Messari: Trading US Stocks on Perp DEX, the Next New Frontier

However, current data indicates that a breakthrough in this field is still difficult to achieve in the short term.

Original Article Title: Equity Perps: Tall Orders and Slow Beginnings

Original Article Author: Sam, Messari Research

Original Article Translation: Deep Tide TechFlow

Key Insights:

Equity perpetual contracts still belong to a high-potential but unproven area, with limited appeal in the on-chain market mainly due to misaligned audience, weak demand, and more popular alternatives (such as 0DTE options).

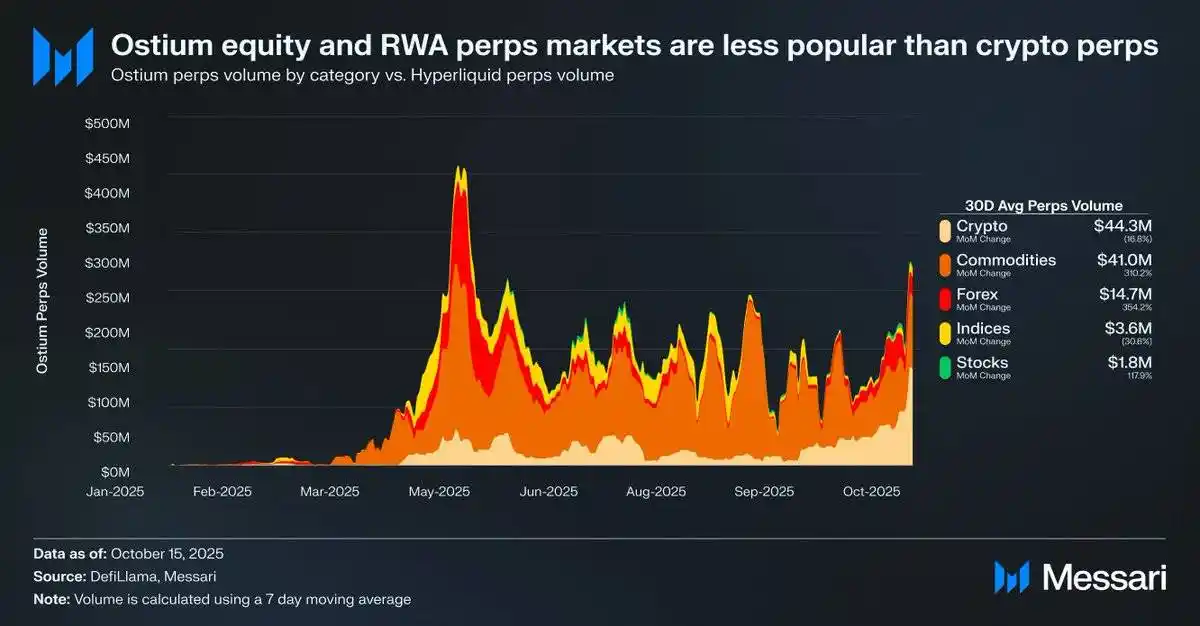

For example, the daily average trading volume of equity perpetual contracts on the Ostium platform is only $1.8 million, while cryptocurrency perpetual contracts reach as high as $44.3 million, demonstrating a weak market demand.

This may imply that due to infrastructure and regulatory constraints, market demand has not been fully unleashed. Hyperliquid's recent HIP-3 upgrade has provided the best opportunity for equity perpetual contracts, but the adoption process is expected to be gradual.

Source: Messari (@0xCryptoSam)

Equity perpetual contracts are considered the inevitable next blue ocean in the on-chain market, but current data suggests that this area is still challenging to break through in the short term. Ostium, as a decentralized exchange focusing on real-world assets (RWAs), has a daily average trading volume of equity perpetual contracts of only $1.8 million, while cryptocurrency perpetual contracts reach $44.3 million, reflecting weak demand.

This adoption gap is mainly due to misaligned audience. On-chain traders have little interest in stocks, while off-chain platforms (such as Robinhood) allow traders to easily trade stocks and options but not perpetual contracts. International investors may be a potential target audience as they cannot directly access the US stock market. However, these investors may prefer to hold stocks directly to gain shareholder rights while avoiding funding costs and settlement risks.

Compared to tokens, stocks have fewer interoperability challenges, benefiting from the convenience of synthetic wrapping. For the average investor, almost every stock in the global market has already been abstracted through the search bar's individual stock code. Therefore, even though perpetual contracts add permissionless and censorship-resistant features to stocks, ordinary stock investors are either unaware of this or simply not interested.

