October 30th Key Market Information Gap, A Must-See! | Alpha Morning Report

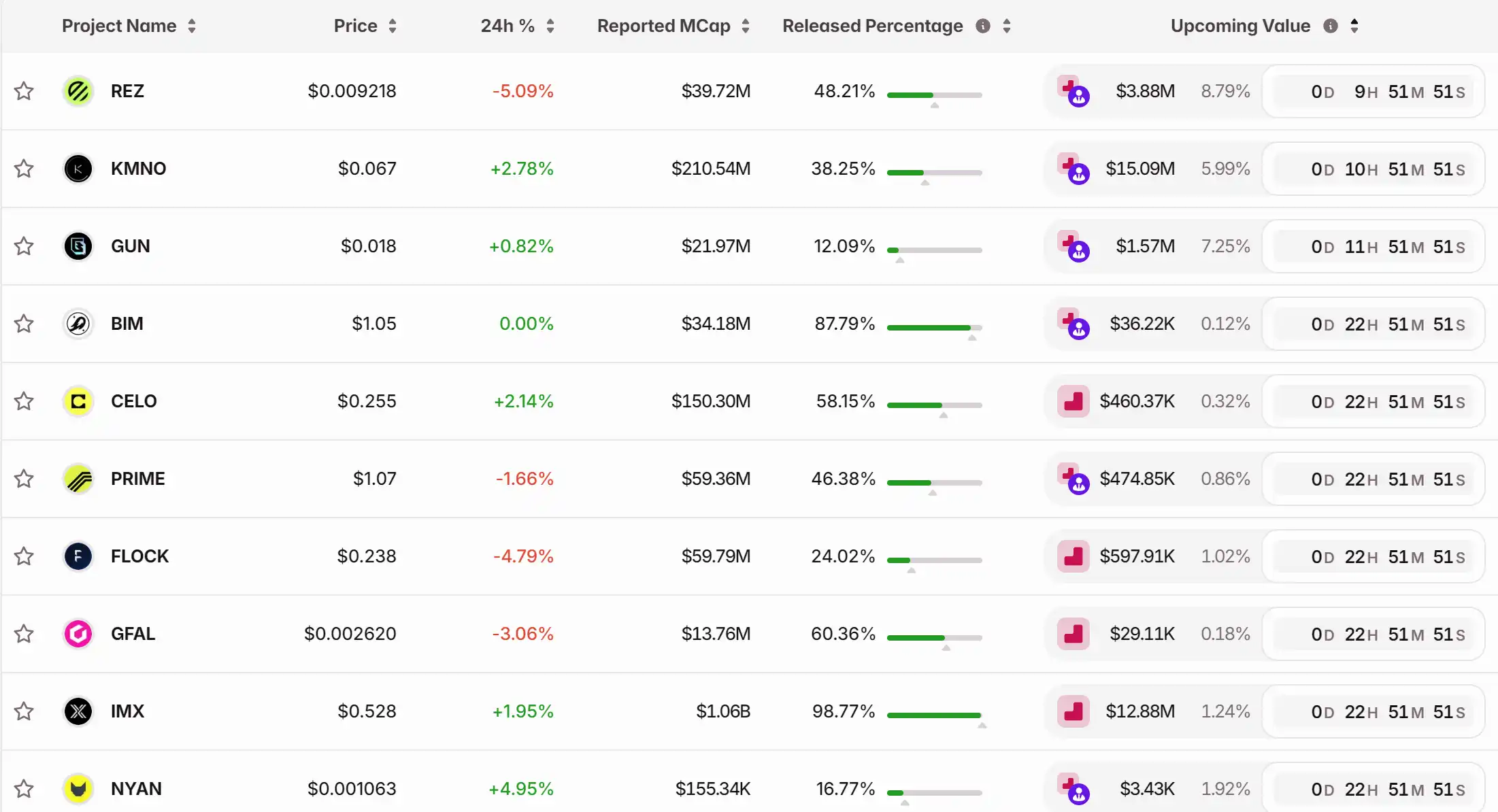

1. Top News: Powell's Hawkish Remarks, Bitcoin Drops Below $110,000, Ethereum Below $3,900 2. Token Unlock: $REZ, $KMNO, $GUN, $BIM, $CELO, $PRIME, $FLOCK, $GFAL

