U.S. and China Move Closer to Trade Ceasefire as Retaliatory Tariffs Intensify

- U.S.-China trade talks in Kuala Lumpur show progress, with both sides aiming for a preliminary agreement before Trump-Xi summit. - U.S. proposes 157% tariffs on Chinese goods over fentanyl concerns, while China imposes reciprocal port charges on U.S.-linked shipping. - Escalating tit-for-tat measures risk global shipping costs and trade routes, as tensions rise ahead of U.S. presidential elections. - Negotiations focus on de-escalation amid mutual threats, with Trump signaling openness to direct talks de

Recent talks between U.S. and Chinese trade officials have seen notable advancement, with both parties voicing hope for a preliminary deal before a possible summit between President Donald Trump and President Xi Jinping. On October 26, U.S. Trade Representative Jamieson Greer mentioned that the discussions in Kuala Lumpur are

China’s Vice Premier He Lifeng and chief negotiator Li Chenggang took part in the meetings, highlighting the importance of reducing friction as both countries increase their threats. The U.S. has announced plans for new tariffs of up to 157% on Chinese imports beginning November 1, citing worries about fentanyl trafficking and restrictions on rare earth exports. Trump has justified these tariffs as a reaction to China’s supposed involvement in sending fentanyl to the U.S. through Venezuela, but he has also indicated a willingness to resolve matters directly with Xi,

In response, China has introduced its own countermeasures. The Ministry of Transport (CMOT) revealed new port fees for ships with American connections, mirroring the U.S. Section 301 tariffs that target Chinese shipping and logistics. These fees, which will rise each year, aim to put pressure on U.S.-affiliated shipping while excluding vessels made in China. Experts point out that this move is part of a growing tit-for-tat strategy, and

The negotiations are taking place during a period of increased geopolitical strain. Trump’s five-day visit to Asia, which includes a scheduled summit in South Korea, highlights the pressing need to resolve these disputes ahead of the U.S. presidential election. Although Beijing has not yet confirmed a meeting between the leaders, officials from the White House

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Pardon or Payment? Trump's Cryptocurrency Decision Ignites Discussion on the Influence of Lobbying

- Trump pardons Binance founder CZ after $740K lobbying, sparking scrutiny over crypto policy influence. - CZ’s 2024 prison sentence for AML violations led to a $4.3B settlement, now reversed by executive clemency. - Critics call it a "favor for crypto criminals," while analysts see relaxed U.S. crypto oversight boosting market confidence. - Trump’s pro-crypto stance includes disbanding enforcement teams, signaling regulatory shifts. - Binance’s $1M+ 2025 lobbying reflects ongoing efforts to rebuild trust

Dogecoin News Today: Meme Coin Battle: Excitement Versus Practical Use in the Quest for Supremacy

- Meme coin investors shift focus to Layer Brett ($LBRETT), an Ethereum L2 project combining meme appeal with utility, as Dogecoin (DOGE) ETF delays stall its momentum. - Pepe Coin (PEPE) struggles to sustain engagement despite social media-driven surges, lacking infrastructure for long-term on-chain activity. - Layer Brett offers low fees, instant transactions, and 590% APY staking, attracting $4.4M in pre-sales amid DOGE's 17% three-month price drop. - Shiba Inu (SHIB) retains brand strength but faces sc

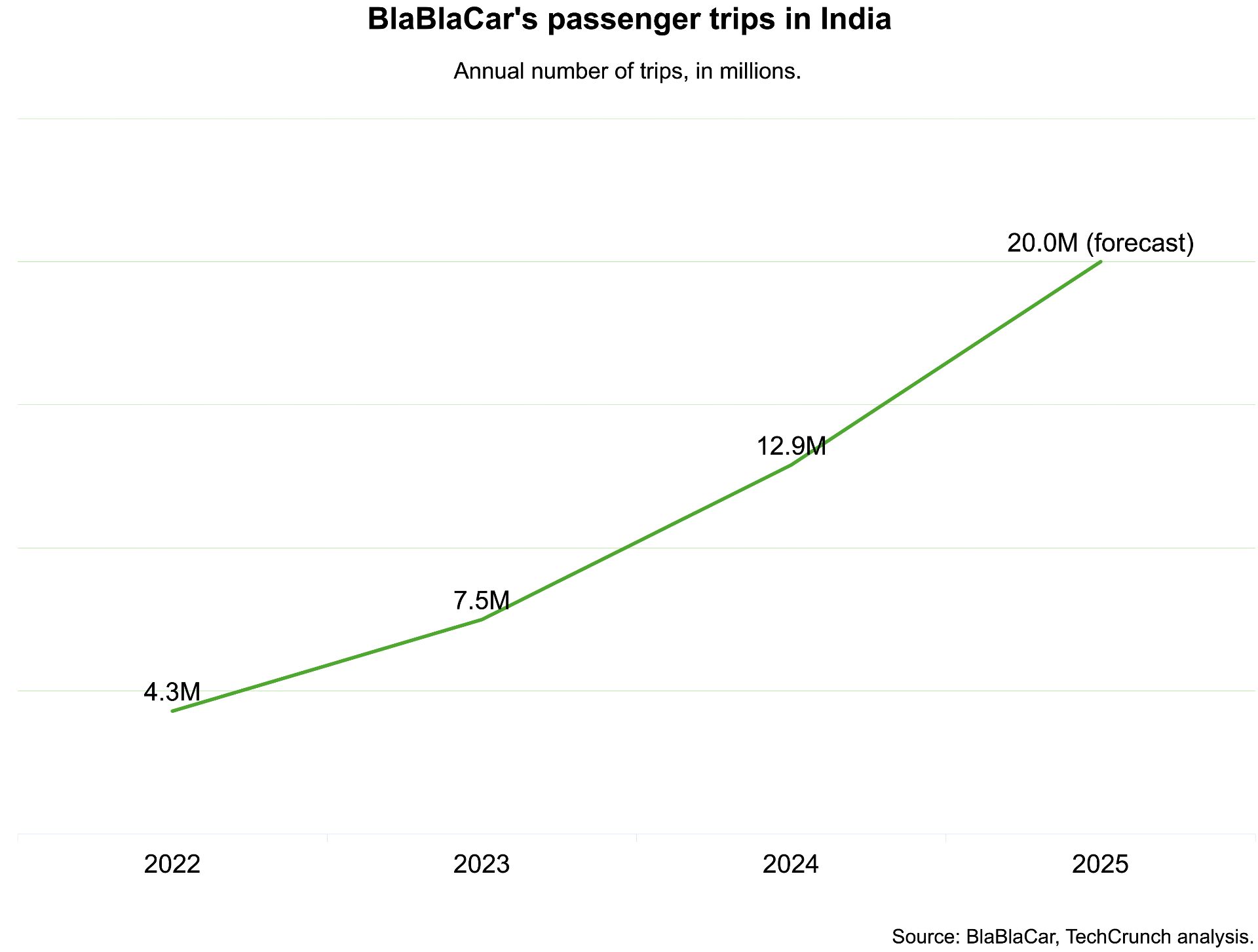

India, which BlaBlaCar previously exited, has now become its largest market