Key Market Information Discrepancy on October 31st, a Must-See! | Alpha Morning Report

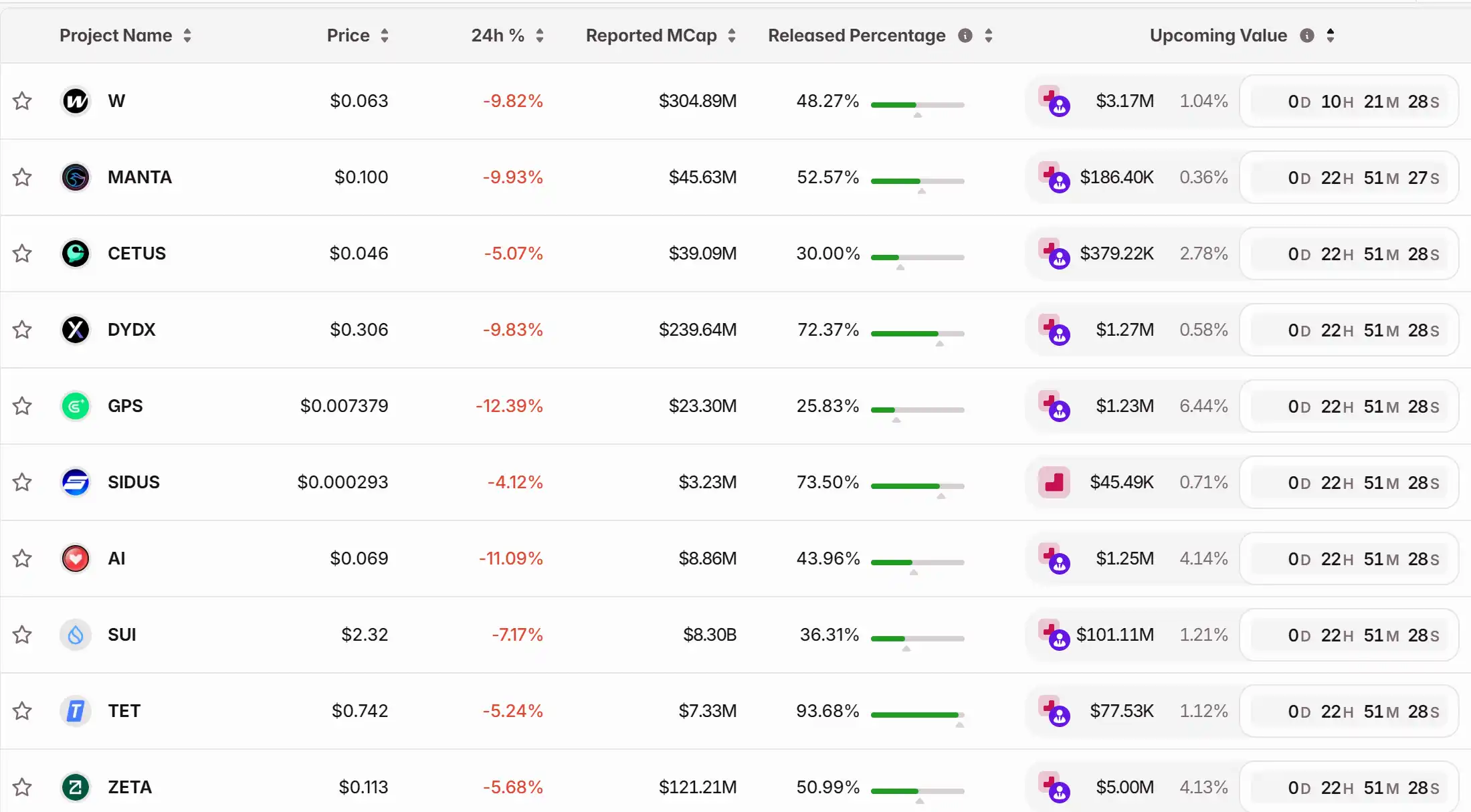

1. Top News: Ethereum's next major upgrade "Fusaka" is scheduled to go live on December 3rd 2. Token Unlock Schedule: $W, $MANTA, $CETUS, $DYDX, $GPS, $SIDUS, $AI, $SUI, $TET, $ZETA

Top News

1.Ethereum's Next Major Upgrade 'Fusaka' Scheduled to Go Live on December 3

2.Bitcoin Surges Past $110,000

5.$1.134 Billion Liquidated Across the Network in the Last 24 Hours, Mainly Long Positions

Articles & Threads

1. "Making Money While Giving Away Money: Recent Developments in Top Perp DEXs"

According to the latest on-chain data, the market landscape of decentralized perpetual contract exchanges (Perp DEXs) has become relatively clear. In terms of 24-hour trading volume, Aster leads with $121.2 billion, followed by Lighter at $86.16 billion in second place, Hyperliquid at $59.58 billion in third, with edgeX and ApeX Protocol ranking fourth and fifth with $50.6 billion and $21.22 billion, respectively. For investors and traders looking to delve deeper into the Perp DEX track, monitoring the developments of these top five platforms should provide a good sense of the overall direction of the industry.

2. "A Mysterious Team That Dominated Solana for Three Months Is Going to Launch a Coin on Jupiter?"

An anonymous team without a website or community that consumed nearly half of the transaction volume on Jupiter in 90 days. To better understand this mysterious project, we need to first delve into an on-chain transaction revolution quietly happening on Solana.

Market Data

Daily Marketwide Funding Rate (as reflected by funding rates) and Token Unlocks

Data Source: Coinglass, TokenUnlocks

Funding Rate

Token Unlocks

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin News Today: Are Bitcoin Futures Indicating a Market Bottom or a Potential Trap for Investors?

- Rare Bitcoin futures signal emerges as open interest drops below $8B and funding rates turn negative, sparking debate about a potential market bottom. - Derivatives experts note this rare alignment of metrics historically precedes crypto market consolidation or reversals, but caution against over-interpretation. - On-chain data shows whale accumulation rising 12% in a month, contrasting with broader market weakness and weak Bitcoin fundamentals. - Analysts warn macroeconomic factors like inflation could

Druckenmiller’s $77 Million Investment Sparks Momentum in Blockchain Lending, Analysts Raise Their Projections

- Billionaire Stanley Druckenmiller's $77M investment in Figure (FIGR) triggered a 15% stock surge, signaling institutional confidence in its blockchain lending model. - Analysts raised price targets to $55-$56 after Q3 results showed 70% YoY loan growth to $2.5B and 55.4% EBITDA margins, surpassing estimates by 40-200%. - Figure's AI-driven capital-light model and RWA tokenization (e.g., $YLDS stablecoin) are highlighted as growth catalysts, with 60% of loans now via its Connect platform. - Institutional

Solana Latest Updates: VanEck's Collaboration on a Staked Solana ETF Reflects Growing Institutional Trust in Blockchain's Prospects

- VanEck partners with SOL Strategies for staking in its new Solana ETF (VSOL), enhancing institutional blockchain integration. - SOL Strategies' ISO-certified validators secure $437M+ in assets, chosen for operational expertise and institutional focus. - VSOL offers staking rewards with fee waivers until $1B AUM, reflecting growing demand for Solana-based funds like Bitwise's BSOL. - VanEck's $5.2B digital asset portfolio expands with VSOL, though staking risks and regulatory uncertainties remain for inve

Blockchain and AI Open Up Pre-IPO Wealth Opportunities to Everyday Investors