On-Chain Revenue Hits $20 Billion in 2025 as DeFi Drives Growth

On-chain revenue has grown to $20 billion in 2025, driven mainly by decentralized finance (DeFi) platforms, according to a new report by crypto investment firm 1kx.

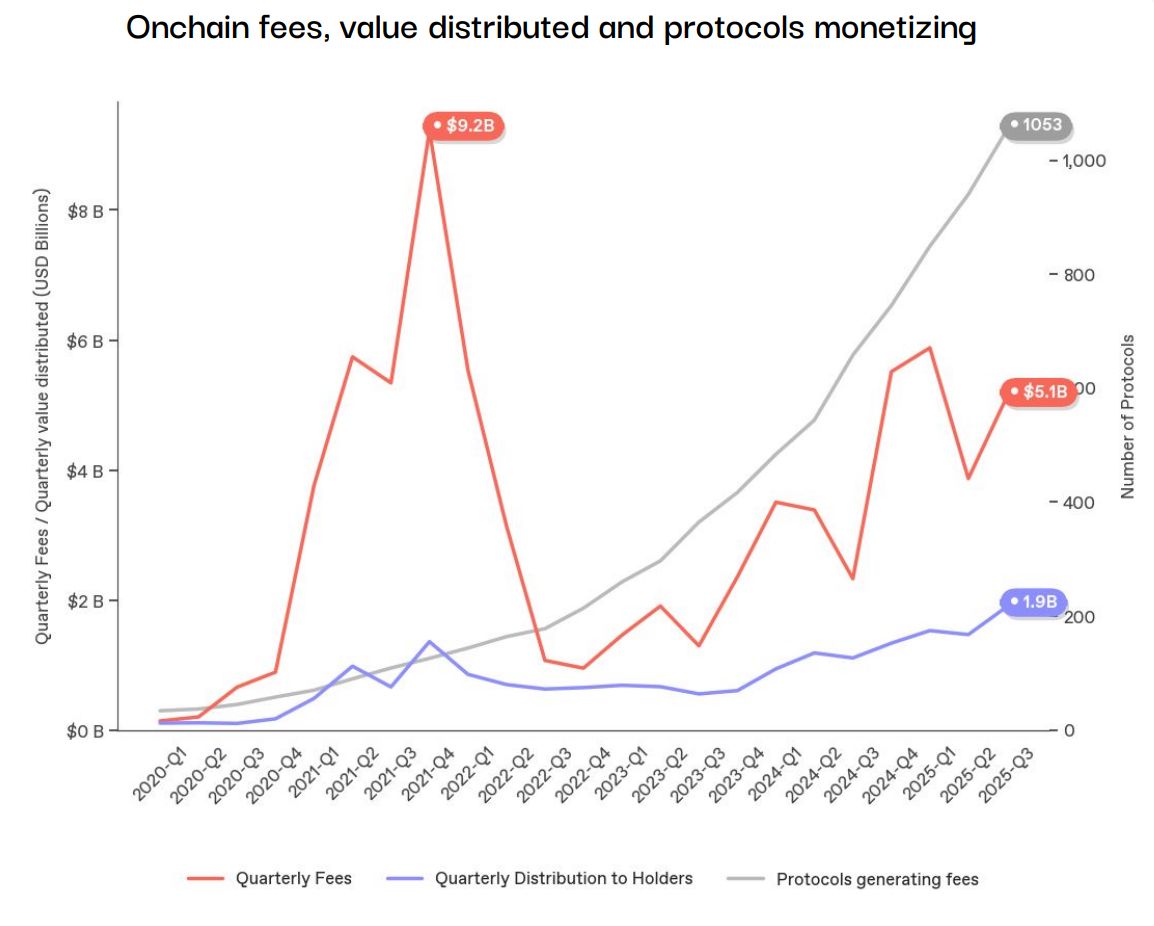

Users paid roughly $9.7 billion in on-chain fees in the first half of 2025, up 41% from the same period last year and the highest H1 total on record. DeFi accounted for 63% of all fees, led by trading activity on decentralized exchanges (DEXs) and derivatives platforms.

