Fed and ETF Boost Cryptocurrency Market! Institutional Investors Sell Ethereum (ETH), Rush to Bitcoin and These Two Altcoins!

This week, Bitcoin and altcoins are focused on the Fed's October interest rate decision and the meeting between US President Donald Trump and Chinese President Xi Jinping.

At this point, while it is almost certain that the FED will cut interest rates by 25 basis points, BTC and the market started the critical week with an increase.

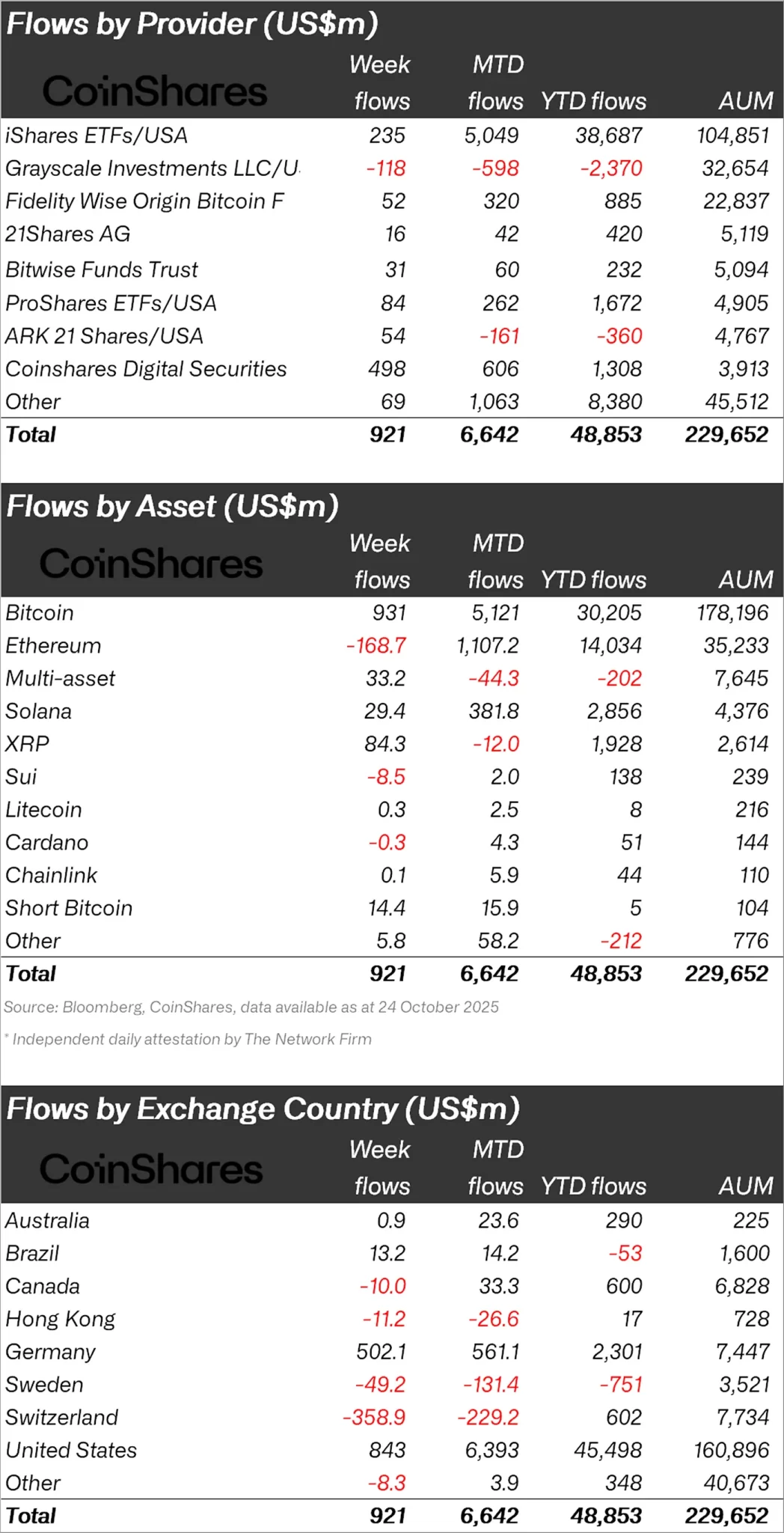

As investors continue to closely monitor market developments with the recovery, CoinShares released its weekly cryptocurrency report and stated that $921 million in inflows occurred last week.

