Crypto News Today: Fed Calm, Nvidia Milestone, and Political Firestorms Wrap Up Uptober

Crypto News Today: End of Uptober, Start of a New Cycle

October 2025 lived up to its “Uptober” name — but only partially .

The month began with strong rallies across Bitcoin and altcoins , only to end with macro caution, political drama, and tech dominance reshaping investor sentiment.

As November begins, the market finds itself at a crossroads between resilience and uncertainty, following a flood of headlines, macro indicators, and corporate moves that could define the next trend.

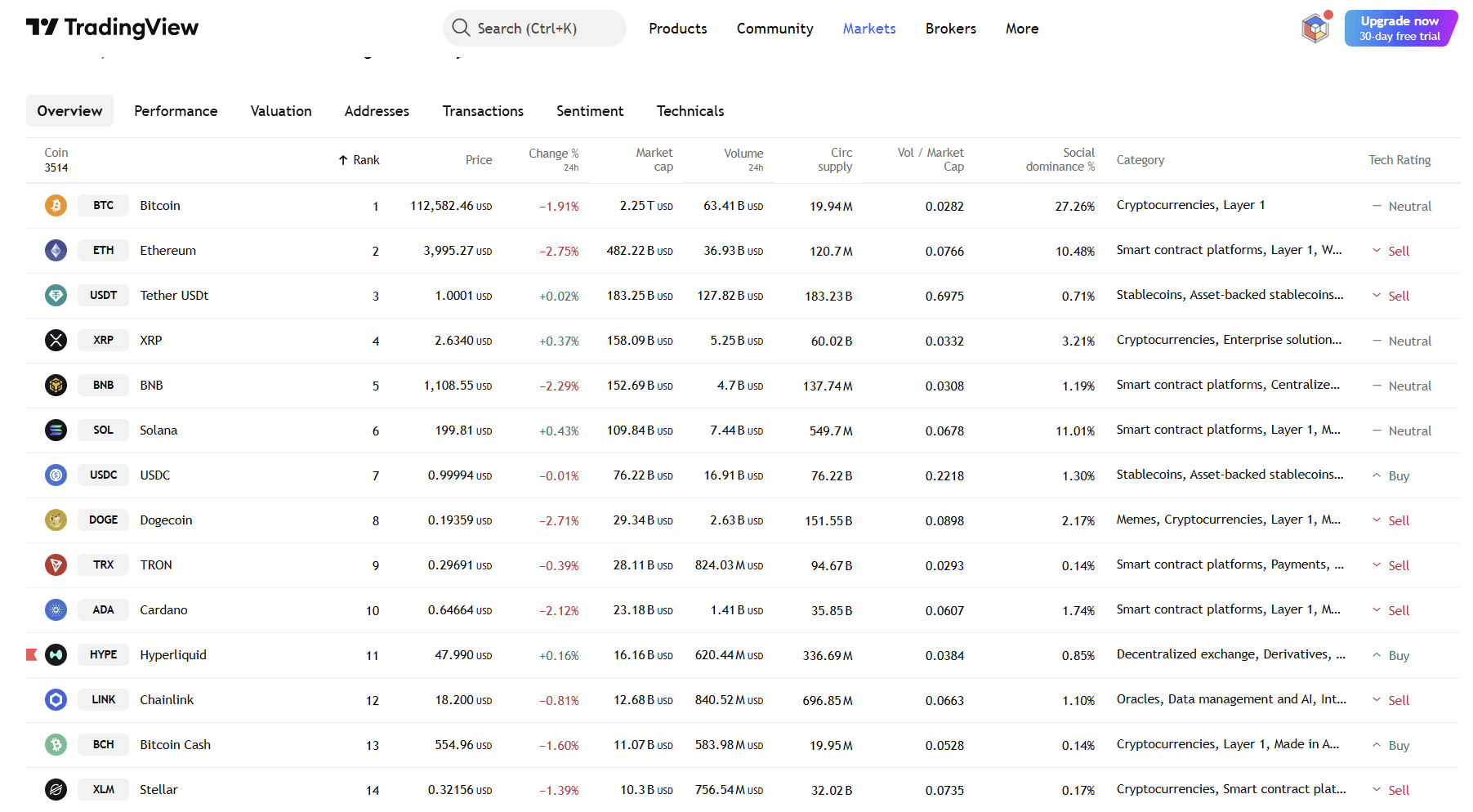

Bitcoin and Ethereum Cool Off

Bitcoin ($BTC) trades around $112,582, down -1.91% in 24 hours, while Ethereum ($ETH) sits at $3,995, down -2.75%. Despite the red candles, both assets remain well above September lows, reflecting stability amid rotation into AI and DeFi narratives.

