Ethereum News Update: The Future of Ethereum’s Price Depends on ETF Inflows and Accommodative Fed Indications

- Ethereum ETFs saw $141.6M inflows on Oct 21, led by FETH and ETHA, reversing prior day's outflows. - Price near $3,857 faces $3,800 support and $4,500 resistance, with 35.2% surge in 24-hour trading volume to $45.8B. - Whale accumulation and 400% stablecoin growth signal bullish sentiment, while Fed's Oct 28-29 rate decision could drive further moves. - Upcoming Fusaka upgrade (Dec 3, 2025) aims to boost network efficiency, while Ferrari's 2027 crypto token hints at expanding adoption.

Ethereum's recent price movement has reignited discussions among market participants as U.S. spot

On October 21, ETF inflows reached $141.6 million, with Fidelity's FETH contributing $59.07 million and BlackRock's ETHA adding $42.46 million. This contrasts with the $145.7 million in outflows recorded the day before,

Technical signals present a mixed outlook. On the daily chart, Ethereum is trading below the Bollinger Band midpoint of $4,146, with resistance at $4,720 and support around $3,563. The narrowing bands suggest a significant move may be imminent, while the RSI at 41.15 points to bearish momentum but

The Fusaka upgrade, scheduled for December 3, 2025, will introduce a gas limit of 16.78 million units to improve network performance, which could appeal to long-term investors. At the same time, Ferrari's plan to launch a digital token for Hyperclub members in 2027 points to broader crypto adoption beyond payments, though its short-term effect on Ethereum's price is uncertain.

Looking at the broader market, Ethereum has dropped 21% over the past month from its $4,946 high, with a 6% loss in the last week. Nevertheless, open interest in Ethereum derivatives rose 0.6% to $43.8 billion, suggesting traders are rebuilding positions after recent declines. Market participants remain cautious, watching the ETH/BTC ratio and the invalidation level at $3,443 as key indicators. A strong close above $4,200 could set the stage for a move toward $4,500, while failing to reclaim this level may lead to another test of the $3,600–$3,500 range.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitget Releases Major Upgrades to GetAgent With Smarter Responses and Free Access for All Users

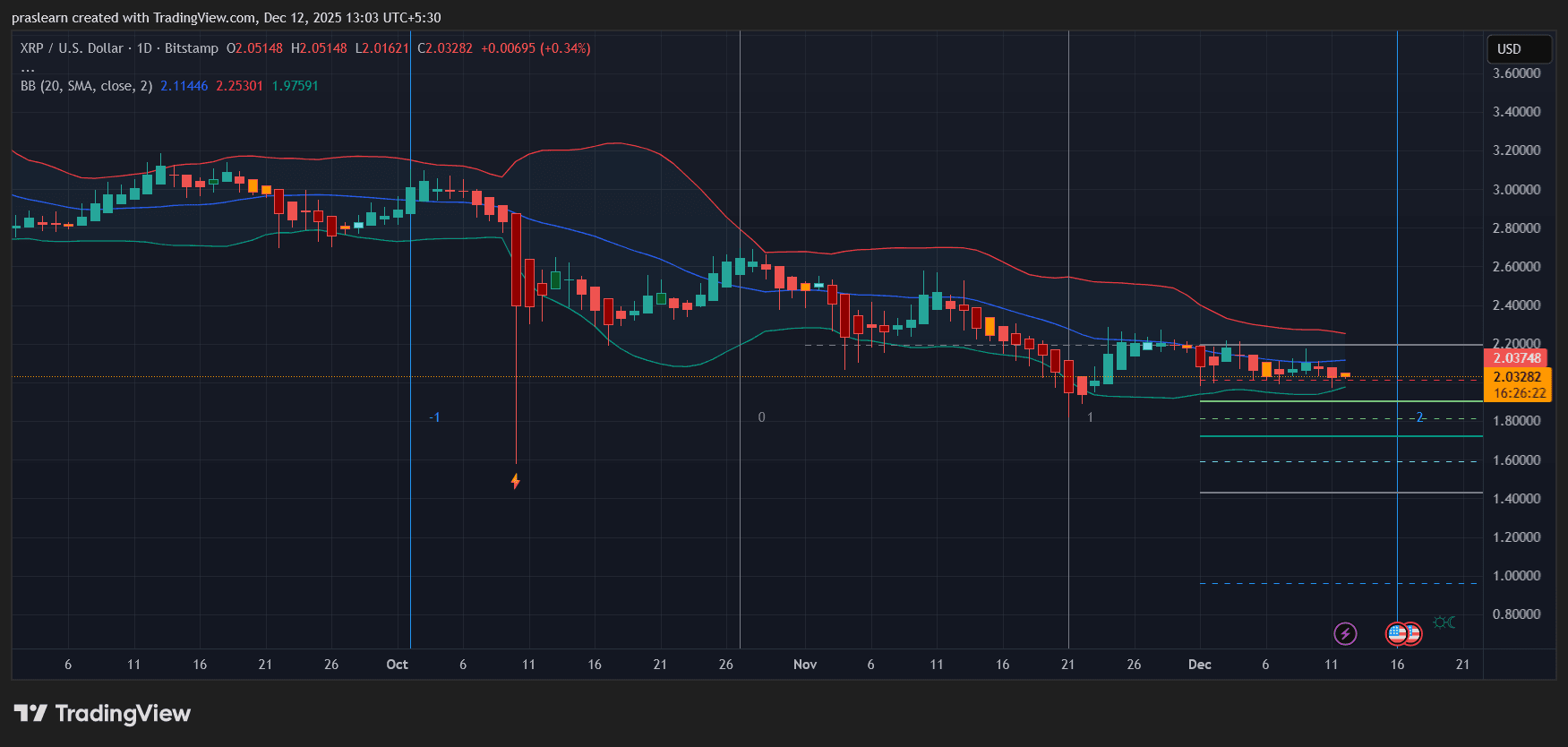

Will Fed Uncertainty Cap XRP’s Upside in 2026?

They already knew the TGA Game of the Year in advance, earning tens of thousands of dollars.

Violating history, yet persisting.

The Convergence of Social Justice and Renewable Energy Implementation in Developing Economies

- IEA data shows emerging markets need $45B/year by 2030 to achieve universal clean energy access, with Africa and Asia facing the greatest demand. - Renewable projects in low-income regions demonstrate nonlinear ESG impacts, with solar microgrids directly reducing energy poverty for 600M+ Africans. - PIDG's $27M guarantees mobilized $270M in African renewables, proving blended finance models can de-risk investments while creating 200-300MW capacity. - Kenya's M-KOPA and Indonesia's JETP showcase scalable