“Following lower-than-expected US Consumer Price Index (CPI) data, investor confidence increased, resulting in an inflow of $921 million into cryptocurrency investment products.”

Bitcoin Enters, Ethereum Exits!

When looking at individual crypto funds, it was seen that the majority of inflows were in Bitcoin.

While Bitcoin experienced an inflow of $931 million, Ethereum (ETH) experienced an outflow of $168.7 million.

When we look at other altcoins, Solana (SOL) experienced an inflow of $29.4 million and XRP $84.3 million, while Sui (SUI) experienced an outflow of $8.5 million.

“A total of $931 million inflows have been made into Bitcoin, bringing cumulative inflows since the US Federal Reserve (Fed) began cutting interest rates to $9.4 billion.

Ethereum saw total outflows of $169 million for the first time in 5 weeks, and daily outflows remained stable throughout the week.

Solana and XRP saw outflows of $29.4 million and $84.3 million, respectively, ahead of their US ETF launches.

When looking at regional fund inflows and outflows, the USA ranked first with an inflow of $843 million.

Following the USA, Germany had an inflow of $502 million and Brazil $13.2 million.

In the face of these inflows, Switzerland experienced an outflow of $358.9 million and Sweden $49.2 million.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

ConstructKoin Develops Blockchain Bridge to Unlock $300 Trillion in Real Estate Liquidity

- ConstructKoin (CTK) unveils 2025–2026 roadmap to bridge institutional capital with blockchain-based real estate financing via compliance-first RealFi protocols. - Four-stage plan includes KYC/AML-compliant onboarding, asset-backed lending expansion, and global institutional partnerships to scale real-world asset tokenization. - CTK differentiates from DeFi by balancing blockchain transparency with regulatory frameworks, attracting institutional capital amid crypto market volatility. - Analysts highlight

Bitcoin News Update: MicroStrategy's $200,000 Bitcoin Investment Encounters 1977-Like Crash Alert Amid Ongoing Bullish Breakout Discussions

- Peter Brandt warns Bitcoin mirrors 1977 soybean crash pattern, predicting a potential 50% drop to $60,000, threatening MicroStrategy’s leveraged BTC holdings. - Contrasting views emerge: TheMarketSniper highlights Bitcoin’s "descending broadening wedge" as a bullish setup, while Crypto₿irb signals a near-term cycle peak. - MicroStrategy faces liquidity risks if Bitcoin declines, as a 50% drop could devalue its 200,000 BTC stake, testing its debt-driven strategy. - Market sentiment remains divided: Arthur

Fireblocks Integrates Security and Ease of Use Through $90M Dynamic Takeover

- Fireblocks acquires Dynamic for $90M to unify institutional custody with consumer crypto onboarding via integrated developer tools. - Dynamic's "Auth0 for web3" tools enable mainstream apps to embed crypto authentication, wallets, and multi-chain support securely. - The deal aligns with crypto infrastructure consolidation trends amid U.S. regulatory clarity and rising stablecoin adoption (30% YoY growth). - Fireblocks now supports 50M on-chain accounts, addressing scalability challenges while competing w

Bitcoin News Update: Prenetics’ Two-Pronged Approach Draws Cryptocurrency Companies and Celebrities in $48 Million Funding Round

- Prenetics raises $48M in oversubscribed offering with crypto firms, celebrities, and institutions. - Dual-warrant structure could unlock $216M, supporting IM8 supplements and Bitcoin treasury expansion. - IM8 achieves $100M ARR in 11 months; CEO targets $1B revenue and $1B Bitcoin holdings by 2029. - Strategic partners include Kraken, Bitdeer; aligns with rising institutional crypto adoption trends.