place with $5.92 million in sales. The collection processed 209,894 transactions with 17,852 buyers and 13,838 sellers.

DX Terminal on Base held second position at $5.62 million, down 18.23% from last week’s $7.56 million. The collection recorded 294,979 transactions.

Source: Top collections by NFT Sales Volume (CryptoSlam)

Source: Top collections by NFT Sales Volume (CryptoSlam)

Bored Ape Yacht Club stormed back into the top rankings at third place with $5.22 million in sales, surging 108.47%.

The Ethereum ( ETH ) collection had 180 transactions with 115 buyers and 115 sellers.

Pudgy Penguins climbed to fourth with $4.85 million, up 21.07% from last week’s $3.80 million. The collection saw 182 transactions with 99 buyers and 105 sellers.

Guild of Guardians Heroes on Immutable-Zk secured fifth place at $3.88 million, up 11.11% from last week’s $3.45 million. The collection had 3,100 transactions.

CryptoPunks entered the top six with $3.79 million, surging 49.48%. The Ethereum collection processed just 21 transactions with 14 buyers and 16 sellers.

Ethereum extends lead

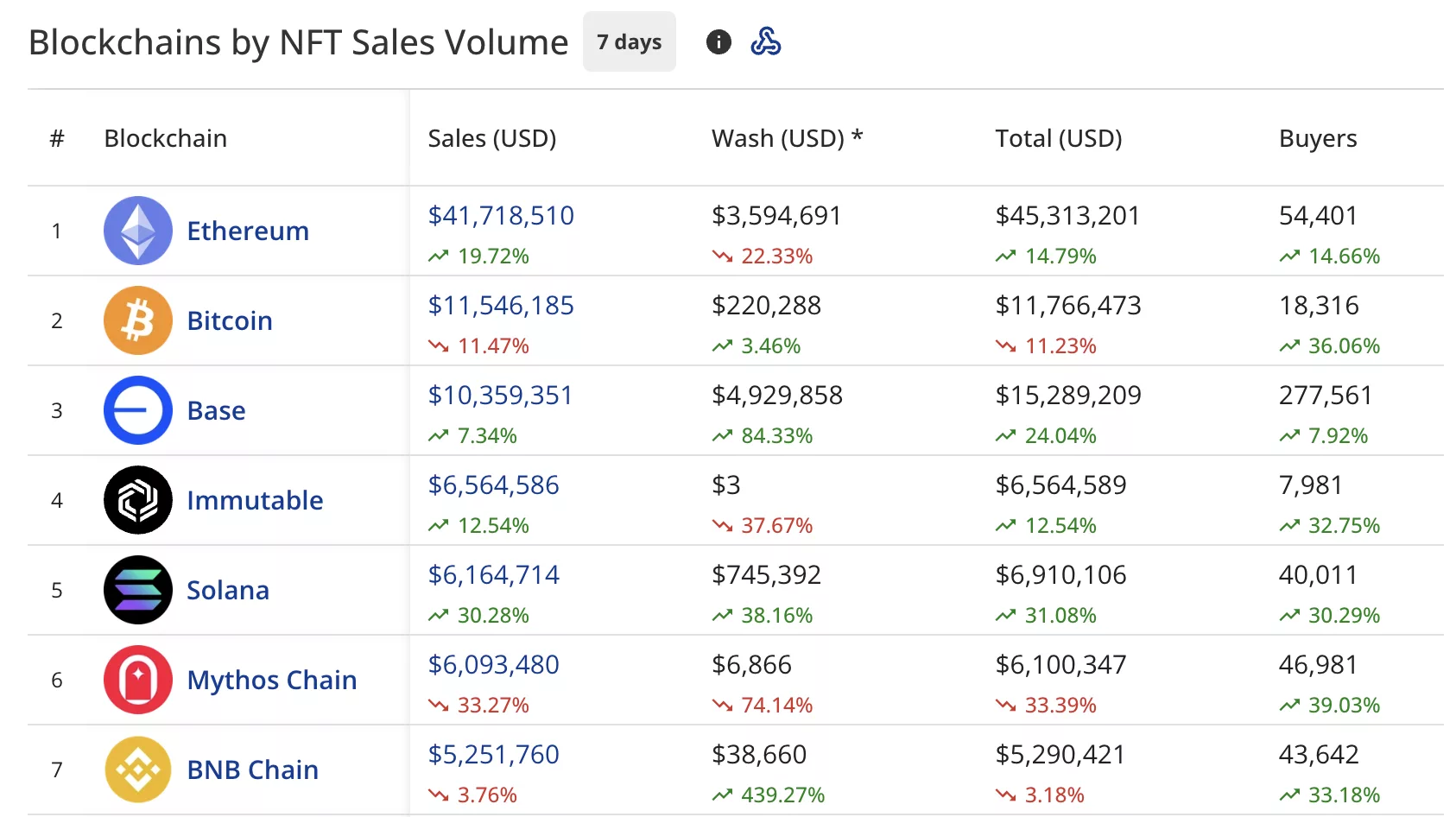

Ethereum strengthened its position at the top with $41.72 million in sales, up 19.72% from last week’s $35.04 million.

