Web3's Evolving Landscape Connects Regulatory Frameworks and Technological Advancement at Zebu Live 2025

- Zebu Live 2025 in London highlighted Web3's shift toward regulatory alignment, technological scalability, and institutional adoption in blockchain and DeFi. - Trade surveillance systems, projected to grow at 14.5% CAGR to $5.9B by 2030, dominated discussions, driven by AI/cloud solutions and MiFID II regulations. - DeFi projects like Blazpay ($925K) and Mutuum Finance ($18.1M) gained traction through audited presales, while BlockDAG's $430M-raised hybrid architecture addressed the blockchain trilemma. -

The Zebu Live 2025 event wrapped up in London this week, bringing together leading figures from the Web3 sector to explore the latest progress in blockchain, decentralized finance (DeFi), and AI-powered financial technologies. The conference showcased a significant transformation within the industry, with attendees focusing on the intersection of regulatory compliance, scalable technology, and growing institutional involvement. Notable topics included the swift expansion of trade monitoring platforms, the increasing popularity of audited crypto initiatives, and the development of hybrid blockchain models aimed at resolving the challenges of security, scalability, and decentralization.

According to a

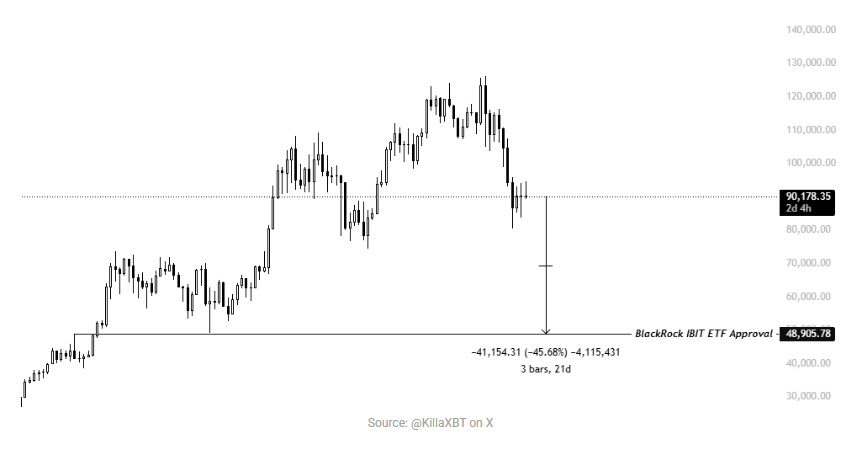

Institutional participation is also on the rise, as demonstrated by the Bitwise

The Zebu Live 2025 conference highlighted the evolution of the Web3 landscape, where technological innovation is increasingly synchronized with regulatory demands and institutional interest. As trade surveillance tools advance and DeFi platforms expand, the sector is moving toward bridging the divide between speculative growth and lasting infrastructure.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Fed Rate Cut Triggers Mixed Crypto ETF Performance as Bitcoin, XRP ETFs Post Inflows, Ether Outflows

Bitcoin To Retest $85,000 Mark In Coming Days – Here’s Why

What’s the Latest on Chainlink (LINK)? Analysis Firm Assesses the Likelihood of a Recovery

Tether’s Offer to Buy Juventus Has Received a Response