Tether Eyes Record $15B Profit in 2025 as USDT Adoption Surges Globally

Tether, the world’s largest stablecoin issuer, is poised for another record year of profitability, reinforcing its dominance in the digital dollar market. As the global demand for blockchain-based payment systems accelerates, the company continues to stamp its dominance in the crypto space.

In brief

- Tether projects $15B profit for 2025, marking another record year amid soaring demand for blockchain-based payments.

- USDT circulation nears $184B, with over 500M users globally as Tether strengthens its digital dollar dominance.

- The GENIUS Act boosts stablecoin adoption, reinforcing USDT’s role in expanding U.S. dollar influence worldwide.

- Tether diversifies beyond finance, becoming Juventus FC’s second-largest shareholder to support the club’s revival.

USDT’s Worldwide Expansion Drives Tether’s Record Profit Projections

According to Bloomberg, the El Salvador–based firm expects to earn about $15 billion in profit in 2025, up from $13 billion in 2024. This anticipated growth underscores the strength of Tether’s business model and operational efficiency , making it one of the most profitable companies in the world on a per-employee basis.

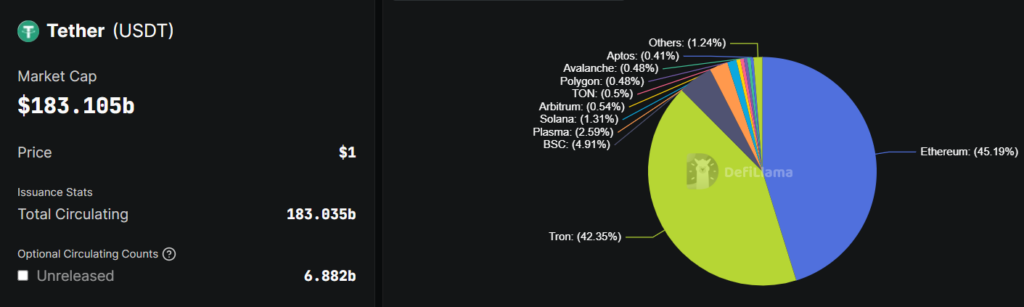

Tether’s profitability is driven largely by the widespread use of its flagship token, USDT, which now has nearly $184 billion in circulation . The token’s dominance has attracted investors and fueled global adoption of digital dollars, particularly in regions where access to traditional banking remains limited.

Recall that the company is reportedly seeking to raise $20 billion at a $500 billion valuation , signaling its ambition to expand beyond its core stablecoin business. Although CEO Paolo Ardoino has not confirmed specific figures, he acknowledged ongoing discussions with “a select group of high-profile investors.”

Among these talks is a deal with Antalpha Platform Holding, a crypto-financing firm, to secure roughly $200 million in financing for a new public company focused on gold-backed digital tokens .

Recently, Tether announced that USDT has surpassed 500 million users worldwide, marking a major milestone in its growth. Ardoino described the achievement as a pivotal step toward financial inclusion, noting that the stablecoin has become an essential tool for individuals and businesses in emerging markets.

He added that the company continues to attract strong interest from potential investors and is working to establish a valuation it considers highly attractive.

Digital Finance Enters New Phase with Rise of Stablecoins

Following the U.S. Congress’s passage of the GENIUS Act—the country’s first legislation focused on stablecoins—the market has gained even greater momentum. The move represents growing recognition of blockchain-based payment systems as a way to reinforce the U.S. dollar’s global influence.

Tether co-founder Reeve Collins sees this as part of a larger shift that could reshape the global monetary system . He noted that in the future, most traditional currencies are likely to exist in tokenized form, operating as stablecoins within digital payment networks.

All currency will be a stablecoin. So even fiat currency will be a stablecoin. It’ll just be called dollars, euros, or yen.

Reeve Collins

Ardoino added that USDT now reaches about 6.25% of the global population, underscoring the scale of digital dollar adoption worldwide.

Beyond finance, Tether is extending its reach into sports. It now holds 10.12% of Juventus Football Club’s capital and 6.18% of its voting rights, making it the Italian club’s second-largest shareholder after Exor , the Agnelli family’s holding company. Tether also plans to participate in Juventus’s €110 million capital increase, aimed at helping the club recover financially.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

3 Future-Proof Cryptos to Add to Your Portfolio for 2026 — LINK, AVAX, and ALGO

Smart Money Bets on These 3 Altcoins for Big Gains

XRP Price Holds at $2.04 as Short Leverage Builds Near $2.07

PEPE Maintains Tight Consolidation at $0.0544 as Prolonged Bull Flag Persists Between Defined Key Levels