Ethereum News Update: Buterin: Relying on Off-Chain Validator Trust Supersedes Mathematical Guarantees, Compromising Security

- Ethereum co-founder Vitalik Buterin warned off-chain validator trust creates critical vulnerabilities, despite on-chain consensus resilience against attacks. - Experts highlighted risks like MEV exploitation, oracle errors, and eclipse attacks, citing historical failures like 2020 bZx protocol breaches. - Market volatility sees Ethereum ETF outflows and 13.75% 60-day price decline, contrasting with bullish 2025 $10,000 price predictions from Fundstrat's Tom Lee. - Developers debate balancing scalability

Vitalik Buterin, one of Ethereum's co-founders, has issued an uncommon alert regarding the dangers of relying on off-chain validator trust. He pointed out that, although Ethereum’s consensus protocol is robust against attacks, systems that depend on validators’ integrity outside the blockchain itself can create significant security flaws. On October 26, Buterin posted a series of messages clarifying that even if 51% of validators act maliciously, they still cannot confirm an invalid block—an essential security guarantee of proof-of-stake networks,

Buterin’s caution has sparked renewed discussion among blockchain developers about the expanding responsibilities of validators in modern blockchain environments. He recognized that Ethereum’s design prevents direct theft of assets on-chain, but warned that validators could still indirectly endanger user funds. For instance, strategies like maximal extractable value (MEV) or censorship could take advantage of validator actions outside the chain. Polygon CTO Mudit Gupta agreed, stating that validators have the ability to “steal money” through MEV, while others, such as Polkadot’s Seun Lanlege, pointed out that malicious validators could disrupt block distribution or carry out eclipse attacks, as reported by Yahoo Finance.

Buterin’s comments come at a time when Ethereum is broadening into decentralized finance (DeFi) and tokenization of real-world assets, both of which depend heavily on off-chain data sources. Past events, such as the 2020 failures of the bZx and Compound protocols due to oracle mistakes, highlight the dangers of external data reliance, as CoinoTag noted. Developers like Robert Sasu from MultiversX have advocated for reducing off-chain dependencies and moving toward fully on-chain solutions to maintain decentralization (reported by Yahoo Finance).

Market trends add further complexity. Ethereum’s price recently hovered around $3,934, marking a 4.85% rise in 24 hours but a 13.75% drop over the past two months (as CryptofrontNews reported). At the same time,

Despite these obstacles, Ethereum’s technological progress persists. By 2025,

This ongoing debate highlights a fundamental challenge in blockchain architecture: finding the right balance between scalability, advanced features, security, and decentralization. As Buterin remarked, “When users depend on validators for actions outside the blockchain, trust takes the place of mathematics” (as BeinCrypto explained). With Ethereum’s market capitalization at $474.89 billion, participants must carefully weigh these trade-offs as the network integrates with traditional finance and expands to a global scale (as CryptofrontNews reported).

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Pardon or Payment? Trump's Cryptocurrency Decision Ignites Discussion on the Influence of Lobbying

- Trump pardons Binance founder CZ after $740K lobbying, sparking scrutiny over crypto policy influence. - CZ’s 2024 prison sentence for AML violations led to a $4.3B settlement, now reversed by executive clemency. - Critics call it a "favor for crypto criminals," while analysts see relaxed U.S. crypto oversight boosting market confidence. - Trump’s pro-crypto stance includes disbanding enforcement teams, signaling regulatory shifts. - Binance’s $1M+ 2025 lobbying reflects ongoing efforts to rebuild trust

Dogecoin News Today: Meme Coin Battle: Excitement Versus Practical Use in the Quest for Supremacy

- Meme coin investors shift focus to Layer Brett ($LBRETT), an Ethereum L2 project combining meme appeal with utility, as Dogecoin (DOGE) ETF delays stall its momentum. - Pepe Coin (PEPE) struggles to sustain engagement despite social media-driven surges, lacking infrastructure for long-term on-chain activity. - Layer Brett offers low fees, instant transactions, and 590% APY staking, attracting $4.4M in pre-sales amid DOGE's 17% three-month price drop. - Shiba Inu (SHIB) retains brand strength but faces sc

