Pi Coin Price Risks Following Fed Rate Announcement

- Pi Core Team’s token sales risk price drop.

- Lack of utility exacerbates financial pressures.

- High inflation from token unlocks concerns investors.

The Pi Coin price may crash after the Fed rate decision due to the core team’s token selling for liquidity, the lack of utility and revenue generation, and high inflation from ongoing token unlocks, as confirmed by on-chain data.

Pi Coin may face a decline after the Federal Reserve’s recent rate decision as experts point to internal token sales and weak utility. Concerns increasingly rise among the community about the project’s sustainability.

Pi Coin’s value matters due to its role in the altcoin market, affecting investor sentiment and demonstrating vulnerability to internal financial strategies.

Recent actions by the Pi Core Team, notably selling over 1.2 million Pi tokens for liquidity, have raised community and investor alarms. Despite significant activity, the lack of major listings or revenue sources remains a key concern for Pi’s sustainability.

“I’ve said many times that it’s our Core Team selling Pi because they don’t have any other source of income. Pi doesn’t have any real utility or anything that generates revenue, so their only option for liquidity is to sell Pi.” — Mr. Spock, Pi Network Advocate

The broader impact of the Fed rate decision will influence altcoin sectors, notably those marked by high inflation and weak fundamentals, highlighted by Pi Coin’s case. Markets remain wary of increased volatility due to liquidity pressures and investor reticence, amplified by the project’s perceived centralization and lack of transparency.

Pi Coin illustrates the volatility inherent in the current crypto space, where inflation and limited use cases prevent effective market resilience. Investors seek clarity regarding the project’s future, with community advocates demanding transparency and reliable on-chain data.

While regulatory bodies remain silent on Pi Coin, these prevailing conditions illustrate the potential for broader market implications. Historical trends affirm that projects lacking substantial infrastructures often underperform, a reality perhaps epitomized by Pi Network’s challenges.

Investors and analysts emphasize the necessity for cryptocurrencies like Pi Coin to transition towards valid industry roles, where innovation and transparency provide a durable foundation against macroeconomic shifts.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

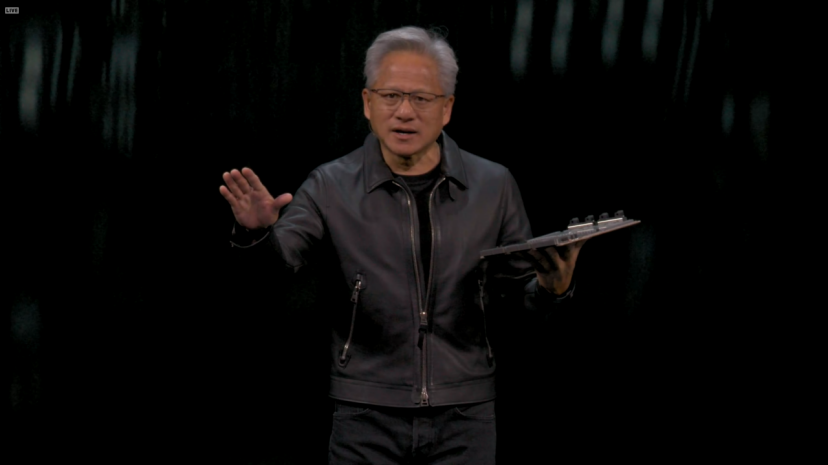

Give Nokia 1 billion, Jensen Huang wants to earn 200 billions

Jensen Huang unveiled some major announcements at the 2025 GTC.

When AI Agents Learn to Make Autonomous Payments: PolyFlow and x402 Are Redefining the Flow of Value on the Internet

x402 has opened the channel, while PolyFlow extends this channel to the real business and AI Agent world.

PolyFlow integrates x402 protocol to drive the next-generation AI Agent payment revolution

PolyFlow's mission is to seamlessly connect traditional systems with the intelligent world through blockchain technology, gradually reshaping everyday payments and financial activities to make every transaction more efficient and trustworthy—making every payment more meaningful.

BNB Price Chart Targets $10,000 as Macro Bull Run Strengthens in 2025