Top News

1. Powell's Hawkish Remarks Lead to Bitcoin Breaking Below $110K, Ethereum Below $3900

2. OpenAI Aims to Go Public in 2027 with Valuation Potentially Reaching $1 Trillion

3. BNB Expected to Cap Total Supply at 1 Billion, Current Circulating Supply Around 137 Million

4. MetaMask's Parent Company ConsenSys Hires JPMorgan and Goldman Sachs to Lead Its IPO

5. Cryptocurrency-Related Stocks See Mixed Performance After U.S. Market Open, Nasdaq Hits New Record High

Articles & Threads

1. "Chillhouse Leads the Rise Alone, The Past and Present of "Web3 Fun People""

The long-silent Solana meme hasn't been this lively in a long time, and it's happening in a way we can hardly imagine — Base Protocol's Jesse Pollak, renowned crypto influencer Cobie, Solana founder Toly, and pump.fun founder alon are "abstracting" each other over a Solana meme coin. Especially with the addition of the Base camp, there is a sense of "breaking the taboo" itself, and in the current environment where various chains are working vigorously to compete with each other, it has taken players by surprise.

2. "Best Market Performance in the Last Two Months of the Year? Should You Go All-In Now or Run?"

As October comes to a close, the crypto market seems to be showing some signs of an uptrend. Over the past two months, "caution" has almost become the theme of the crypto market, especially after experiencing the 10/11 crash. The impact of this major drop is slowly fading, and market sentiment does not seem to be deteriorating further but instead has found new hope. Starting from the latter part of the month, some signals of an uptrend have gradually emerged: net inflow data turning positive, altcoin ETF approvals in batches, and increased rate cut expectations.

Market Data

Daily Market Overall Fund Heat (reflected based on funding rates) and Token Unlocks

Data Source: Coinglass, TokenUnlocks

Funding Rate

Token Unlocks

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

21Shares Plans Return with Launch of HYPE ETF: A Detailed Look

New Fund to Follow HYPE's Market Performance and Staking Rewards as 21Shares Eyes Comeback

Bitcoin News Today: Bitcoin Eyes $110k Surge—Is $1.51B at Risk of Liquidation or Does This Reflect Growing Institutional Trust?

- Bitcoin near $120,000 triggers $1.51B short liquidation risk if it breaches $110,000, per Yahoo Finance analysis. - Bitcoin ETFs see $931M inflows vs. Ethereum ETF outflows, highlighting institutional preference for Bitcoin's liquidity. - Security threats (40.8% social engineering scams) and regulatory actions (AUSTRAC $37k fine) persist despite market optimism. - Bitcoin's $115k "CME gap" breakout could validate bullish momentum, but $1.51B liquidation risk underscores market fragility.

Ethereum News Today: Ethereum’s Fusaka Update: Achieving Greater Scalability While Maintaining Security

- Ethereum's Fusaka upgrade launches Dec 3 after Hoodi testnet success, enhancing scalability and security via PeerDAS and gas limit increases. - Upgrade raises block gas limit 5x to 150M units and enables parallel smart contract execution, doubling transaction capacity while maintaining decentralization. - Three-phase rollout includes mainnet activation, blob capacity expansion, and hard fork, with post-upgrade focus shifting to the Glamsterdam upgrade for block time optimization. - While addressing Ether

XTZ has dropped 56.21% so far this year as the overall market experiences a decline

- XTZ fell 0.25% in 24 hours to $0.5645, reflecting a 56.21% annual decline amid broader market pressures. - Technical indicators show deteriorating trends, with oversold RSI and downward-moving 50/200-day averages failing to signal recovery. - Market participants monitor the $0.54 support level, with further declines risking psychological $0.50 thresholds and altcoin sell-offs. - A backtesting analysis of similar -56.21% declines aims to identify historical patterns for potential bounce scenarios or exten