Despite this growth, 2021 remains the historical peak, though on-chain fees have grown more than tenfold since 2020, representing a compound annual growth rate of roughly 60%.

The report cites blockchain technology as becoming more stable and reliable, helping earnings remain steady even as user fees are lower than in the past. Better efficiency and cheaper infrastructure are also helping drive overall revenue growth.

“On-chain fees, though still a minority of industry income, offer clear signals of adoption and long-term value creation: 2025 YtD has close to 400 protocols with $1M+ ARR, and 20 passing over $10M in value to their token holders,” the report reads. “This is enabled by blockchain’s global reach and rising efficiency, which allow applications to scale rapidly and profitably.”

DEXs like Raydium and Meteora benefited significantly from Solana’s surge this year, while Uniswap lost market share, dropping from 44% to 16%. In derivatives, Jupiter increased its fee share from 5% to 45%, and Hyperliquid, launched less than a year ago, now accounts for 35% of category fees.

Lending remains dominated by Aave, the largest DeFi protocol with a total value locked (TVL) of $39 billion. Meanwhile, Morpho, a lending aggregator with a TVL of $8.25 billion, increased its share to 10% from nearly zero in H1 2024.

Looking ahead, total on-chain revenue is expected to rise to more than $27 billion in 2026, the authors predict, driven by new technologies and clearer regulations like the GENIUS Act.

“Applications are scaling faster and larger than ever with increasing value distribution, while regulatory clarity supports broader investor participation,” the report concludes. “As the relationship of fees and valuations for applications shows, on-chain economics have entered a more mature phase where fundamental fee metrics warrant close attention from investors.”

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum Updates Today: Immediate Buzz Versus Lasting Worth—How the Crypto World is Changing

- Crypto investors target undervalued assets like MoonBull ($MOBU), BullZilla ($BZIL), and Ethereum (ETH) for explosive growth potential. - MoonBull's 95% APY staking, deflationary tokenomics, and 9,256% projected return highlight its presale appeal alongside Ethereum's 2.0 upgrades. - Meme coins like BullZilla and La Culex leverage viral marketing with DeFi features, while BlockchainFX ($BFX) attracts $10.4M in presale with multi-asset trading. - Solana (SOL) and Cardano (ADA) reinforce crypto's innovatio

XRP News Today: Emerging "XRP 2.0" Competitors Challenge the Buzz Around XRP's Institutional Adoption

- XRP's institutional adoption hits $11B in holdings, but price remains stuck at $2.40-$2.50 amid weak retail demand and declining futures Open Interest. - Emerging projects like Avalon X and Digitap challenge XRP's dominance with innovative payment models and RWA growth, capturing investor attention as "XRP 2.0" alternatives. - SEC settlements and XRP ETF approvals boost long-term confidence, yet price remains 27% below 2025 highs due to bearish on-chain metrics and macroeconomic uncertainties. - Analysts

ECB Targets 2029 for Digital Euro Launch to Restore Public Confidence as Cash Usage Drops and Private Sector Competition Rises

- ECB targets 2029 for digital euro, requiring legislative and technical readiness. - Project extends beyond 2025 deadline, focusing on privacy, anti-money laundering, and partnerships. - Initiative aims to counter cash decline and private payment systems, spurred by global crypto trends. - IBM's Haven platform enhances digital asset security amid rising crypto thefts. - Collaboration between central banks and private sector is crucial for digital euro's success.

AI Wellness Platforms Emerge to Address Growing Chronic Disease Rates in Developing Regions

- Lupin Digital Health (LDH) launched VitaLyfe, an AI wellness app targeting India's working population to combat cardiometabolic diseases through personalized diet/exercise tracking and gamified goals. - The platform, ISO-certified and compliant with India's data laws, stores data locally and showed strong engagement during its 5,000-user beta test, expanding LDH's digital therapeutics into preventive care. - HEALWELL AI partnered with Saudi Arabia's Lean Business Services to advance AI healthcare, focusi