White House to Attend Ripple Swell 2025 in New York

Quick Take Summary is AI generated, newsroom reviewed. Ripple’s Swell 2025 takes place on November 4–5 in New York. The White House is reportedly attending for the first time. Trump’s administration has shown increasing crypto support in 2025. XRP trades near $2.15 with a $118 billion market cap.References X Post Reference

Reportedly, the White House will appear for the first time in the Swell Conference of Ripple in New York on November 45, 2025. This statement, which was shared on X by the account BullrunnersHQ, has attracted a lot of attention to the crypto community. The Swell event is an event held by Ripple Labs annually and deals with the cross-border payment system and blockchain innovation. The involvement of the executive arm of the U.S. government is the first in the eight years history of Swell.

🚨THE WHITE HOUSE WILL MAKE ITS FIRST-EVER APPEARANCE AT RIPPLE’S SWELL CONFERENCE ON NOV 4–5, 2025

— BULLRUNNERS (@BullrunnersHQ) October 26, 2025

#XRP #XRPCommunity pic.twitter.com/lDhjB7RMBE

Swell 2025 Will Highlight Blockchain Adoption in Finance

Ripple affirmed that Swell 2025 will bring together global financial leaders, fintech companies and policymakers. The New York location of the event highlights strategic emphasis of Ripple in the U.S. after decades of international performance. Since 2017, Swell launched such important technologies as On-Demand Liquidity and demonstrated significant partnerships with banking. This look of the White House is in line with increasing involvement in the Trump administration in the policy of digital assets also.

In February 2025, the administration introduced a digital asset working group and asked Congress to enact the “Clarity Act” to clarify the classification of tokens. This has changed the federal attitude towards crypto particularly following the speech given by Trump in the January 2025 when Trump made a promise to make America the crypto capital of the world.

Position and Market Relevance of Ripple

Ripple is one of the pioneering blockchain companies that provide institutional payment technology based on RippleNet and the XRP Ledger. Plus, by October end, XRP will be trading around $2.15 at a market capitalization of approximately 118 billion making it the sixth largest globally. The legal tussle that Ripple has been squaring out with the U.S. The involvement of the White House may indicate a new stage of policy clarity, which may facilitate institutional reluctance.

Possible Implications on XRP and the general market

Traditionally, the pro- crypto political events have triggered short-term rallies. After Trump gave a speech about pro-cryptocurrency in January 2025, Bitcoin also increased by 20 per cent. Analysts believe that XRP may have the same advantage in case the White House confirms their presence. Market sentiment on X is positive, with the users describing the news as historic and excellent to the whole crypto market. But the cynical authors warn that there is still no official confirmation on the part of Ripple or the White House.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

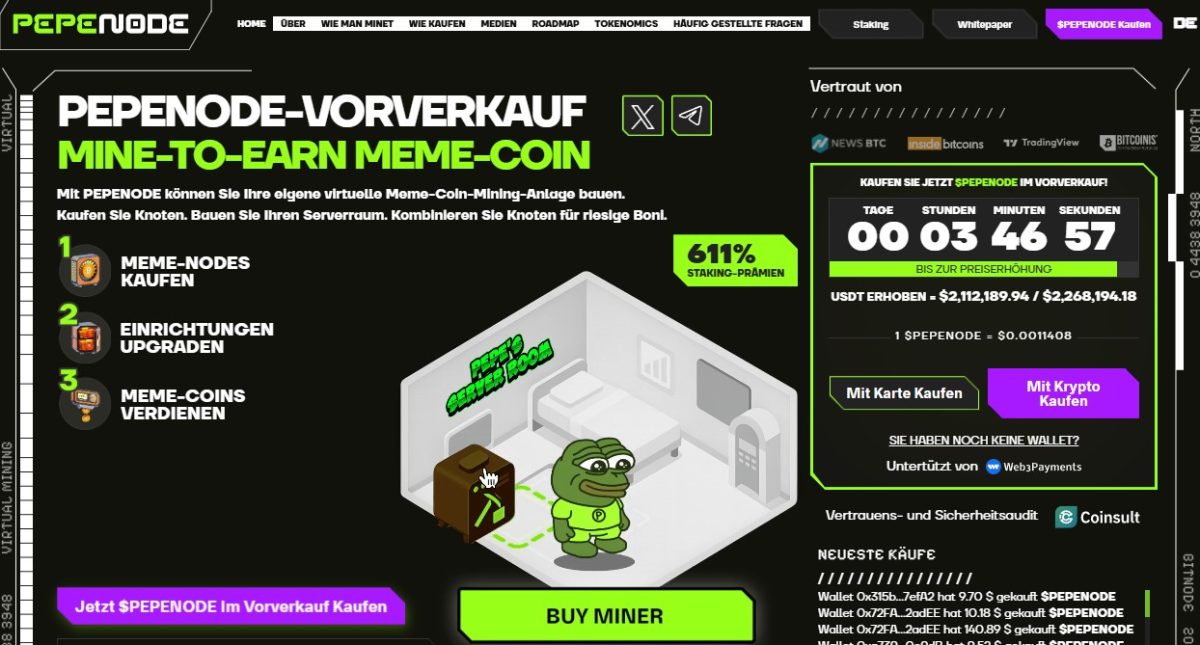

Ethereum Prognose: PepeNode als Ausweich-Play

Cardano price forms bullish divergence as NIGHT token demand jumps