Bitcoin News Today: $6 Billion Bitcoin Options Set to Expire—Will It Trigger a Breakout or More Pain?

Bitcoin Options Expiry Spurs Cautious Sentiment as $6 Billion in Contracts Settle

The digital asset sector is at a crucial

This expiration comes as overall market volatility remains muted, with Bitcoin's implied volatility at 40 and Ethereum's at 60, signaling a lull compared to earlier wild price moves. According to Deribit analysts, traders are holding positions through expiry, with increased interest in calls above $120,000 and puts at $100,000. Short-term puts saw a surge in premiums earlier in the week as traders sought protection, while long-dated Ethereum calls stretching into 2026 suggest ongoing bullish expectations.

Looking past the options expiry, Bitcoin's price trends in 2025 are being shaped by spot ETF inflows and limited liquidity, with exchange reserves at their lowest in six years, as reported by

Wider macroeconomic developments add further complexity. The U.S. President Donald Trump's pardon of Binance's Changpeng Zhao led to a 5% jump in

Market participants are encouraged to keep an eye on on-chain data, ETF activity, and macroeconomic triggers. Deribit analysts warn that while volatility linked to expiry usually calms after 8:00 UTC, the combination of thin liquidity, large holder moves, and central bank actions is likely to keep Bitcoin trading within a narrow band until a clearer trend develops.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Pardon or Payment? Trump's Cryptocurrency Decision Ignites Discussion on the Influence of Lobbying

- Trump pardons Binance founder CZ after $740K lobbying, sparking scrutiny over crypto policy influence. - CZ’s 2024 prison sentence for AML violations led to a $4.3B settlement, now reversed by executive clemency. - Critics call it a "favor for crypto criminals," while analysts see relaxed U.S. crypto oversight boosting market confidence. - Trump’s pro-crypto stance includes disbanding enforcement teams, signaling regulatory shifts. - Binance’s $1M+ 2025 lobbying reflects ongoing efforts to rebuild trust

Dogecoin News Today: Meme Coin Battle: Excitement Versus Practical Use in the Quest for Supremacy

- Meme coin investors shift focus to Layer Brett ($LBRETT), an Ethereum L2 project combining meme appeal with utility, as Dogecoin (DOGE) ETF delays stall its momentum. - Pepe Coin (PEPE) struggles to sustain engagement despite social media-driven surges, lacking infrastructure for long-term on-chain activity. - Layer Brett offers low fees, instant transactions, and 590% APY staking, attracting $4.4M in pre-sales amid DOGE's 17% three-month price drop. - Shiba Inu (SHIB) retains brand strength but faces sc

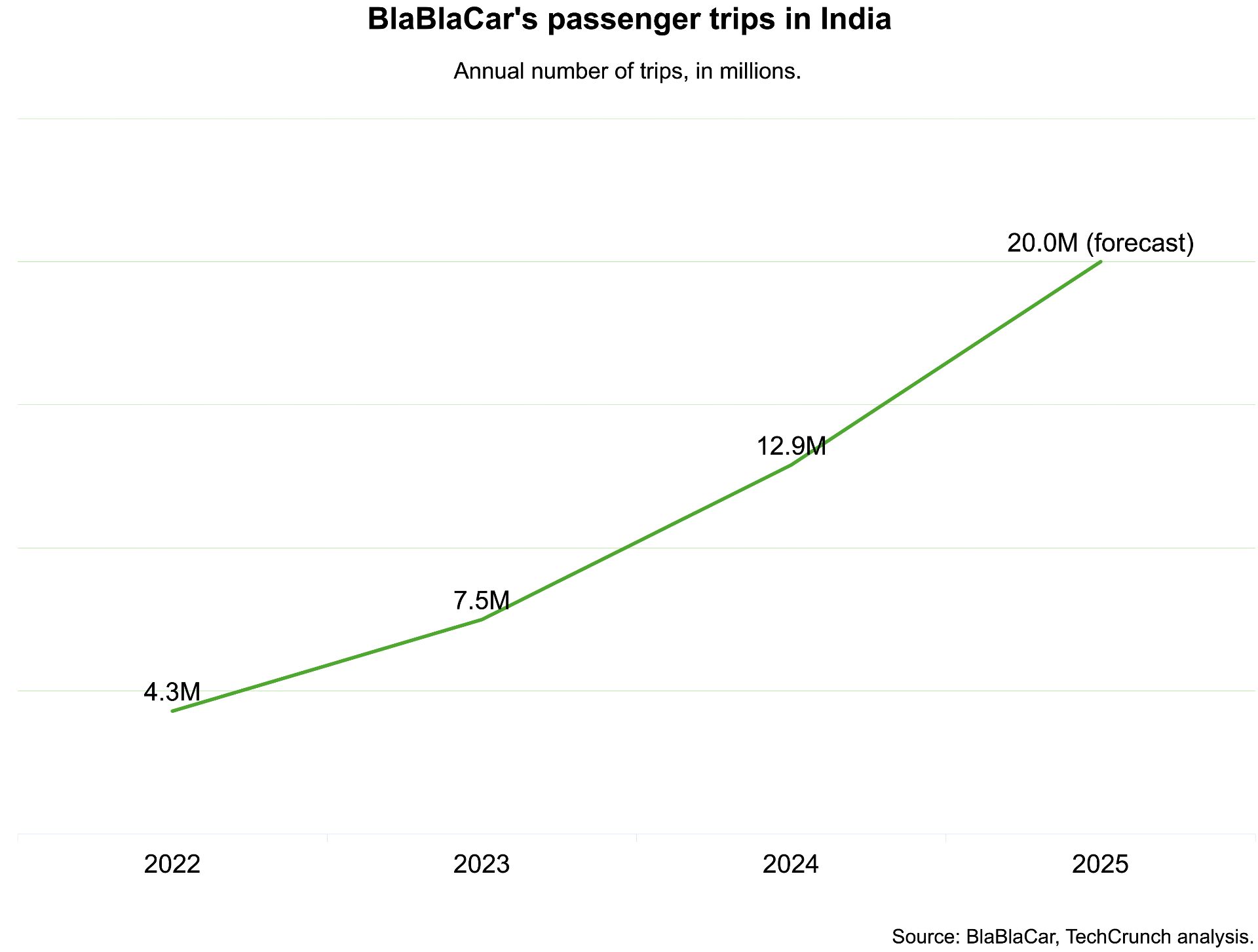

India, which BlaBlaCar previously exited, has now become its largest market