Crypto Trader Says NFT Altcoin Primed To Surge More Than 15%, Outlines Path Forward for XRP and Sei

A popular crypto analyst thinks chart patterns suggest one non-fungible token (NFT)-related altcoin is primed to surge in price.

The digital asset trader Ali Martinez tells his 161,200 X followers that PENGU , the native token of the Pudgy Penguins NFT collection, just broke out of a falling wedge pattern.

A falling wedge breakout is a technical analysis pattern that is used to identify potential bullish reversals in an asset’s price. The pattern is characterized by a series of lower highs and lower lows that form a wedge-shaped pattern on the chart. As the pattern progresses, the distance between the highs and lows decreases, which indicates that the selling pressure is weakening. When the price breaks out of the upper trend line of the wedge, it’s traditionally considered bullish.

Martinez says PENGU could surge to $0.026. With the asset trading at $0.0224 at time of writing, that would represent an increase of more than 16%.

The analyst also notes that “key support is holding” for the decentralized finance (DeFi) layer-1 blockchain Sei ( SEI ).

“If buyers step in, the next targets are $0.31 and $0.44.”

SEI is trading at $0.206 at time of writing.

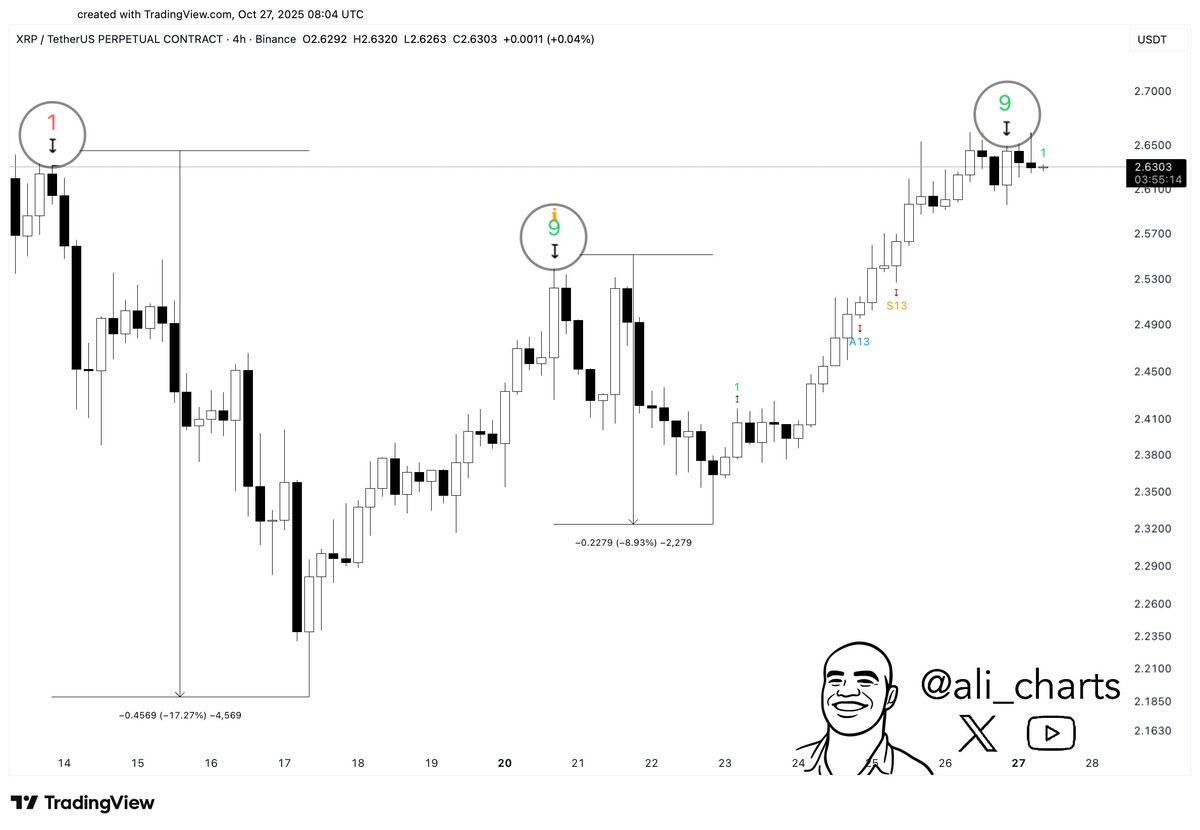

Conversely, Martinez notes that the TD Sequential Indicator, a tool that identifies potential trend exhaustion and price reversal points by counting a sequence of price bars, flashed a sell signal for the payments altcoin XRP .

XRP is trading at $2.68 at time of writing.

Generated Image: Midjourney

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum Latest Update: ETHZilla Offloads $40M in ETH to Reduce Gap Between Stock Price and NAV

- ETHZilla sold $40M in ETH to fund stock buybacks, aiming to reduce its 30% NAV discount by repurchasing 600K shares at $12M. - The move follows a $250M buyback plan leveraging treasury strength, with remaining funds to continue narrowing the NAV gap until normalization. - Competitor BitMine expanded its ETH holdings to 3.24M, while ETHZilla's Satschel partnership targets tokenized real-world assets. - Analysts highlight ETHZilla's high Price/Book ratio (50.97) but note its liquidity-focused strategy alig

Bitcoin Updates: Ideal Conditions and Major Investors Drive Bitcoin Closer to $145K

- Bitcoin surged past $116,500 in early November, with analysts predicting potential rallies to $130,000 and $145,000 by year-end. - A "perfect storm" of macroeconomic factors, including Fed rate cut expectations, $1.5T liquidity injections, and improved U.S.-China relations, fueled bullish momentum. - On-chain data showed increased accumulation by short-term holders and ETF inflows, while whale activity stabilized prices above $100,000 after a $19.35B liquidation event. - Institutional demand rose as firm

XRP News Today: Evernorth's XRP Holdings Surpass $1 Billion, Strengthening Ripple's Bridge Asset Ambitions

- Evernorth's XRP treasury hit $1B via 388.7M tokens, supported by Ripple's 126.8M XRP transfer and institutional investments. - XRP's 4% price surge to $2.58 reflects renewed confidence, driven by corporate adoption and ETF approval speculation. - Ripple's $1.25B Hidden Road acquisition expands XRP-based settlement capabilities, reinforcing its bridge asset strategy. - Upcoming ETF approvals (99% Polymarket probability) and Evernorth's Nasdaq listing (Q1 2026) could unlock institutional capital flows. - A

BlackRock's IBIT purchases $65M in Bitcoin