SUSHI 0.00% Over 24 Hours During Market Fluctuations and Lock-Up Contracts

- SUSHI closed at $0.5325 on Oct 26, 2025, with 0% 24-hour change but 60.78% annual decline amid market volatility. - Analysts link its near-term performance to macroeconomic conditions and sector investor sentiment, despite no direct ties to U.S. economic data. - Lock-up agreements expiring on Oct 26 for Nebius and Lucid Diagnostics may indirectly influence market liquidity perceptions. - Proposed backtesting strategies face technical issues (zero-price days, coding errors), requiring data filtering or al

On October 26, 2025, the SUSHI cryptocurrency token ended the day at $0.5325, showing no change over the previous 24 hours. Over the last seven days, SUSHI saw a modest increase of 0.76%. However, the token has dropped 20.38% in the past month and suffered a steep 60.78% decrease over the last year. This price action highlights ongoing volatility, with recent short-term gains failing to compensate for substantial long-term losses. Experts believe SUSHI’s short-term trajectory will largely depend on overall market trends, including global economic factors and prevailing investor attitudes toward cryptocurrencies.

During this period, several significant market events have taken place or are expected, such as the release of various U.S. economic statistics like unemployment figures and wholesale sales reports. Despite this, these events do not have a direct impact on SUSHI’s price, as the cryptocurrency market generally moves independently of traditional economic indicators. Still, worldwide economic conditions can shape investor risk preferences, which may indirectly influence digital assets like

It is also worth noting that lock-up periods for shares of companies such as Nebius Group N.V. and Lucid Diagnostics Inc. are set to conclude on October 26, 2025. These agreements, which began on September 10 and last for 46 days, prevent company insiders from selling or transferring certain shares and options. While these corporate events are not directly connected to SUSHI, they do signal broader market activity and could affect how investors view liquidity and capital movement in the wider financial landscape.

A backtesting method has been suggested to analyze how SUSHI’s price might behave by looking at historical trends. This method involves pinpointing specific event dates and checking if the token has historically fallen by at least 10% within 30 days after such events. However, the backtest faced two technical problems: a bug in the event backtest engine and a division-by-zero error caused by at least one day where the closing price was recorded as zero. These issues prevent the backtest from producing valid results unless the input data is adjusted.

To address this, one approach is to exclude all event dates where SUSHI’s closing price was zero, as well as any 30-day periods that include those dates. This would allow the event-based backtest to run on a cleaned dataset while keeping the original logic intact. Alternatively, a strategy backtest could be used, where trades are initiated on dates when a 10% drop is detected and closed after 30 days. This approach would generate risk and return statistics using the strategy backtest engine, which is better equipped to handle data irregularities. Both methods are feasible: the first maintains the original event-driven analysis, while the second offers more adaptability for assessing real-world performance.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Pardon or Payment? Trump's Cryptocurrency Decision Ignites Discussion on the Influence of Lobbying

- Trump pardons Binance founder CZ after $740K lobbying, sparking scrutiny over crypto policy influence. - CZ’s 2024 prison sentence for AML violations led to a $4.3B settlement, now reversed by executive clemency. - Critics call it a "favor for crypto criminals," while analysts see relaxed U.S. crypto oversight boosting market confidence. - Trump’s pro-crypto stance includes disbanding enforcement teams, signaling regulatory shifts. - Binance’s $1M+ 2025 lobbying reflects ongoing efforts to rebuild trust

Dogecoin News Today: Meme Coin Battle: Excitement Versus Practical Use in the Quest for Supremacy

- Meme coin investors shift focus to Layer Brett ($LBRETT), an Ethereum L2 project combining meme appeal with utility, as Dogecoin (DOGE) ETF delays stall its momentum. - Pepe Coin (PEPE) struggles to sustain engagement despite social media-driven surges, lacking infrastructure for long-term on-chain activity. - Layer Brett offers low fees, instant transactions, and 590% APY staking, attracting $4.4M in pre-sales amid DOGE's 17% three-month price drop. - Shiba Inu (SHIB) retains brand strength but faces sc

