China and U.S. Trade Negotiations Strain Delicate Ceasefire as Rare Earth Disputes and Tariff Risks Escalate

- China and the U.S. restart trade talks in Malaysia to extend a tariff truce and avoid economic confrontation, led by He Lifeng and U.S. officials. - Negotiations address escalating tensions over tariffs, export controls, and rare earth management, with U.S. policy inconsistencies threatening progress. - Rare earth elements remain central, as China dominates global production while Trump threatens "sky-high" tariffs over tightened controls. - Businesses face pricing uncertainty amid shifting regulations,

China and the US are preparing to restart crucial trade negotiations in Malaysia this week, aiming to prevent further economic conflict and possibly prolong a temporary halt on tariffs that is due to end on November 10, according to

This round of discussions comes after a turbulent year in US-China economic ties, characterized by cycles of negotiations and retaliatory steps. The US has enacted 100% tariffs on Chinese imports and broadened export bans on key technologies, while China has responded with restrictions on rare earth exports and new port charges for US vessels, according to China Daily. Although four previous meetings helped steady relations and lifted market confidence, recent US moves—including a Section 301 probe into China’s adherence to the 2019 Phase One trade deal—have revived concerns over a renewed trade conflict, as stated in

Rare earth minerals remain a central issue. China, which leads global output of these vital resources used in electronics and defense, has maintained that it does not restrict civilian exports, according to China Daily. Nevertheless, US President Donald Trump has warned of imposing “extremely high” tariffs in response to China’s tighter controls, as reported by

Companies are already experiencing the impact. Zhejiang Arcana Power Sports Tech Co., an exporter of fitness equipment, saw US shipments rise by 22.6% year-on-year through September, highlighting the value of stable trade ties, China Daily reported. The firm’s vice president, Geng Liangfeng, stated that “a healthy China-US economic partnership is fundamental for businesses in both countries to prosper together.” Still, firms are grappling with price volatility and regulatory challenges as they adapt to changing export rules, according to

The results of the Malaysia negotiations will also shape diplomatic relations. Trump’s scheduled meeting with Chinese President Xi Jinping at the APEC summit in South Korea depends on progress in easing tensions, with the US president previously threatening to call off the talks, Benzinga reported. Thomas Helbling of the IMF highlighted the global implications, pointing out that ongoing friction could negatively affect Asia’s economies, which are “very open and reliant on international trade,” China Daily noted.

Though experts warn that mutual confidence is still fragile, both governments have indicated a willingness to keep talking. Li Chenggang, a senior Chinese negotiator, remarked that “China and the US have held productive talks and identified some viable solutions, reaching initial agreements,” according to Benzinga. However, Wang Wen from Renmin University cautioned that “this approach undermines the trust essential for any durable deal,” as reported by China Daily.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Dogecoin News Today: Meme Coin Battle: Excitement Versus Practical Use in the Quest for Supremacy

- Meme coin investors shift focus to Layer Brett ($LBRETT), an Ethereum L2 project combining meme appeal with utility, as Dogecoin (DOGE) ETF delays stall its momentum. - Pepe Coin (PEPE) struggles to sustain engagement despite social media-driven surges, lacking infrastructure for long-term on-chain activity. - Layer Brett offers low fees, instant transactions, and 590% APY staking, attracting $4.4M in pre-sales amid DOGE's 17% three-month price drop. - Shiba Inu (SHIB) retains brand strength but faces sc

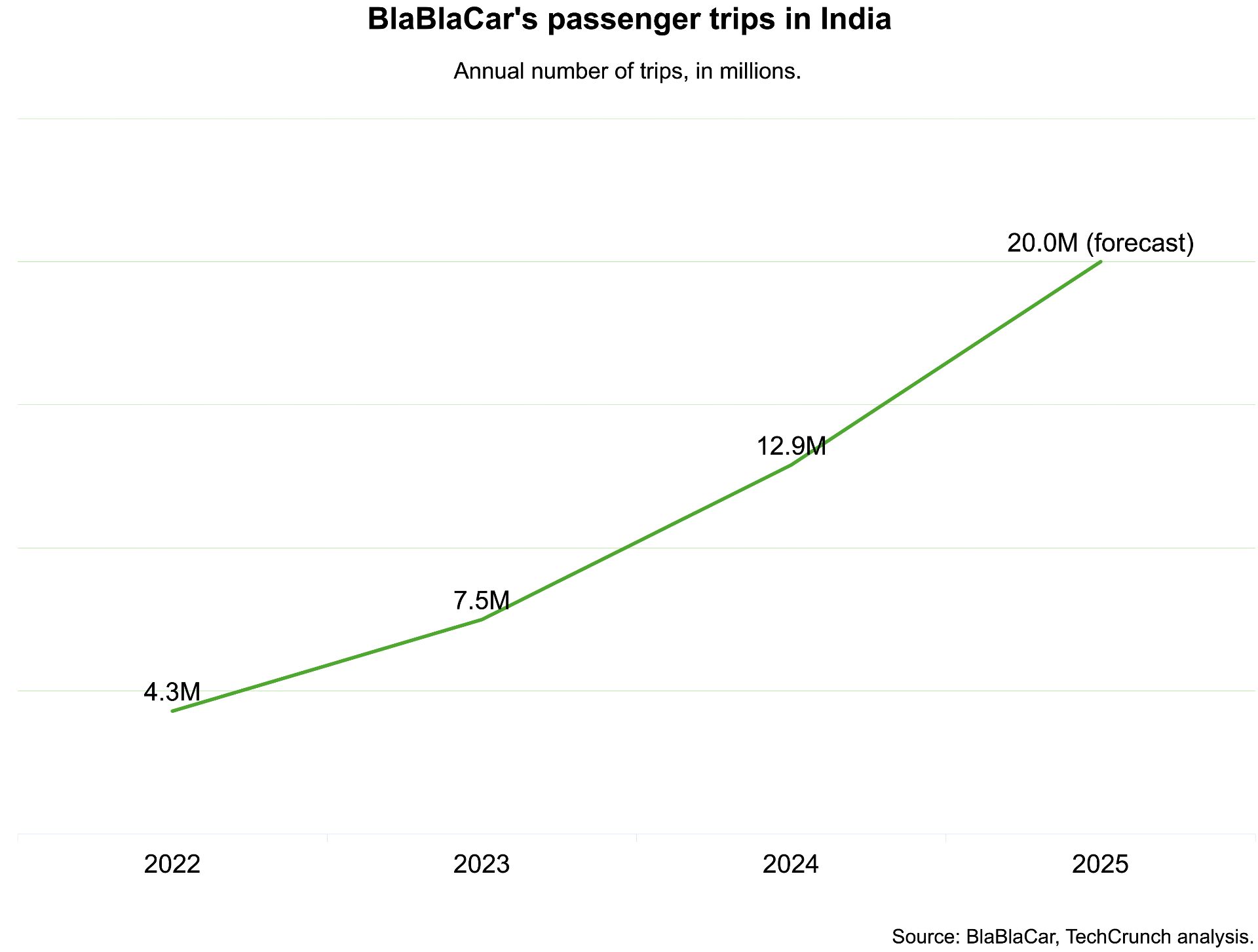

India, which BlaBlaCar previously exited, has now become its largest market

TechCrunch Mobility: The debate over the ‘robot army’