Cardano News Update: The Reason Investors Are Flocking to Mutuum Finance's Presale Ahead of Price Increases

- Mutuum Finance (MUTM) has raised $18.1M in presale with 17,500 holders, nearing 80% allocation at $0.035 per token before Q4 2025 launch. - Its roadmap includes Ethereum-based lending protocols, mtToken yields, and Chainlink integration, supported by a 90/100 CertiK audit and $50K bug bounty. - Whale activity and bullish forecasts suggest MUTM could mirror SHIB/XRP's growth, with price targets up to $0.70 (15-20x returns) if adoption matches early momentum. - Risks include regulatory challenges and liqui

The cryptocurrency community is currently focused on Mutuum Finance (MUTM), a DeFi initiative that has already drawn over 17,500 holders and secured upwards of $18.1 million, as reported in

The development roadmap for Mutuum Finance, detailed in

Investor trust has been strengthened by the project’s security initiatives. MUTM received a 90/100 Token Scan rating from CertiK’s audit, and a $50,000 bug bounty program highlights its dedication to openness. Large-scale purchases by major investors further support its potential: blockchain data shows transactions in the six-figure range, including a single buy of $150,000 worth of MUTM, as noted in

Experts are comparing MUTM’s growth path to previous DeFi breakout projects. Many draw parallels to

Price outlooks remain highly optimistic. Some forecasts are bullish, projecting MUTM could reach $0.60–$0.70 within 12 to 18 months—a 15 to 20 times increase from current prices. This positive sentiment is echoed in rankings that list MUTM among the top investment picks for 2025, as seen in

Despite the enthusiasm, there are still risks. The project’s future depends on its ability to deliver on its roadmap, draw in liquidity after launch, and address regulatory challenges. Still, with 45.5% of its 4 billion token supply allocated to community sale—780 million already sold—and robust security measures in place, Mutuum Finance is emerging as a strong contender in the DeFi sector.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

木頭姐豪擲$5,500萬加倉,Bitcoin Hyper受關注

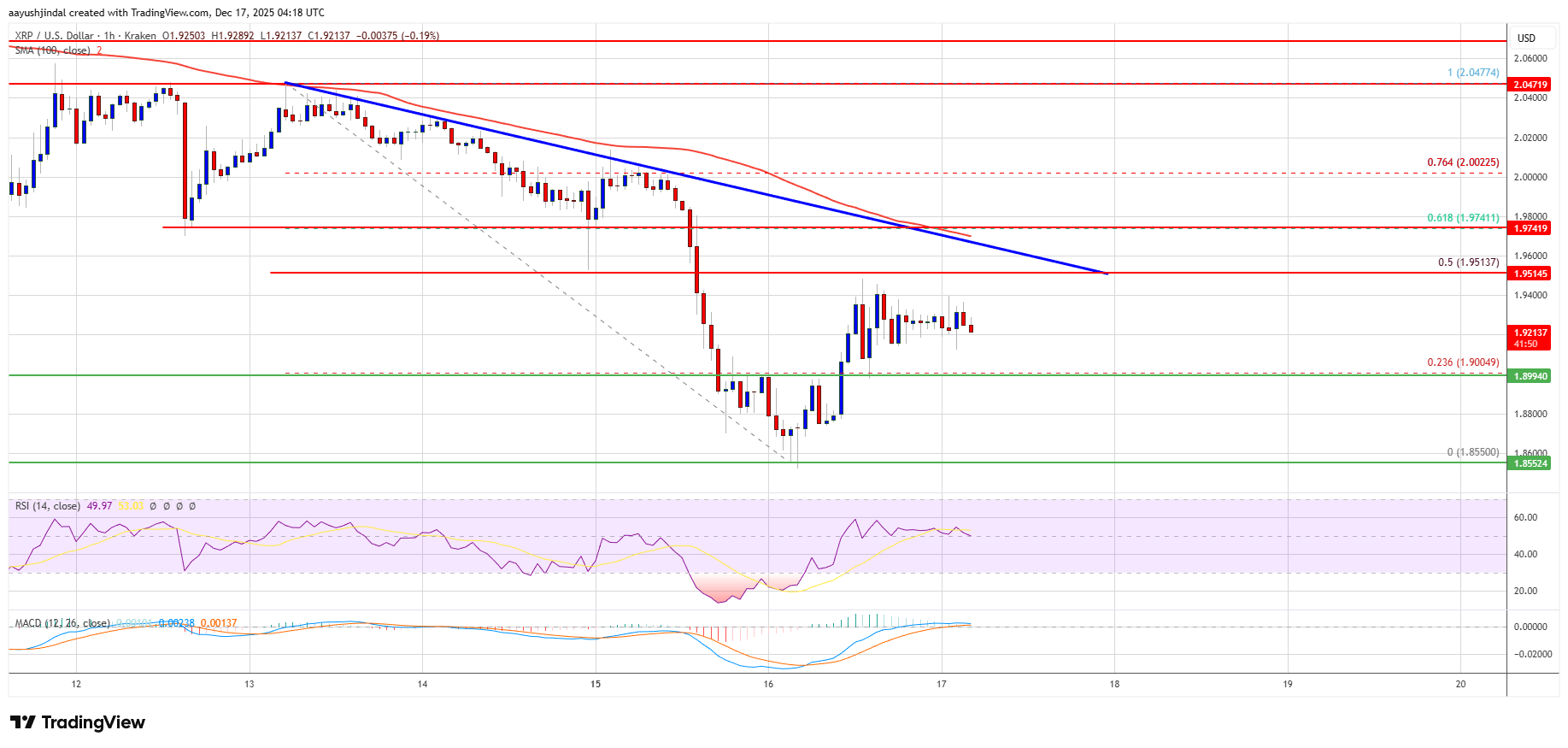

XRP Price Recovery Looks Fragile—Can Bulls Break the Cap?