Truth Social to Blend Politics, Prediction Trading, and Crypto

Trump Media & Technology Group (DJT) is expanding Truth Social beyond politics, launching Truth Predict — a built-in prediction market powered by Crypto.com Derivatives North America.

Trump Media & Technology Group (DJT) is expanding its social empire and entering the prediction market, a $20+ billion volume industry, through a new partnership.

The media platform will integrate prediction markets directly into Truth Social through an exclusive partnership with Crypto.com Derivatives North America (CDNA), a CFTC-registered exchange and clearinghouse.

Trump Media To Enter Prediction Markets Business

The new “Truth Predict” feature will allow Truth Social users to trade contracts on real-world events. These range from US elections and Federal Reserve (Fed) decisions to gold prices and sports outcomes.

It effectively transforms social conversations into tradeable foresight. The move would turn the platform into the first social media network to offer embedded access to federally regulated event contracts.

“Truth Predict will allow our loyal users to engage in prediction markets with a trusted network while harnessing our social media platform to provide unique ways for users to discuss and compare their predictions,” read an excerpt in the announcement, citing Devin Nunes, Chairman and CEO of Trump Media.

Prediction markets, where users buy and sell contracts tied to event outcomes, have exploded in 2025, with combined volumes exceeding $20 billion across major platforms like Polymarket and Kalshi.

Polymarket dominates the crypto-native side, while Kalshi leads regulated US markets. Truth Social’s entry marks a hybrid approach to leverage regulatory compliance via CDNA and Crypto.com’s crypto infrastructure to reach a politically engaged retail base.

According to the announcement, Truth Predict will soon begin beta testing in the US before expanding globally.

Users who earn “Truth gems” by engaging on Truth Social and the streaming platform Truth+ will be able to convert them into Crypto.com’s Cronos (CRO) token and use them to buy prediction contracts, effectively introducing an on-platform play-to-trade economy.

Kris Marszalek, CEO of Crypto.com, called the integration a major step toward mainstream adoption of event-based markets.

“Prediction markets are poised to be a multi-deca-billion-dollar industry. Combining regulated trading with social engagement makes Truth Predict a powerful tool for market sentiment,” read the announcement, citing Marszalek.

For Trump Media, the move deepens its transformation from a conservative social media network into a fintech ecosystem spanning streaming, payments, and soon, speculative trading.

The company claims over $3 billion in financial assets and recently posted its first quarter of positive cash flow since going public.

Therefore, the partnership could fuse political discourse with market speculation, a potent mix ahead of the 2026 midterms.

If successful, Truth Predict could redefine how retail investors engage with politics, creating a new breed of prediction-driven social finance where free speech meets financial bets.

In short, Trump’s latest play goes beyond markets to potentially monetize belief itself.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

How iRobot Strayed from Its Original Path

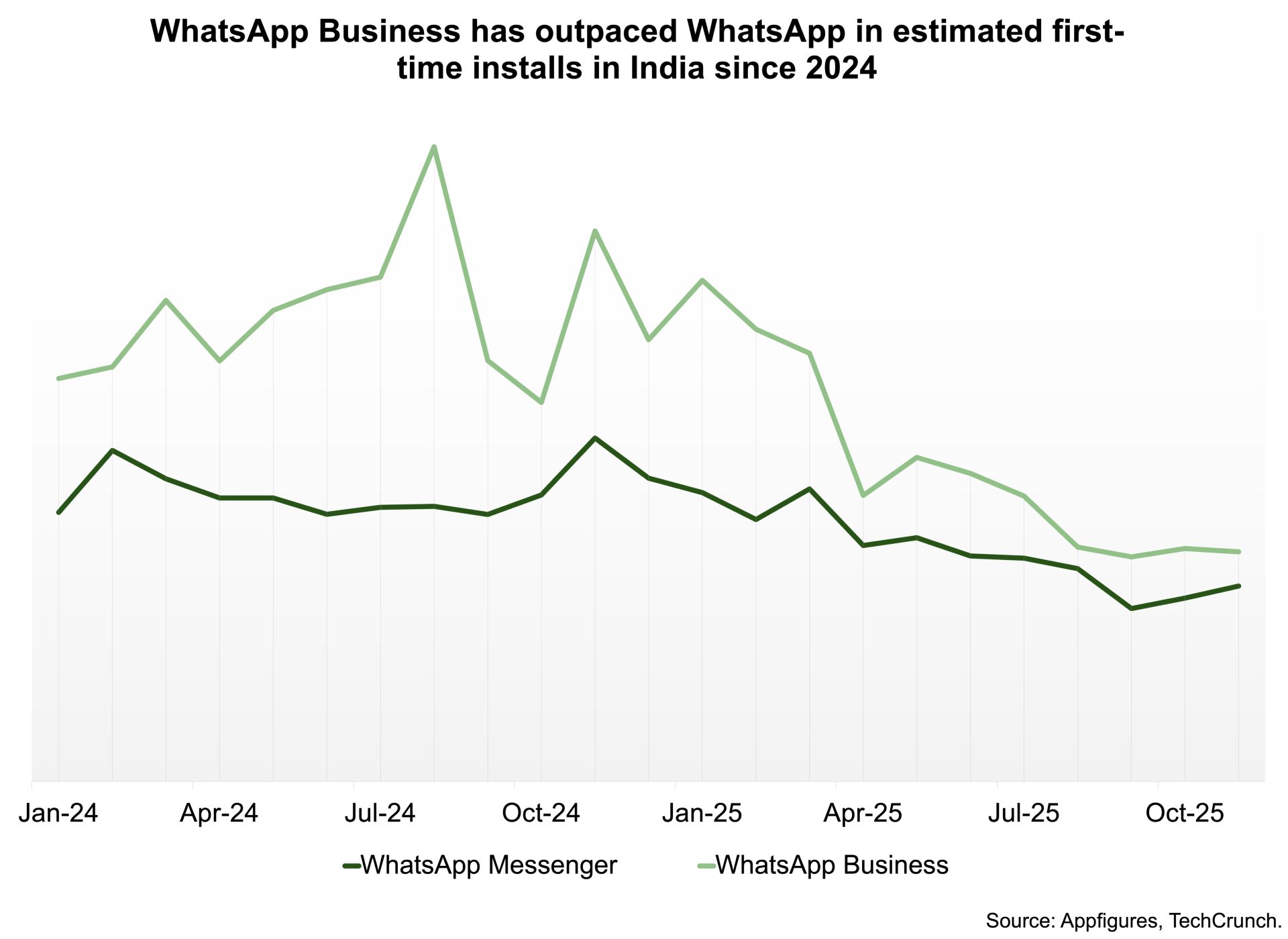

WhatsApp’s largest user base is now presenting its greatest challenge

Assessing Bitcoin’s Price Movement in Light of Macroeconomic Changes and Positive ETF Sentiment in November 2025

- Bitcoin faces macroeconomic headwinds in 2025, with Fed tightening causing a 15% crypto market cap drop, but ETF approvals drove 45% growth in institutional Bitcoin ETF AUM to $103B. - Institutional investors navigate $81k-$91k Bitcoin consolidation, balancing Fed policy risks against 68% adoption rates and regulatory clarity from EU MiCA and U.S. GENIUS Act. - Strategic entry strategies include core positions at $85k-$87k support, hedging with stablecoins/altcoins, and timing Fed rate cut expectations t

Moonbirds to launch BIRB token in early Q1 2026