BTC dominance holds near 27% , showing how traders continue to treat it as a macro hedge even as volatility rises.

Meanwhile, Solana ($SOL) outperformed major peers, rising +0.43% to $199 , extending its strong performance throughout Uptober thanks to growing developer momentum and token launches.

Legal Front: CZ vs. Warren, Crypto vs. Washington

One of the biggest stories of the week came from Binance Founder Changpeng Zhao (CZ), who reportedly plans to sue U.S. Senator Elizabeth Warren for defamation if she doesn’t retract alleged “false statements.”

This move underscores growing political friction between the crypto industry and U.S. regulators — but also signals that crypto leaders are pushing back harder than ever.

BNB’s price, however, reflected short-term caution, falling -2.29% to $1,108.55, as investors weighed reputation risk vs. resilience.

Peter Schiff Reignites the “Bitcoin Bubble” Debate

Long-time critic Peter Schiff returned to the spotlight, labeling Bitcoin a “bubble about to pop.”

While his comments echo his decade-long skepticism, the timing — just as Bitcoin stabilizes above $110K — is often seen as a contrarian signal by traders.

The broader sentiment remains neutral, with no signs of panic or structural weakness in Bitcoin’s technicals.

Macro Diplomacy: Trump, Xi, and the Return of Trade Optimism

Global diplomacy also played a major role this week.

President Donald Trump met with China’s President Xi Jinping to discuss Nvidia ($NVDA) AI chips, highlighting how tech and geopolitics are colliding in this new digital era.

Trump hinted at “something very satisfactory” coming out of the meeting — a statement that helped calm broader markets.

In parallel, Treasury Secretary Bessent declared that the U.S. and Japan are entering a “Golden Age”, while the U.S. Senate repealed tariffs on Brazil, signaling easing trade tensions heading into November.

These moves boost investor confidence, especially across AI and crypto markets, where liquidity is highly sensitive to global cooperation.

Tech Dominance: Nvidia’s $5 Trillion Milestone

No October recap would be complete without Nvidia’s historic rise .

The company became the first in history to reach a $5 trillion market cap, now worth more than all U.S. and Canadian banks combined.

This record marks a defining moment for AI — and by extension, for AI-linked cryptos like Fetch ($FET), Render ($RNDR), and Hyperliquid ($HYPE), which gained +0.16% to $47,990 today.

Nvidia’s growth cements AI as the decade’s dominant narrative, likely spilling over into blockchain projects that bridge data, computing, and decentralized intelligence.

DeFi Evolution: Ex-FTX President’s New Platform

In a surprising twist, the former FTX US President announced a new perpetuals trading platform for stocks, blending traditional markets with DeFi mechanics.

This reinforces a broader trend — the convergence of TradFi, CeFi, and DeFi, where innovation continues despite past scandals.

Projects like dYdX, GMX, and Hyperliquid stand to benefit from this renewed attention to derivatives and decentralization.

Market Snapshot

By TradingView - Cryptos (All)

By TradingView - Cryptos (All)

Was It Really “Uptober”?

October lived up to its bullish reputation in parts — Bitcoin broke records early in the month, several AI and meme coins surged, and institutional inflows reached new highs.

Yet the final week saw macro tightening, rate-cut uncertainty, and sideways movement, cooling enthusiasm heading into November.

So was it really Uptober?

➡️ Yes — but one that ended with a pause rather than euphoria.

What to Expect in November

- Macro Focus: Fed clarity and inflation data will dominate sentiment.

- Political Front: Watch how the CZ vs. Warren feud and Trump’s foreign policy moves shape regulation and market perception.

- AI Trend: Nvidia’s momentum will likely fuel AI-crypto demand into Q4.

- Market Outlook: A consolidation phase before another potential leg up if liquidity expands.

November could start choppy but optimistic, especially if Bitcoin maintains support above $110K and Ethereum rebounds above $4K.

Conclusion

October ends with a mix of bullish innovation and political turbulence, but the market remains structurally strong.

As AI dominance, regulatory pushback, and global diplomacy collide, November could bring a new cycle of narratives — setting the tone for a volatile but opportunity-rich Q4.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

x402 "Doers" List | Who is Really Driving x402?

Which x402 "infrastructure proponents" and "pragmatists" are driving the development of the x402 protocol?

IQ and Frax collaborate to launch the KRWQ Korean won stablecoin based on the Base network

Pi Coin Price Risks Following Fed Rate Announcement