SHIB’s Utility Deficit: Shibarium TVL Exposes Structural Flaw

The Shiba Inu (SHIB) token is struggling to recover its price, a failure analysts attribute to fundamental structural challenges rather than simple market volatility. This assessment follows new analyses declaring that SHIB’s goal of reaching the $0.0001 price level is a “dead end road” given the token’s core deficiencies. The Structural Challenge: Supply Overhang vs.

The Shiba Inu (SHIB) token is struggling to recover its price, a failure analysts attribute to fundamental structural challenges rather than simple market volatility.

This assessment follows new analyses declaring that SHIB’s goal of reaching the $0.0001 price level is a “dead end road” given the token’s core deficiencies.

The Structural Challenge: Supply Overhang vs. Delayed Deflation

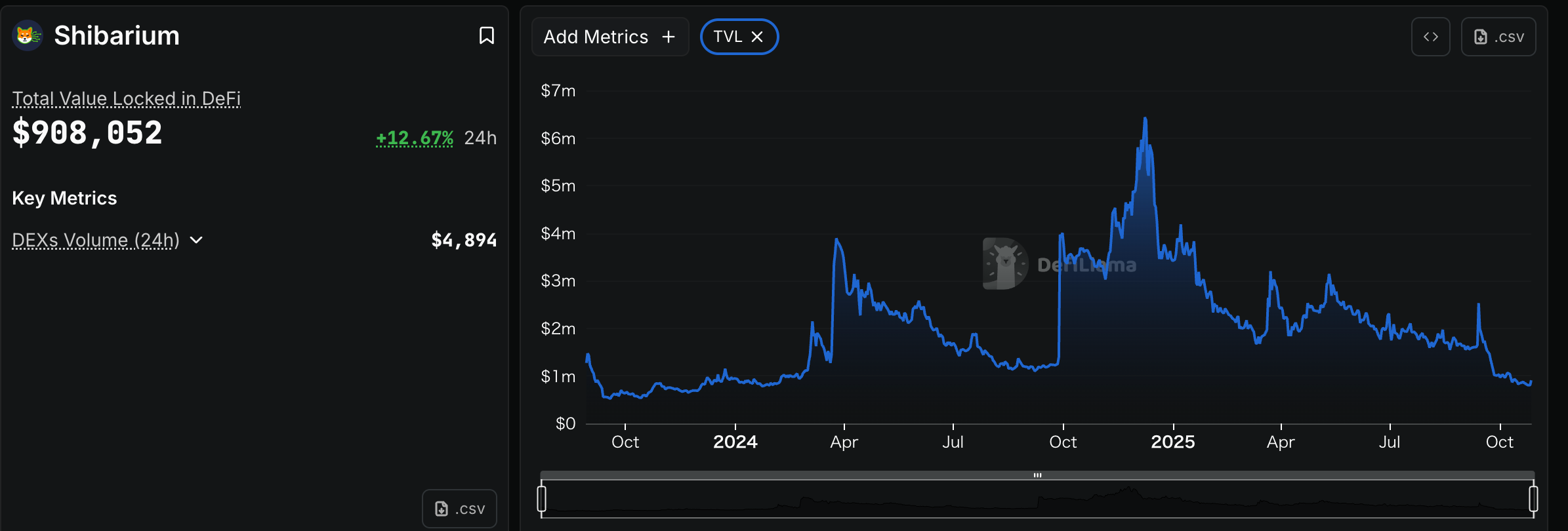

This harsh outlook is underscored by cold on-chain data: the Total Value Locked (TVL) on its layer-2 solution, Shibarium, has fallen and remained consistently below $1 million since early October, exposing a critical lack of ecosystem utility and adoption.

Shibarium TVL Throughout 2025. Source:

Shibarium TVL Throughout 2025. Source:

SHIB faces the core conflict: a mismatch between its massive circulating supply and the slow pace of its deflationary mechanism. SHIB’s ecosystem was designed to utilize its layer-2 network, Shibarium, to burn tokens and reduce the total supply of approximately 589 trillion tokens.

Let’s clear the smoke$SHIB is fully decentralized no one holds the “keys.” Nothing was “destroyed” because no one ever had control to begin with.At launch, half the supply was sent to Vitalik. He burned 410T+ SHIB and donated the rest to charity. The other half was locked in…

— The Dark Shib (@TheDarkShib) October 26, 2025

However, the low TVL on Shibarium continues. This is a fraction of the network’s theoretical potential. Therefore, the token burn rate significantly lags market expectations. This stagnation suggests that development efforts have not translated into meaningful network activity or user adoption.

Given that SHIB’s market capitalization is still in the billions, a TVL below $1 million is a stark indicator that decentralized applications (dApps) and users are not embracing the chain at the scale required.

Analysts interpret this technical failure as the primary structural reason. They increasingly view ambitious price targets like 0.0001 as unrealistic. The sheer scale of the token supply requires a massive, sustained deflationary pressure that the current ecosystem is failing to provide.

