Institutional traders now drive 80% of Bitget’s volume: Report

Singapore-based crypto exchange Bitget has seen an uptick in institutional participation, with institutional traders now accounting for roughly 80% of total volume as of September, according to a report by Bitget in collaboration with blockchain analytics platform Nansen.

The report noted that institutional activity on Bitget’s spot markets climbed from 39.4% of total volume on Jan. 1 to 72.6% by July 30. Futures trading saw an even more dramatic shift, with institutional market makers growing from just 3% of activity at the start of 2025 to 56.6% by late July.

The study identified liquidity as the key measure of institutional adoption in crypto, noting that Bitget’s order-book depth, spreads and execution quality now match peers such as Binance and OKX across major trading pairs.

In financial markets, liquidity refers to how quickly and easily an asset can be traded without causing a significant change in its price.

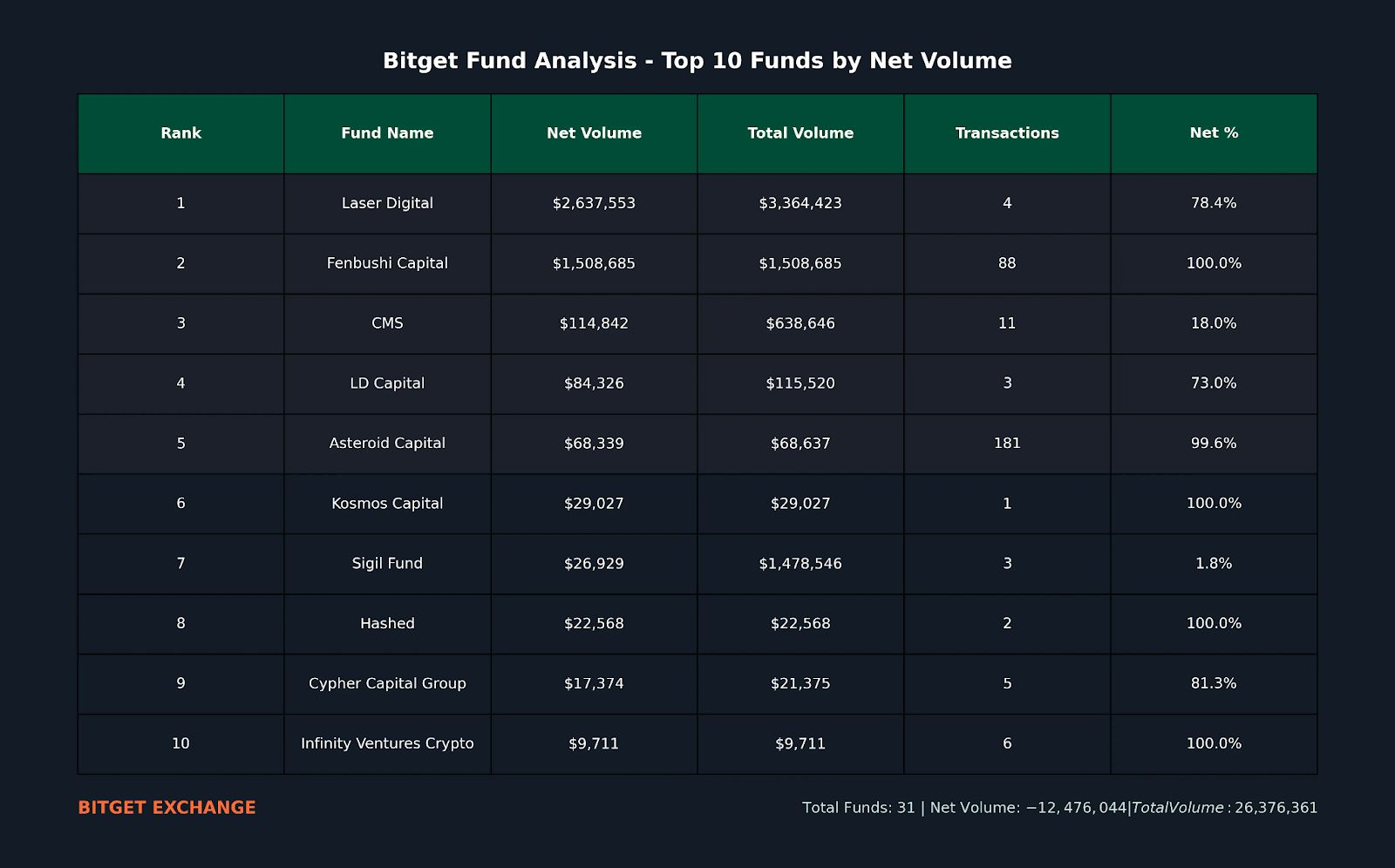

Laser Digital and Fenbushi Capital led institutional inflows on Bitget, accounting for the majority of positive net flows to the exchange, according to onchain data from Nansen.

During the first half of the year, Bitget averaged around $750 billion in monthly trading volume, with derivatives accounting for about 90%. According to the report, institutions make up roughly half of derivatives activity.

In comparison, Binance, the world’s largest centralized crypto exchange, saw its spot trading volume climb to $698.3 billion in July from $432.6 billion in June, an increase of 61% month over month, data from Coingecko shows.

Related: Binance Wallet partners with Bubblemaps to help fight insider crypto trading

Exchanges cater to institutional investors

As institutional adoption of crypto has surged throughout 2025, crypto exchanges are competing for market share in a variety of ways.

In January, Crypto.com announced an institutional trading platform featuring over 300 trading pairs and support for advanced trading strategies tailored to institutional investors, signaling the company’s deeper push into Wall Street.

In September, Binance unveiled a “crypto-as-a-service” platform for licensed banks, stock exchanges and brokerages, giving traditional finance institutions direct access to its liquidity, futures and custody infrastructure.

OKX announced in October a partnership with Standard Chartered to launch a collateral-mirroring program in the European Economic Area, enabling institutional clients to store their crypto assets directly with Standard Chartered’s custody arm.

Magazine: Solana vs Ethereum ETFs, Facebook’s influence on Bitwise: Hunter Horsley

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

China's Crackdown on Stablecoins and Asia's Advances in Cryptocurrency

- China's central bank intensifies stablecoin crackdown, labeling them global financial threats and undermining monetary sovereignty. - DBS and Goldman Sachs execute Asia's first OTC crypto options trade, advancing institutional adoption of digital assets. - Japan launches JPYC, a fully licensed yen-backed stablecoin, aiming for $70B valuation by 2030 to bridge traditional finance and Web3. - Despite China's exclusion, global stablecoin market exceeds $308B, but underground usage persists via offshore exch

China’s Strict Stablecoin Ban Compared to Japan’s Push for Regulated Innovation

Avalon Labs (AVL) releases whitepaper for AI-powered RWA marketplace

Bitcoin News Today: MicroStrategy's Cryptocurrency Gamble: Software Profits Face Off Against Bitcoin Price Swings

- MicroStrategy reported mixed Q3 results with $8.42 EPS (below estimates) but $128.69M revenue (above estimates), driven by 62.9% software revenue growth. - CEO Phong Le reaffirmed $70.9B Bitcoin portfolio (640,808 coins) and 2025 targets of $20B Bitcoin gains, contingent on $150K BTC price by year-end. - $20B year-to-date capital raises via preferred shares (STRK/STRF) and B- credit rating highlight aggressive crypto strategy amid Bitcoin's $125K price drop from October peak. - Analysts remain divided: Z