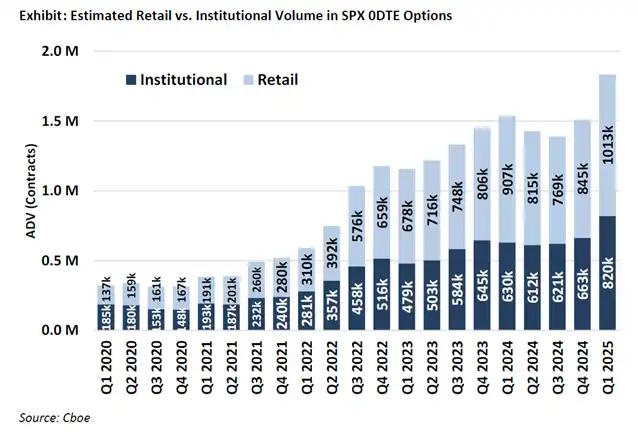

Source: fow

The most likely users of stock perpetual contracts are retail options traders (who drive 50%-60% of 0DTE trades on the Robinhood platform). However, traditional exchanges relying on banking services will only adopt stock perpetual contracts when the law is clear. The U.S. Commodity Futures Trading Commission (CFTC) has approved perpetual contract trading for BTC and ETH, but these two have been deemed non-securities. While perpetual contracts are more intuitive than options, the popularization of stock perpetual contracts may be slower than expected due to the close link between retail adoption paths and legal clarity.

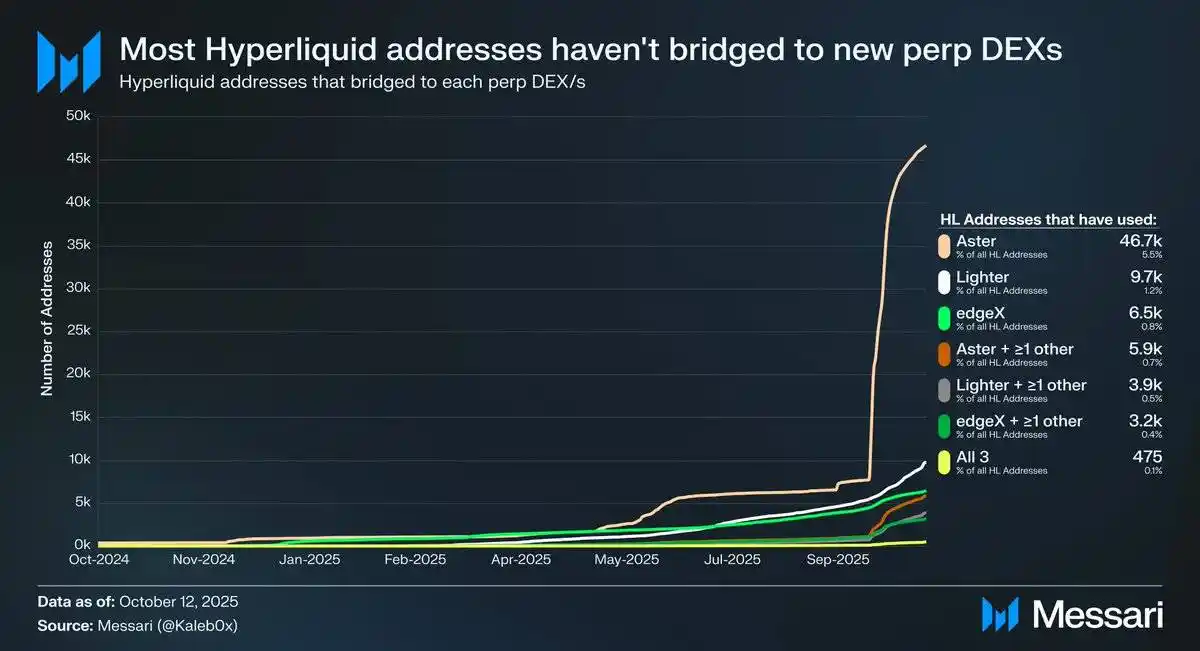

Source: @Kaleb0x

Let's discuss the potential development direction of stock perpetual contracts under the background of the HIP-3 upgrade on Hyperliquid. HIP-3 introduces a permissionless perpetual contract market, and data shows that less than 10% of Hyperliquid addresses have bridged to Aster, Lighter, and edgeX, with even fewer users opting for multiple perpetual contract decentralized exchange (DEX) platforms. This indicates that funds on Hyperliquid are sticky and of higher quality. Based on this data, the future of stock perpetual contracts can be predicted from two perspectives:

Hyperliquid users are loyal to the platform and, regardless of asset listings or features, they are more likely to choose Hyperliquid over other perpetual contract DEXs.