The Utility Deficit and Capital Flight to AI/DePIN

A secondary but critical factor that drives SHIB’s struggle is the ongoing rotation of capital within the crypto market. This capital is moving toward sectors that offer tangible utility. As the broader Web3 trend shifts decisively from “meme” to “utility,” SHIB is losing ground to projects that provide real-world value.

In the second half of 2025, capital has favored sectors like AI compute (e.g., Bitfarms’ pivot) and DePIN, projects that generate revenue from data, computation, and enterprise efficiency. These utility-driven tokens offer clear fundamentals beyond speculation.

Conversely, SHIB struggles to shed its “meme coin” image. The lack of TVL confirms that Shibarium has not found a unique, compelling use case. It needs this to attract developers and users away from established Layer-2 networks.

The sustained utility deficit means that whales and savvy money investors opt to divest from SHIB and redirect capital to these higher-growth, utility-focused sectors.

Community Resilience and the Competitive Landscape

Despite the long-term structural issues, community efforts show resilience. Data released yesterday indicates that SHIB token burns surged by over 42,000% in the past 24 hours, leading to a modest price increase to $0.00001062.

HOURLY SHIB UPDATE$SHIB Price: $0.00001062 (1hr 0.13% ▲ | 24hr 4.63% ▲ )Market Cap: $6,253,290,169 (4.61% ▲)Total Supply: 589,247,248,145,084TOKENS BURNTPast 24Hrs: 29,404,116 (42124.85% ▲)Past 7 Days: 54,846,173 (-76.05% ▼)

— Shibburn (@shibburn) October 27, 2025

The capital flight is not limited to utility tokens; it also targets alternative meme projects that promise aggressive tokenomics. One prominent figure noted on X that “the smart ones are rotating to Shib on Base,” citing a 32.6% supply burn and “AI-driven utility” as key drivers.

$Shib on Base Brother! Infinitely deflationary with 32.61% already burned. AI veterinary app releasing soon where 30% of those proceeds also buy and burn tokens. is the real deal. They also just had an AMA with that was very informative. Don’t…

— Keneezie (@CryptoKeneezie) October 26, 2025

This active competition highlights that investors now actively seek faster burn mechanisms and verifiable utility. This forces the original SHIB project to compete with AI tokens and newer, more aggressive meme coin models.

For SHIB to maintain relevance and pursue price recovery, its team must urgently demonstrate measurable and innovative utility. This requires more than just community hype. Instead, it demands attracting significant liquidity and developer engagement to Shibarium. This action ultimately proves that the token functions as a critical piece of Web3 infrastructure

The recovery of Shibarium’s TVL is the necessary first signal that SHIB can break free from its structural constraints.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum Rises 6.7% Over the Past Week as ETF Developments Advance and Large Investors Accumulate

- Ethereum rose 6.7% in 7 days amid ETF approval progress and whale accumulation, despite a 0.12% 24-hour dip to $4,118.20. - BlackRock's staking ETF application under SEC review and MegaETH's $999M ICO highlight institutional interest in Ethereum's ecosystem. - Whale activity shows $196M in Ethereum accumulation, with Pal and "100% Win Rate Whale" increasing positions by 200-100 ETH each. - A proposed backtesting strategy tests Ethereum's response to 5% price surges, aiming to validate institutional-drive

U.S. Announces $490 Billion Investment as Global Regulations and Geopolitical Dynamics Evolve

- U.S. Commerce Secretary finalizes $490B investment to boost domestic industries and global trade partnerships. - Kuwait accelerates capital market modernization via quadrilateral plan to enhance competitiveness and investor confidence. - KalshiEX sues New York over regulatory jurisdiction, claiming federal preemption for sports outcome derivatives. - Thailand's PM meets U.S. President Trump ahead of Cambodia ceasefire, signaling Southeast Asia diplomatic shifts. - Global developments highlight regulatory

Hyperliquid News Today: BigBear.ai's Defense AI Boom: Genuine Profits or Hype Fueled by Collaborations?

- BigBear.ai's stock surged 300% in 2025 due to defense AI partnerships and government spending, mirroring Palantir's rally. - The company secured $380M in contracts and expanded biometric solutions but reported $228.6M net loss and slashed revenue guidance. - Palantir's $10B U.S. Army contract and $1B+ Q2 revenue highlight defense AI growth, though both firms face valuation skepticism. - BigBear's edge-computing focus contrasts with Palantir's commercial expansion, as investors await Q3 earnings to valida

AI-Powered Retail Growth: PayPal and OpenAI Combine ChatGPT for Effortless Shopping

- PayPal partners with OpenAI to integrate payment systems into ChatGPT via Agentic Commerce Protocol (ACP), enabling in-chat transactions. - The collaboration connects PayPal's 400M shoppers with ChatGPT's 700M users, streamlining checkout while managing fraud and merchant integrations. - PayPal's shares rose 14% premarket as the deal expands AI-driven commerce, with 2026 plans to make 24,000+ merchants' catalogs searchable in ChatGPT. - Risks include technical scaling challenges and fraud controls for co