Bitcoin News Update: JPMorgan Now Recognizes Bitcoin and Ethereum as Equivalent to Gold in Its Collateral System

- JPMorgan Chase will let institutional clients use Bitcoin and Ethereum as loan collateral by 2025, advancing crypto's integration into traditional finance. - The program uses third-party custodians for security and mirrors strategies by Swiss banks, treating crypto assets as equivalent to gold and stocks. - This move could boost liquidity for crypto holders while reducing taxable events, aligning with broader industry efforts to expand digital asset adoption. - Despite CEO Jamie Dimon's past criticism, J

JPMorgan Chase & Co. plans to permit institutional clients to use

This new offering expands on JPMorgan’s previous acceptance of crypto-related ETFs as collateral, such as BlackRock’s

JPMorgan’s strategy could release substantial liquidity for crypto investors, allowing them to secure loans while still benefiting from any future price increases. As noted in a

The rollout of this program comes amid a broader wave of crypto adoption. For example,

Market sentiment has been cautiously positive. Both Bitcoin and Ethereum have experienced slight increases recently, with Bitcoin trading around $110,595 and Ethereum at $3,924 in late October 2025. Although JPMorgan CEO Jamie Dimon has previously dismissed Bitcoin as a "pet rock," the bank’s practical approach highlights the growing acceptance of cryptocurrencies within established financial circles.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Pardon or Payment? Trump's Cryptocurrency Decision Ignites Discussion on the Influence of Lobbying

- Trump pardons Binance founder CZ after $740K lobbying, sparking scrutiny over crypto policy influence. - CZ’s 2024 prison sentence for AML violations led to a $4.3B settlement, now reversed by executive clemency. - Critics call it a "favor for crypto criminals," while analysts see relaxed U.S. crypto oversight boosting market confidence. - Trump’s pro-crypto stance includes disbanding enforcement teams, signaling regulatory shifts. - Binance’s $1M+ 2025 lobbying reflects ongoing efforts to rebuild trust

Dogecoin News Today: Meme Coin Battle: Excitement Versus Practical Use in the Quest for Supremacy

- Meme coin investors shift focus to Layer Brett ($LBRETT), an Ethereum L2 project combining meme appeal with utility, as Dogecoin (DOGE) ETF delays stall its momentum. - Pepe Coin (PEPE) struggles to sustain engagement despite social media-driven surges, lacking infrastructure for long-term on-chain activity. - Layer Brett offers low fees, instant transactions, and 590% APY staking, attracting $4.4M in pre-sales amid DOGE's 17% three-month price drop. - Shiba Inu (SHIB) retains brand strength but faces sc

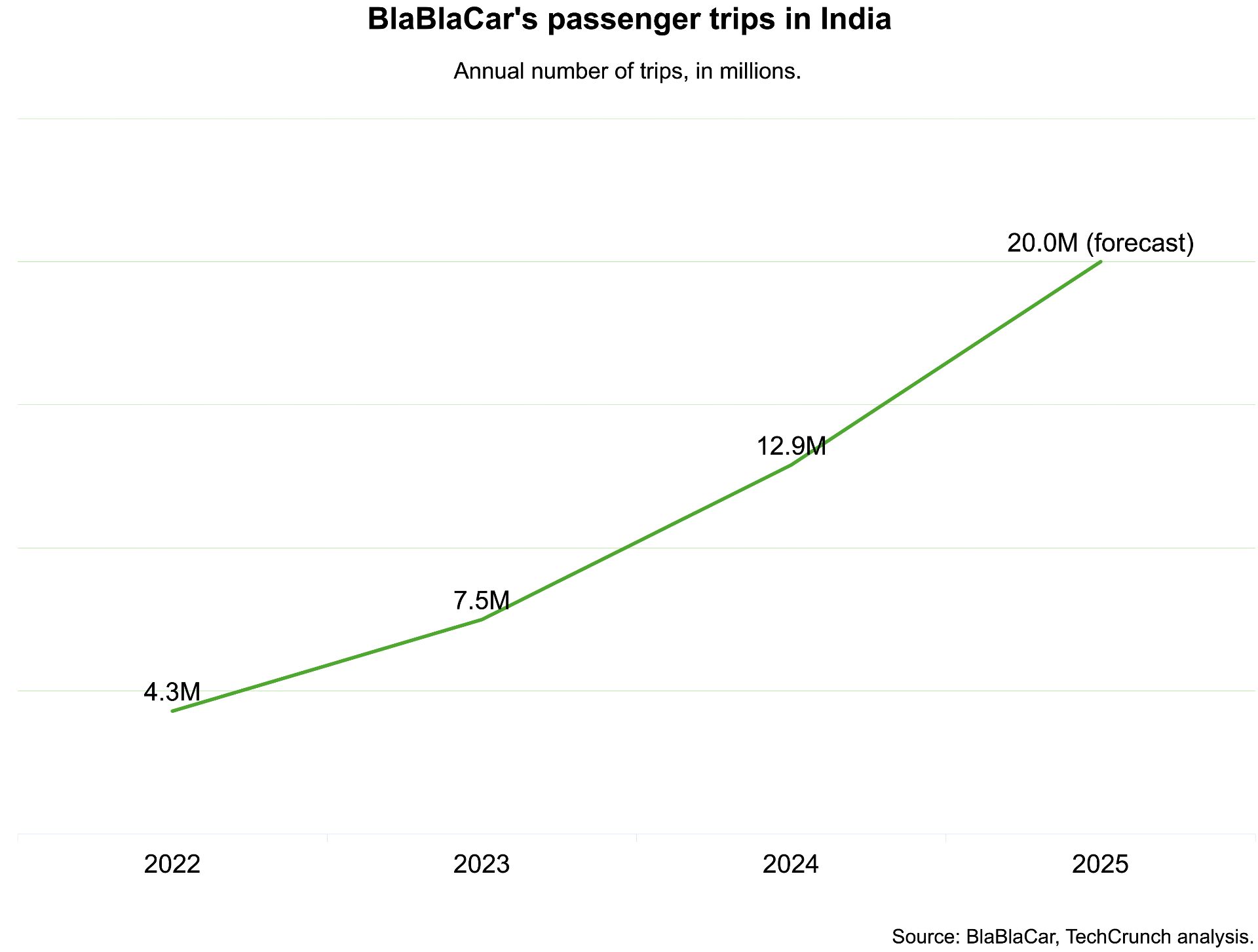

India, which BlaBlaCar previously exited, has now become its largest market