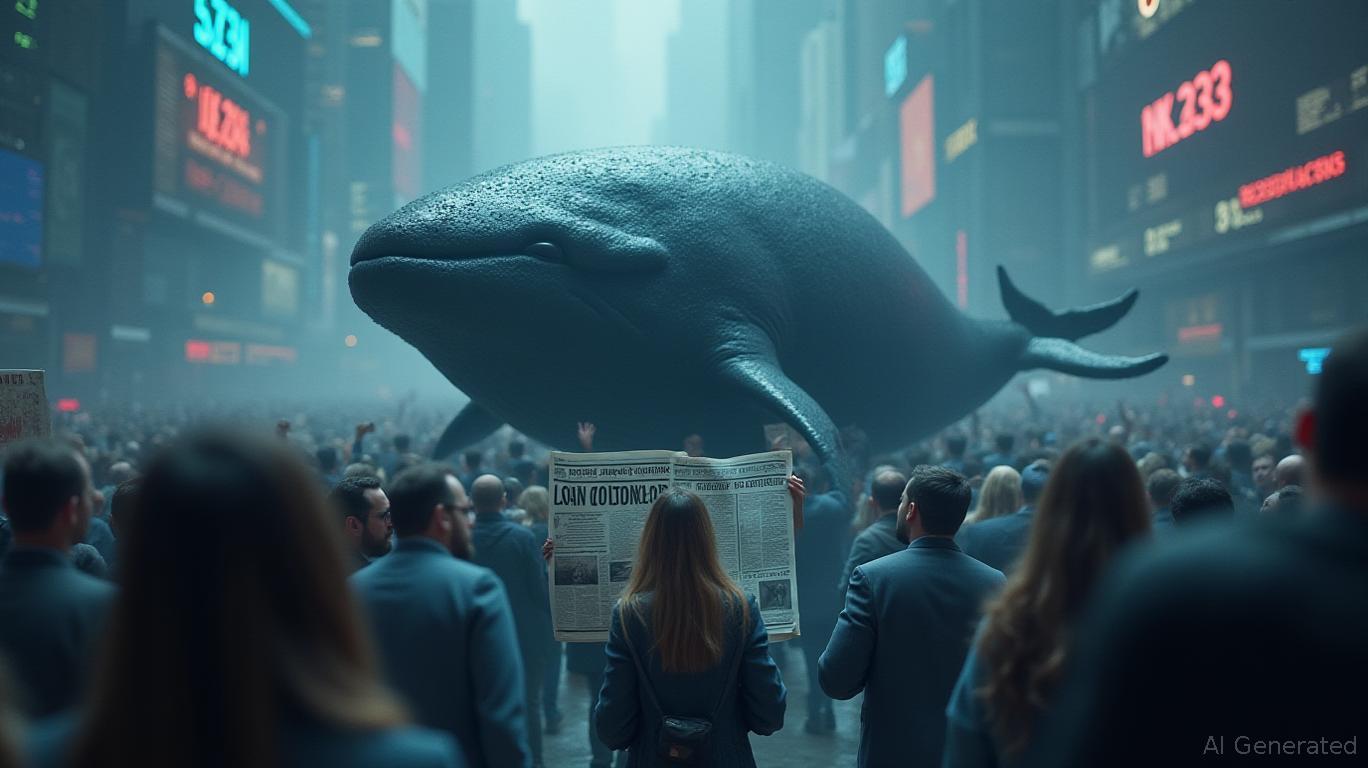

Crypto’s Ideal Whale: Absorb a $7M Deficit or Weather the Turbulence?

- A top crypto whale with 100% historical trade success now faces $7M in losses amid market shifts. - Analysts link the downturn to macroeconomic pressures, regulatory risks, and reduced speculative trading. - The whale's position volatility highlights risks even seasoned traders face in crypto's unpredictable market. - Market observers watch whether this whale will adjust strategies, potentially signaling broader sentiment changes.

An influential crypto whale, previously recognized for an unbroken streak of successful trades, is now facing substantial unrealized losses exceeding $7 million based on the most recent market figures, as reported by

The whale’s long-standing position, once regarded as a model for effective trading, is now being tested as market dynamics evolve. Experts point to several contributing elements, such as global economic challenges, regulatory ambiguity, and a decline in speculative trading, as noted by

Industry watchers are paying close attention to see if this well-known investor will alter their strategy or remain steadfast during the downturn. Should the whale reverse their position, it could indicate a broader change in market sentiment; holding steady, however, may strengthen belief in the long-term prospects of cryptocurrencies. This scenario highlights the difficulties that even veteran traders encounter in a market renowned for its volatility.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Updates: Federal Reserve Policy Shift and Trump-Xi Friction Drive Crypto to a Pivotal Moment: Bitcoin and Ethereum Reach Critical Levels

- Bitcoin surged past $108,000 and Ethereum exceeded $3,800 amid Trump-Xi tariff tensions and Fed policy shifts, per Cointelegraph. - Fed Chair Powell's hint at ending quantitative tightening and institutional capital rotation to Ethereum ETFs drove market optimism, Yahoo analysis noted. - Binance's CZ Zhao projected $28T Bitcoin valuation while SEC's tokenized securities approval and corporate BTC accumulation signaled regulatory confidence. - Market resilience showed through $19.35B liquidation recovery,

Qtum Ally: Streamline Advanced Processes Using Secure, On-Premise AI

- Qtum Foundation launches Qtum Ally, a desktop AI agent integrating 12 LLMs via Model Context Protocol (MCP) for local automation workflows. - Operating natively on Windows/macOS, Ally prioritizes data sovereignty by processing information locally without cloud infrastructure or telemetry collection. - The platform enables cross-application automation through MCP's interoperability framework, supporting self-hosted models and decentralized blockchain integration plans. - Qtum positions Ally as a privacy-f

Ethereum Updates Today: Ethereum Challenges $4,270—Will Upward Trend Persist or Is a Pullback Imminent?

- Ethereum approaches $4,270 resistance amid $522M global crypto liquidations, led by $124.6M ETH losses as "Machi Big Brother" whale unwinds positions. - MegaETH's oversubscribed $360M layer-2 ICO claims 100,000+ TPS, attracting 100,000+ participants with $7.2B hypothetical valuation. - Regulatory scrutiny intensifies with MEV bot fraud trial and ConsenSys IPO plans, while Fed rate uncertainty triggers $550M crypto ETF outflows. - Derivatives activity hits $560B volume on Binance, but 70.63% long position

Bitcoin News Update: Pumpkin Faces $138K Deficit, Highlighting Crypto's Leverage Dilemma

- Crypto entity "Pumpkin" suffered $138,500 losses from leveraged position liquidation amid heightened market volatility driven by U.S.-China tensions and Fed policy shifts. - $817M in crypto liquidations occurred in 24 hours, with long positions accounting for 75% of losses, following October's $19.37B flash crash triggered by Trump's tariff announcement. - Bitcoin remains range-bound near $111,300, failing to sustain "Uptober" momentum, while Ethereum forms a potential $3,750–$3,800 support zone amid $12