Hyperliquid users are satisfied with the current perpetual contract market products.

I believe both of these viewpoints make sense. Considering that Hyperliquid users have not massively shifted funds in the face of incentives, they may be loyal to Hyperliquid. However, as most of the trading volume and open interest on Hyperliquid are concentrated in mainstream assets, similar to other perpetual contract DEXs, it is currently difficult to determine whether Hyperliquid users care about market diversity and whether stock perpetual contracts are attractive to regular users (more importantly, to the whales holding 70% of Hyperliquid's open interest).

In addition, these traders may also have accounts on both traditional trading platforms and brokerage platforms, further limiting the potential market size of stock perpetual contracts on Hyperliquid.

It is worth noting that stock perpetual contracts may not bring new open interest or trading volume to Hyperliquid but may instead divert existing trading volume.

Although Ostium (with an annual average perpetual contract trading volume of $220 billion) and stock tokenization tools (such as xStocks, with a spot trading volume of $2.79 billion) have not yet experienced explosive growth, this may reflect infrastructure limitations rather than a lack of underlying demand. This pattern mirrors the early growth trajectory of perpetual contracts. GMX demonstrated the demand for on-chain perpetual contract markets, but the infrastructure at the time could not support sustained trading volume. Hyperliquid overcame this bottleneck, unleashing latent demand. By the same logic, after stock perpetual contracts receive the necessary performance and liquidity enhancements under HIP-3, they may find their first scalable product-market fit on Hyperliquid. While current data cannot confirm this outcome, this precedent is worth noting.

Compared to 0DTE options, the long-term potential of stock perpetual contracts remains evident. Projects like Trade[XYZ] can leverage regulatory arbitrage to build an early user base before entering the market on traditional exchanges. However, the real challenge lies in attracting off-chain retail traders, which has always been difficult for crypto applications.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin News Update: The Appeal of Bitcoin Compared to Liquidity Concerns: S&P Removes Strategy from Index

- S&P Global downgraded Strategy Inc. to junk status, removing it from the S&P 500 due to heavy crypto exposure and liquidity risks. - The company holds 640,808 BTC ($74B) but faces $15B in convertible debt, risking asset liquidation if Bitcoin prices drop. - CEO Michael Saylor remains bullish, aiming for a $2T Bitcoin portfolio by 2040 despite market volatility and mixed crypto treasury results. - JPMorgan and others are adapting to crypto, allowing digital assets as loan collateral, signaling growing ins

Uniswap News Today: MetaMask Token Buzz Highlights Drive Toward Ecosystem Decentralization

- MetaMask's potential token "MASK" speculation intensified after a password-protected claim portal emerged, raising 2025 launch odds to 35% on Polymarket. - Consensys CEO Joe Lubin hinted at a token as a "step toward decentralization," while a $30M loyalty program suggests ecosystem expansion efforts. - Co-founder Dan Finlay warned against phishing risks, emphasizing official channels for any token distribution amid past fake claim site attacks. - Market reactions highlight crypto volatility, with MetaMas

Pudgy Penguins' Price Rally Resembles 2020 DeFi Boom with $0.026 Milestone Approaching

- Pudgy Penguins (PENGU) surged past a falling wedge pattern, targeting $0.026 as key resistance amid rising on-chain accumulation and technical strength. - High-net-worth investors accumulated 2.16M PENGU weekly, aligning with a bullish cup-and-handle breakout validated by expanding volume and RSI momentum. - Market optimism grows with Kung Fu Panda collaboration, $1.34B market cap, and $111M daily volume, though $0.018-$0.020 support remains critical for sustained gains.

Ethereum News Today: Ethereum Surpasses Bitcoin in Institutional Uptake as Companies Seek Better Returns and Enhanced Efficiency

- Ethereum's institutional adoption outpaces Bitcoin as corporate treasuries accumulate 5.98M ETH (4.94% of supply), driven by yield opportunities post-Proof-of-Stake transition. - BitMine Immersion's 77,055 ETH purchase (3.31M total) and SharpLink Gaming's $78.3M ETH buy highlight growing corporate demand amid easing trade tensions and rising ETH prices. - Market analysis notes $4,270 as critical resistance level, with $650M short positions at $4,100 reflecting cautious optimism despite record corporate E