Michael Saylor of Strategy has hinted at a potential new Bitcoin purchase through a chart showing the company’s 640,250 BTC holdings valued at $69 billion, suggesting ongoing accumulation despite market pressures on corporate treasuries.

- Strategy leads with 640,250 BTC, representing 2.5% of Bitcoin’s total supply and outpacing other corporate holders.

- The company’s latest post on X fuels trader speculation of imminent buys, based on historical patterns.

- Corporate Bitcoin treasuries face NAV declines, with firms like Metaplanet seeing market values drop below holdings amid volatile prices.

Discover Michael Saylor’s latest hint at Strategy’s Bitcoin purchase amid treasury challenges. Explore holdings data and market impacts in this analysis by COINOTAG. Stay informed on crypto trends—read now!

What is Strategy’s Latest Hint on Bitcoin Purchases?

Strategy Bitcoin purchase signals continue as Michael Saylor, the company’s executive chairman, recently shared a chart on X illustrating cumulative Bitcoin acquisitions, emphasizing that “the most important orange dot is always the next.” This post highlights Strategy’s current holdings of 640,250 BTC, valued at approximately $69 billion based on recent market prices. The chart tracks 82 purchase events, with the aggregate cost basis at around $74,000 per coin, reflecting a 45.6% unrealized gain despite broader market fluctuations.

Saylor hints at upcoming Bitcoin purchase. Source: Michael Saylor

Saylor hints at upcoming Bitcoin purchase. Source: Michael Saylor

Strategy, formerly known as MicroStrategy, has positioned itself as a leader in corporate Bitcoin adoption. The firm’s strategy involves leveraging its balance sheet to acquire BTC as a primary treasury reserve asset. This approach, initiated in 2020, has drawn both praise for its boldness and criticism for its risks in volatile markets. Saylor’s cryptic messaging often precedes actual transactions, as seen in previous announcements where similar posts on social media were followed by confirmed buys. Last week, for instance, Strategy added 220 BTC for $27.2 million during a period when Bitcoin reached new all-time highs.

According to data from BitcoinTreasuries.Net, Strategy’s dominance in Bitcoin holdings underscores its pivotal role in the ecosystem. The company’s reserves not only bolster its financial position but also influence broader market sentiment, encouraging other firms to consider similar strategies.

How Do Corporate Bitcoin Treasuries Rank Globally?

