Key Market Information Discrepancy on October 29th, a Must-See! | Alpha Morning Report

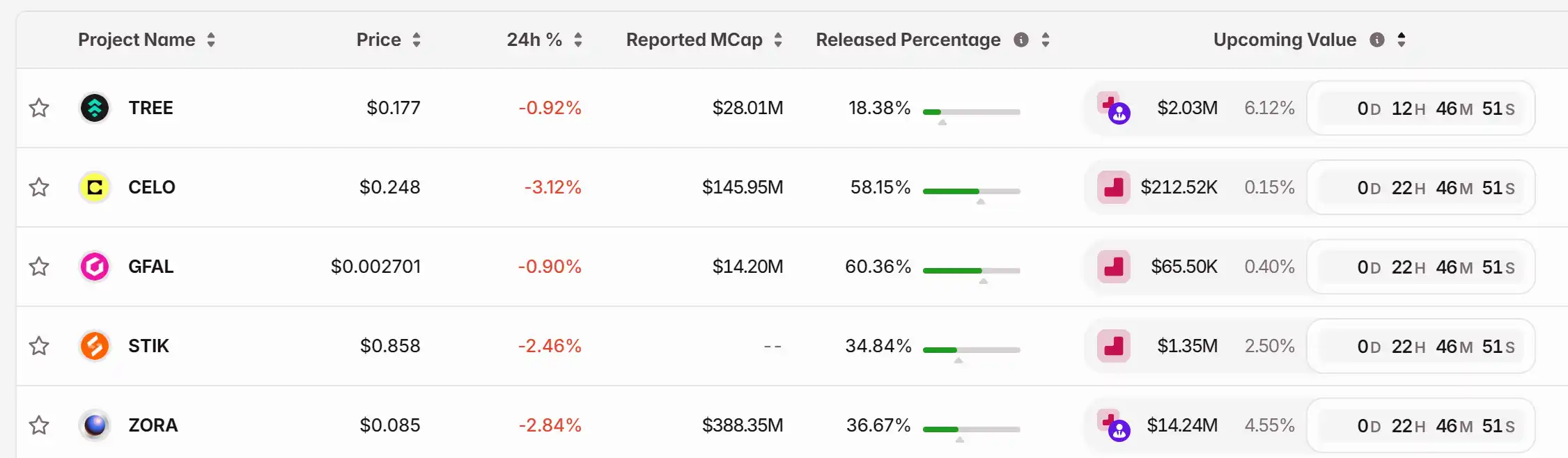

1. Top News: BSC On-Chain Chinese Narrative Meme Trading Slumps, 'Binance Life' Holds the Fort Alone, 'Hakimi' Heat Stable 2. Token Unlocking: $TREE, $CELO, $GFAL, $STIK, $ZORA

Featured News

1. BSC On-chain Chinese Narrative Meme Trading Sluggish, "Binance Life" Solo Holding the Flag, "Hakimi" Heat Stable

2. Monad MON Airdrop Distribution Results Now Available for Query

3. U.S. Stock Market Continues to Hit New Highs, Crypto Market Slightly Down Against the Trend

4. Visa to Accept Four Stablecoins on Four Blockchains, Support Currency Exchange

5. OpenAl Announces Completion of Capital Restructuring, May Prepare for Listing

Articles & Threads

1. "Why Didn't the x402 Protocol Flash in the Pan?"

It's been almost a week since the x402 Protocol ignited the market enthusiasm with the meme coin $PING. So far, the majority of market views are positive, with optimistic expectations for the future development of the x402 Protocol and discussions on various projects. However, some voices also believe that the rapid rise of x402 may not be able to sustain the overheated market expectations in the short term, leading to a lack of follow-up strength. So, what changes have occurred in the x402 Protocol ecosystem in this nearly week-long period?

2. "After Speculating on Coins for a Year, My Earnings Are Lower Than My Mom's Stock Speculation"

This is a year of "everything rising," but the crypto circle is widely recognized as a "very difficult year to make money." Compared to the past few years, 2025 seems like a rare "leap year." The U.S. stock market hits new highs again, A-shares' core assets rebound, gold hits historical highs, commodities rebound collectively, and almost all markets are rising. However, in the crypto circle, even though Bitcoin hit a new all-time high of $120,000, many are complaining that this is the "hardest year to make money in the crypto circle." When friends talk about their family's investment operations this year, they say, "In terms of ROI from speculating on coins this year, it is completely lower than my mom's stock speculation."

