Bitcoin News Update: Positive Sentiment Drives November Crypto Surge with MoonBull and CRO Rising Thanks to Staking and New Partnerships

- November 2025 crypto optimism centers on MoonBull ($MOBU), whose $450K+ presale offers 95% APY staking and 9,256% ROI projections. - Cronos (CRO) surges 10% after Trump Media partnership announcement, marking its third major boost this year via treasury agreements and ETF developments. - Bitcoin (BTC) nears $116K amid easing U.S.-China tensions and MicroStrategy's $43M BTC purchase, though consolidation persists ahead of Fed policy decisions. - Ethereum (ETH) leads DeFi innovation while crypto ETPs see $

The cryptocurrency sector is undergoing notable changes in November 2025, as

Cronos (CRO), Crypto.com’s native asset, climbed 10% after news broke of a partnership with Trump Media to bring prediction markets to Truth Social. This initiative, utilizing Crypto.com’s Derivatives North America (CDNA) platform, is the third significant catalyst for CRO this year, following a $6.42 billion treasury deal in August and an ETF launch in March, according to a

Bitcoin (BTC) has hovered near a two-week peak of $116,410, buoyed by improved U.S.-China trade relations and encouraging economic indicators. MicroStrategy’s recent acquisition of 390 BTC for $43 million—financed through preferred shares—has further demonstrated institutional faith, raising its total holdings to 640,800

Ethereum (ETH) continues to lead in decentralized finance (DeFi) and smart contract development, with ongoing improvements to

Crypto ETPs saw $921 million in new investments last week, fueled by hopes for a Federal Reserve rate reduction and lower-than-expected inflation, according to Bitzo analysis. However, S&P Global downgraded MicroStrategy to junk status due to its significant Bitcoin exposure and liquidity concerns. Despite this, the Fear & Greed Index has moved to "neutral," indicating a balance between caution and confidence.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

木頭姐豪擲$5,500萬加倉,Bitcoin Hyper受關注

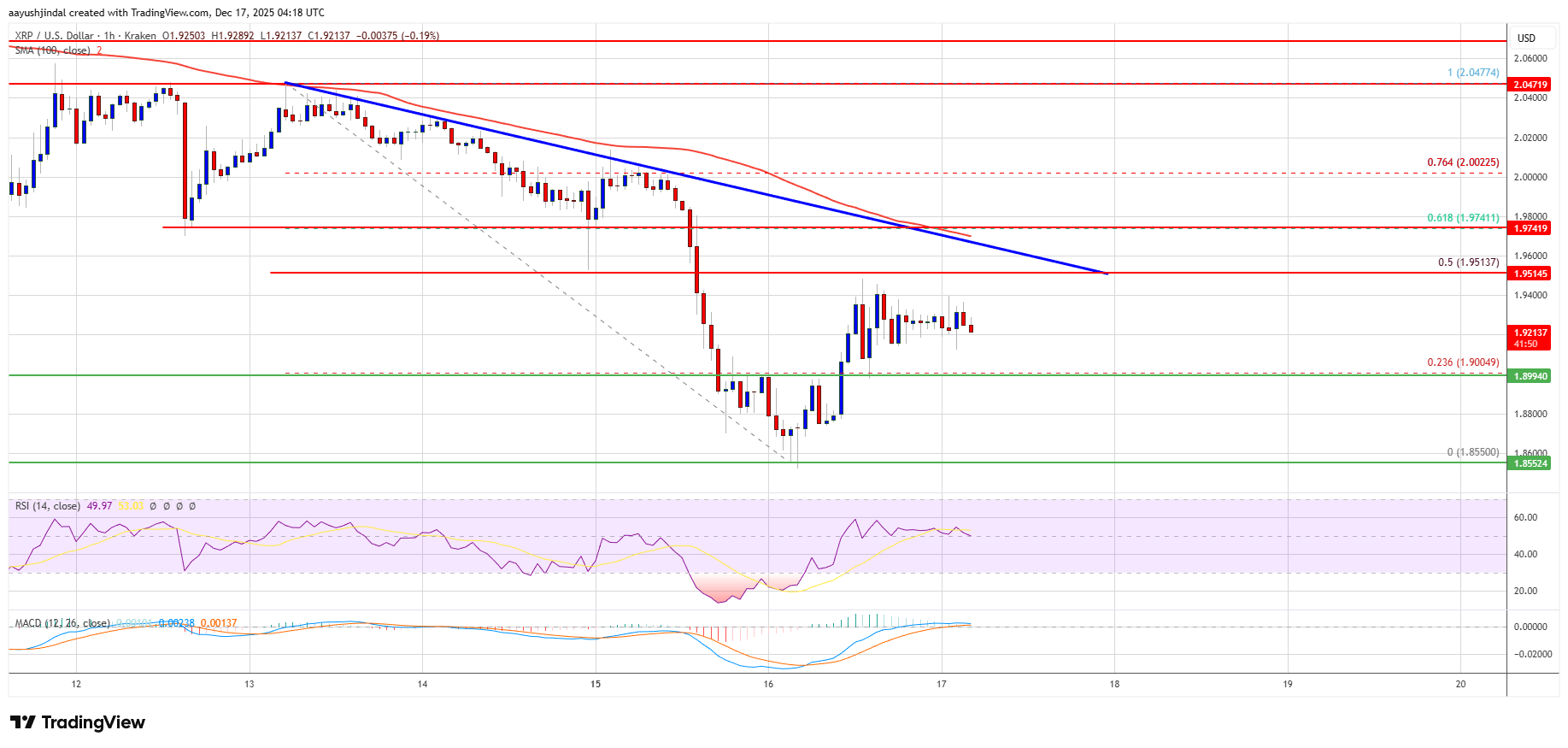

XRP Price Recovery Looks Fragile—Can Bulls Break the Cap?