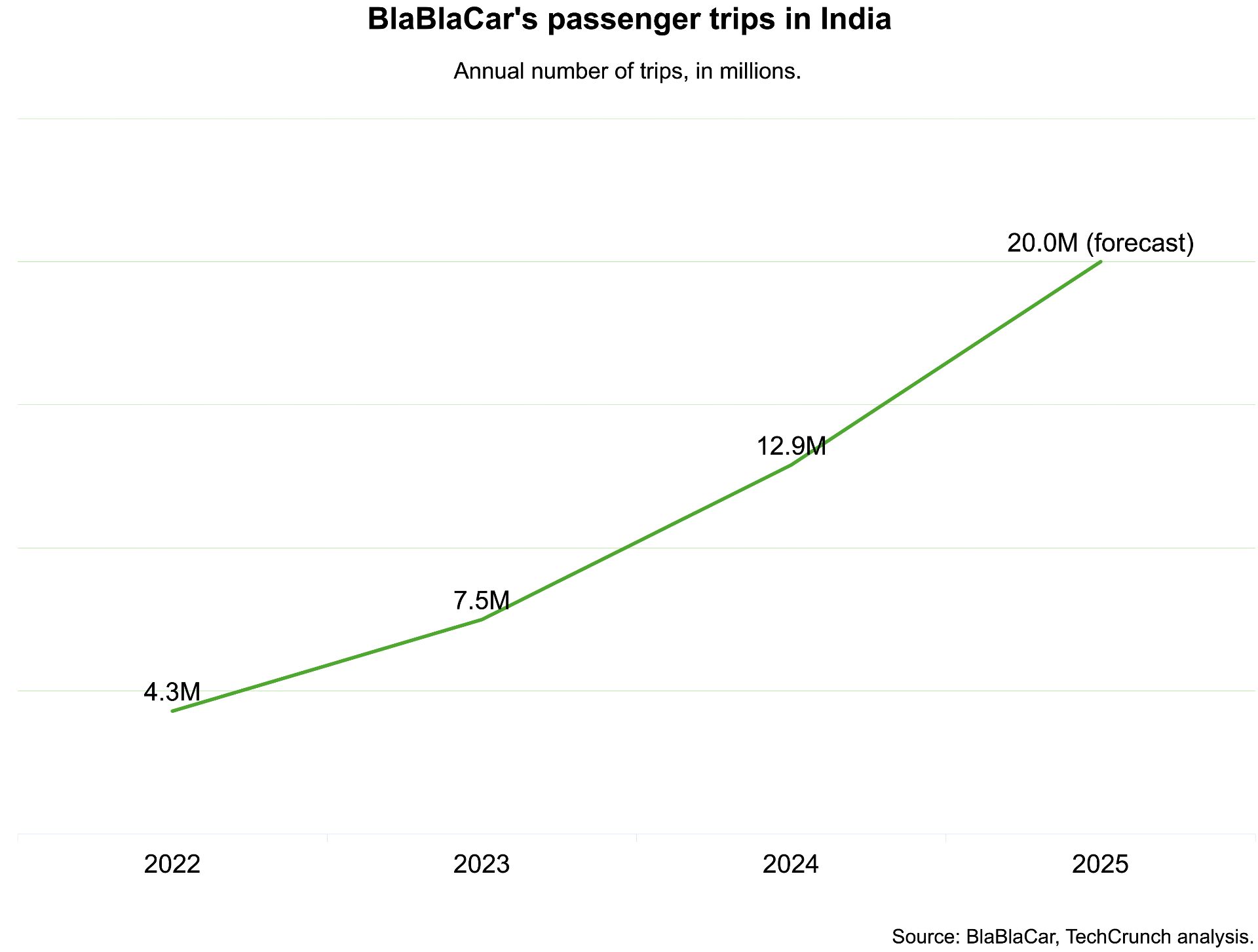

India, which BlaBlaCar previously exited, has now become its largest market