Market Data

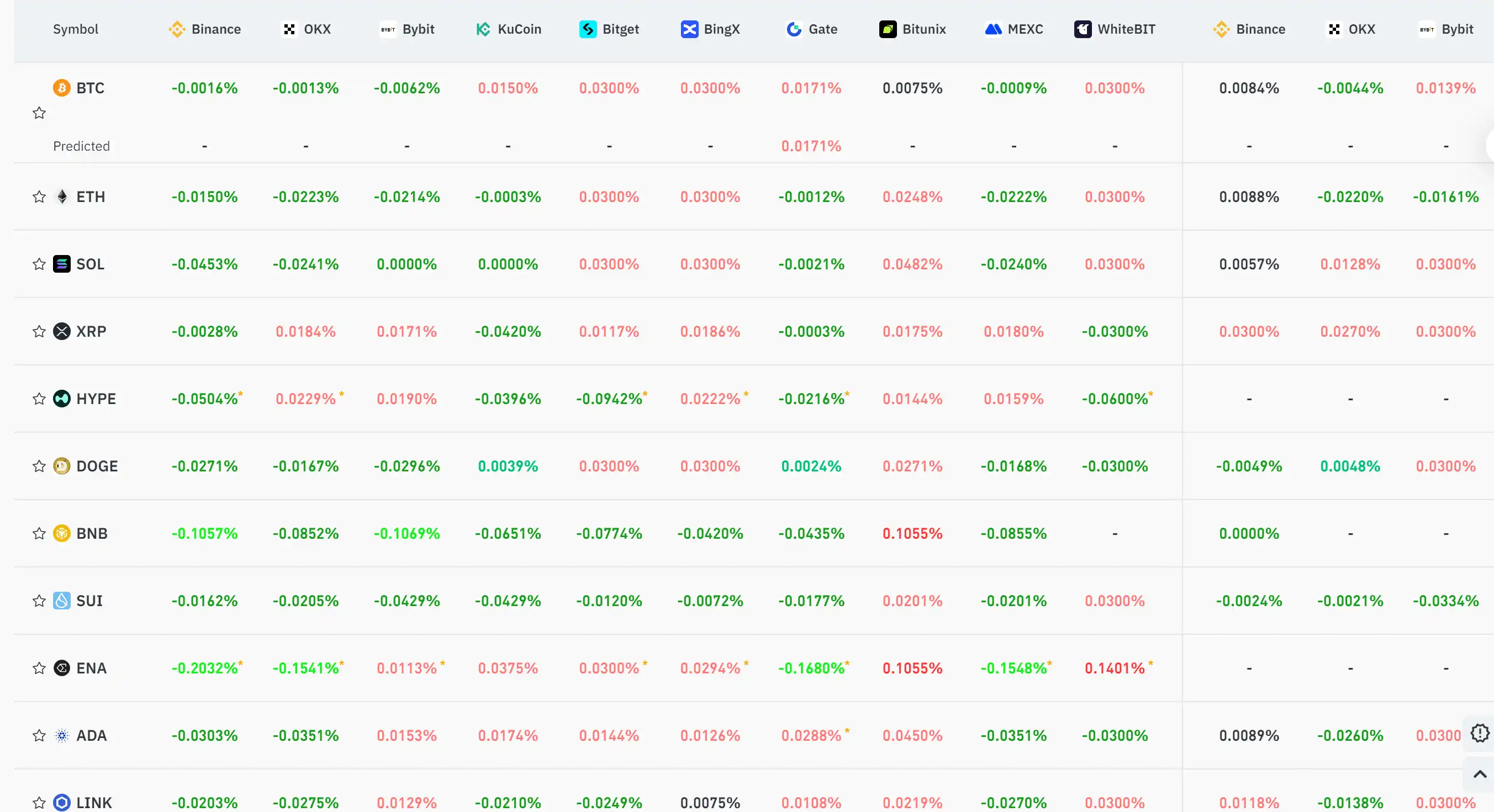

Daily Market Overall Funding Heatmap (as reflected by Funding Rate) and Token Unlocks

Data Source: Coinglass, TokenUnlocks

Funding Rate

Token Unlocks

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Updates: Dollar Rises Amid Trade Optimism, Crypto Awaits as Fed Decision Approaches

- The U.S. dollar hit multi-year highs amid trade optimism and near-certainty of a Fed rate cut before its policy meeting. - EUR/JPY surged to 178.15, signaling strong dollar momentum, while Bitcoin saw $931M inflows as investors anticipate monetary easing. - A 25-basis-point Fed cut is expected to weaken the dollar, boost risk assets, and trigger capital rotation into emerging markets and crypto. - Trump narrowed Fed chair candidates to five, including Rick Rieder, with implications for inflation, labor m

Bitcoin Updates: Crypto Industry Evolves—Whale Nets $17M Profit While DEX Volume Surpasses $1T During Market Fluctuations

- A crypto whale (0xc2a) earned $17M via 20x leveraged longs on Bitcoin and Ethereum during heightened volatility near $17B options expiry. - Decentralized exchanges (DEXs) hit $1T+ monthly volume in October 2025, driven by geopolitical shocks and incentive programs. - Fed policy decisions and tech earnings now shape crypto markets, which increasingly diverge from traditional assets amid institutional-grade infrastructure growth.

Bitcoin Updates Today: Are Bitcoin Repurchases a Risky Bet or a Brilliant Business Move?

- Metaplanet Inc. launched a $500M share buyback using Bitcoin-collateralized loans to close its stock price gap with $3.5B BTC holdings. - The 13.13% buyback aims to boost Bitcoin yield per share and restore investor confidence amid mNAV rebound to 1.03. - Critics warn Bitcoin-backed buybacks risk asset sales during price drops, while the strategy mirrors corporate crypto trends leveraging digital assets for capital optimization. - Shares rose 2.3% post-announcement, but sector remains polarized between b

Diplomatic Efforts and Technological Advancements Drive Growth in the Luxury Sector Despite Global Political Uncertainty

- Global luxury markets expand via digital innovation, with France's sector projected to grow from $23.75B to $35.97B by 2033, driven by fashion, jewelry, and tourism. - Gulf hospitality boom sees Hilton's Saudi Arabia hotel count surpass 100, while UK-GCC trade talks aim to boost luxury exports by £1.6B annually through diplomatic agreements. - Geopolitical tensions, including Trump's $70B Gaza reconstruction plan facing Gulf resistance and Saudi Arabia's oil price challenges, risk destabilizing cross-bor