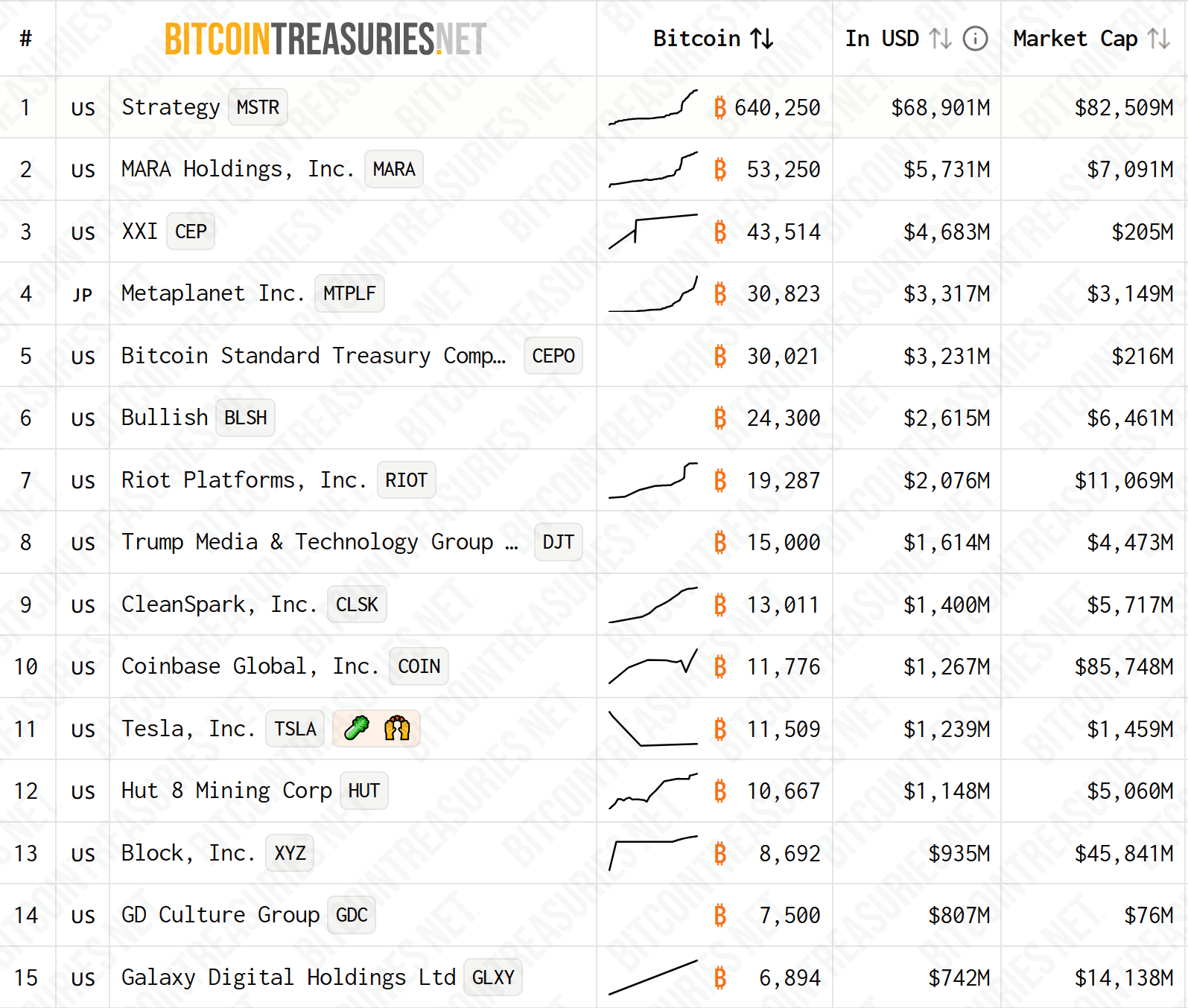

Strategy maintains its position as the top corporate Bitcoin holder with 640,250 BTC, equivalent to nearly 2.5% of Bitcoin’s circulating supply. This surpasses the combined holdings of the next several major players, including public miners and other treasuries. In comparison, MARA Holdings, formerly Marathon Digital, holds 53,250 BTC valued at about $5.7 billion, while XXI, also known as CEP, ranks third with 43,514 BTC worth $4.7 billion.

Japan-based Metaplanet follows in fourth place with 30,823 BTC, and the Bitcoin Standard Treasury Company, or CEPO, completes the top five at 30,021 BTC. Other notable U.S.-listed entities like Riot Platforms, CleanSpark, Coinbase, and Tesla hold smaller yet significant positions, with the top 15 public companies collectively amassing over 900,000 BTC. This concentration highlights the growing institutional interest in Bitcoin as a store of value.

Top 15 Bitcoin treasury firms. Source: BitcoinTreasuries.Net

Top 15 Bitcoin treasury firms. Source: BitcoinTreasuries.Net

BitcoinTreasuries.Net’s latest report emphasizes that these holdings reflect a strategic shift among corporations toward digital assets. For example, miners like MARA and Riot integrate Bitcoin directly into operations, while tech firms like Tesla view it as a hedge against inflation. Expert analysts from firms such as 10x Research note that such treasuries have driven Bitcoin’s adoption, with total corporate holdings now exceeding 1 million BTC when including private entities. However, this ranking is dynamic, influenced by market prices and ongoing acquisitions.

The data also reveals geographic diversity, with U.S. firms leading but Asian companies like Metaplanet gaining ground rapidly. Metaplanet, for instance, has aggressively expanded its BTC reserves in 2024, mirroring Strategy’s playbook but on a smaller scale. Official statistics from blockchain analytics platforms confirm these figures, showing no discrepancies in on-chain verification.

Frequently Asked Questions

What Makes Strategy’s Bitcoin Strategy Unique Among Corporates?

Strategy’s Bitcoin strategy stands out due to its scale and conviction, treating BTC as a core treasury asset rather than a speculative investment. With holdings acquired at an average of $74,000 per coin, the firm has benefited from price appreciation to $108,000 levels. Michael Saylor often cites Bitcoin’s scarcity and historical performance as justification, positioning it superior to traditional reserves like cash or bonds. This approach has yielded significant unrealized gains but requires careful debt management for further purchases.

Why Are Bitcoin Treasury NAVs Declining Recently?

Bitcoin treasury net asset values are declining due to a combination of share price corrections and Bitcoin’s price volatility. Many firms issued equity at premiums far above their BTC holdings’ value during the 2025 bull run, leading to a “round-trip” where valuations have reverted. For instance, Metaplanet’s market cap recently fell below its BTC reserve value, with its market-to-NAV ratio hitting 0.99. Analysts at 10x Research report billions in paper losses for retail investors, while companies retain actual Bitcoin assets. This trend underscores the risks of leveraged crypto exposure in public markets.

Key Takeaways

- Imminent Purchase Signal: Saylor’s chart post suggests Strategy’s next Bitcoin acquisition could boost holdings beyond 640,250 BTC, continuing its aggressive accumulation.

- Market Leadership: As the largest holder, Strategy influences corporate adoption, with its 2.5% supply stake highlighting institutional confidence in Bitcoin’s long-term value.

- NAV Challenges: Despite gains, treasury firms face valuation pressures; investors should monitor ratios like Metaplanet’s to gauge sustainability and potential buying opportunities.

Conclusion

Michael Saylor’s hint at a Strategy Bitcoin purchase reinforces the company’s unwavering commitment to expanding its treasury amid challenges like collapsing NAVs in the broader corporate landscape. With 640,250 BTC already secured and leading global rankings, Strategy exemplifies bold institutional adoption. As Bitcoin prices stabilize around $108,000, future acquisitions could further solidify its position. Investors are encouraged to track official announcements and market data for updates—COINOTAG will continue monitoring developments in corporate crypto strategies.