The network recorded $3.59 million in wash trading, bringing its total to $45.31 million. Buyers increased by 14.66% to 54,401.

Bitcoin ( BTC ) held second place with $11.55 million, down 11.47% from last week’s $13.17 million. The network saw 18,316 buyers, up 36.06%.

Source: Blockchains by NFT Sales Volume ( CryptoSlam )

Source: Blockchains by NFT Sales Volume ( CryptoSlam )

Base remained in third with $10.36 million, up 7.34% from last week’s $10.19 million. The blockchain recorded $4.93 million in wash trading, with buyers rising 7.92% to 277,561.

Immutable ( IMX ) climbed to fourth position with $6.56 million, up 12.54% from last week’s $5.73 million. The network had 7,981 buyers, up 32.75%.

Solana ( SOL ) secured fifth place with $6.16 million, surging 30.28% from last week’s $4.92 million. The blockchain attracted 40,011 buyers, up 30.29%.

Mythos Chain dropped to sixth at $6.09 million, down 33.27% from last week’s $9.27 million. The blockchain had 46,981 buyers, up 39.03%.

BNB Chain ( BNB ) rounded out the top seven with $5.25 million, down 3.76% from last week’s $5.33 million. Buyers jumped 33.18% to 43,642.

CryptoPunk leads high-value transactions

- CryptoPunks #8407 topped individual sales at $413,469.94 (100 ETH), sold five days ago.

- Bored Ape Yacht Club #3105 placed second at $359,769.63 (90 ETH), sold three days ago.

- V1 Cryptopunks Wrapped #4350 sold for $248,839.14 (62.9 ETH) seven days ago.

- Autoglyphs #256 fetched $222,558.91 (59 WETH) two days ago.

- CryptoPunks #7378 completed the top five at $212,360.44 (51 ETH), sold five days ago.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Japan Unveils $110B Stimulus: Major Shift from Fiscal Restraint to Economic Expansion and National Security

- Japan's PM Sanae Takaichi unveils $110B stimulus to combat stagnation and bolster security amid China tensions. - Plan includes tax cuts, utility subsidies, defense spending, and strategic investments in AI, semiconductors , and shipbuilding. - Funded by 14-trillion-yen supplementary budget, with potential expansion to 20-trillion-yen ($133B) as per analyst estimates. - Shift from austerity reflects Takaichi's hardline security stance and response to China's travel advisory over Taiwan remarks. - Impleme

Bitcoin News Update: Bitcoin Reaches $96K Amidst Institutional Interest and Challenges from Regulations and Price Barriers

- Bitcoin surged past $96,000 as buyer accumulation and seller exhaustion drove short-term recovery, though $106,000–$118,000 remains a key resistance zone. - Harvard’s $443M investment in BlackRock’s IBIT highlights growing institutional adoption, contrasting traditional preferences for private equity. - Bitcoin Depot reported 20% Q3 revenue growth but faces regulatory challenges, expanding internationally while projecting Q4 declines due to compliance costs. - MicroStrategy’s Michael Saylor denied Bitcoi

Bitcoin News Today: Bitcoin Faces $62K Drop Threat Amid Fed's Data Silence Predicament

- Bitcoin faces $62K crash risk amid Fed uncertainty caused by U.S. government shutdown's "data blackout" disrupting inflation/labor data. - Post-Nov 13 reopening saw BTC rebound above $102K, but markets remain fragile with 20% decline from October peak despite $140B ETF growth. - Fed rate cut odds dropped to 52% for December, creating volatility as institutions like Harvard Endowment invest $443M in Bitcoin ETFs. - U.S. miners struggle with 37.75% global hashrate share amid lack of federal incentives, con

Bitcoin Updates Now: Crypto Faces a Standstill as Market Anxiety Meets Harvard’s Confident Bitcoin Investment

- Alternative Data's Fear & Greed Index hit record low 10 on Nov 16, signaling extreme crypto market fear and frozen investor sentiment. - Bitcoin fell 5% to $96,000 while CD20 lost 5.8% as profit-taking, liquidations, and liquidity declines accelerated selloffs. - Rising U.S. Treasury yields and central bank uncertainty worsened losses, with Nansen noting "perfect storm" of macro risks and institutional outflows. - Harvard's $443M IBIT ETF investment contrasts current bearishness, highlighting diverging i