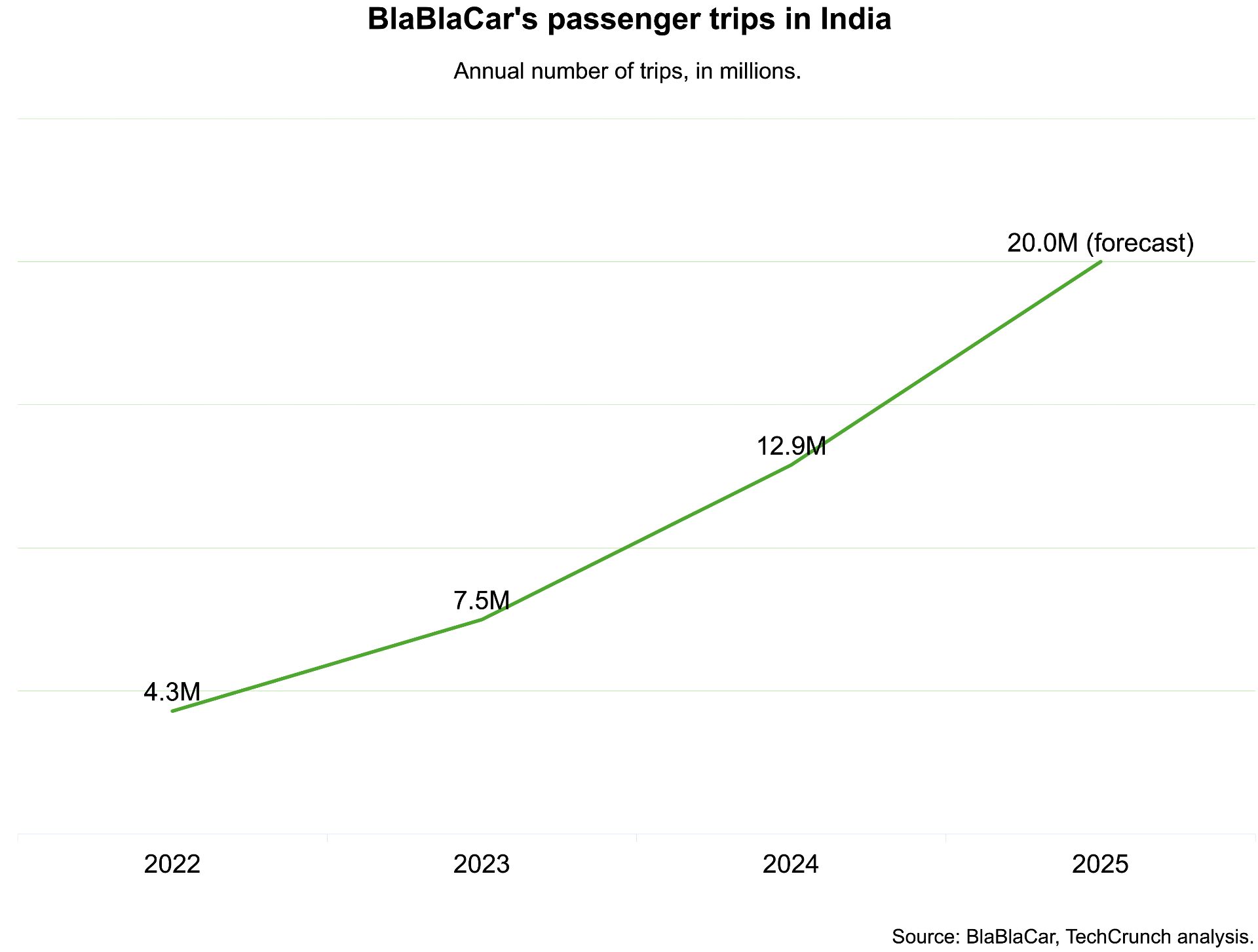

India, which BlaBlaCar previously exited, has now become its largest market