Meme Coin Craze: Comparing MoonBull's Tokenomics with Competitors' Risky Profits

- MoonBull ($MOBU) raised $450K in Stage 5 presale, offering 9,256% ROI with sustainable tokenomics including liquidity injections and burns. - Rivals BullZilla ($BZIL) and CULEX ($CULEX) also attract investors, with BZIL projecting 2,738% ROI and CULEX showing grassroots growth despite less structured models. - Upcoming U.S. inflation data and favorable crypto regulations create a speculative environment, favoring projects with transparent governance and deflationary mechanisms like MoonBull. - MoonBull’s

The crypto market is experiencing heightened activity in

BullZilla ($BZIL) is also seeing increased momentum. Meanwhile, CULEX ($CULEX) has established itself as a community favorite, surpassing $6,000. With its price set at $0.00002104 and an upcoming increase to $0.00002274, interest is growing, though its structure and utility are less developed compared to MoonBull.

Current market dynamics are favorable for meme coin expansion. The anticipated release of U.S. inflation statistics, crude oil stock data, and U.K. CPI numbers could impact overall market sentiment, according to

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitget Releases Major Upgrades to GetAgent With Smarter Responses and Free Access for All Users

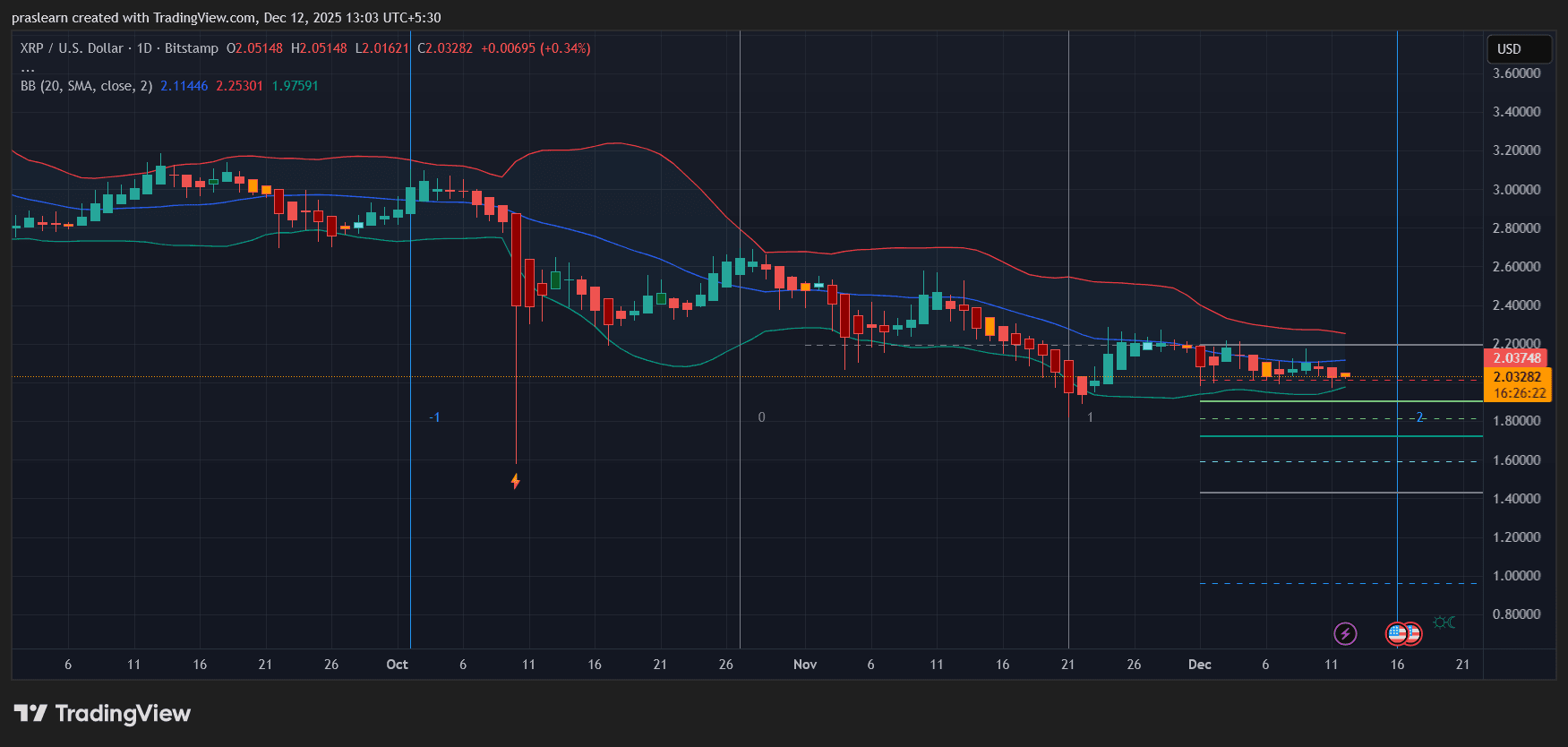

Will Fed Uncertainty Cap XRP’s Upside in 2026?

They already knew the TGA Game of the Year in advance, earning tens of thousands of dollars.

Violating history, yet persisting.

The Convergence of Social Justice and Renewable Energy Implementation in Developing Economies

- IEA data shows emerging markets need $45B/year by 2030 to achieve universal clean energy access, with Africa and Asia facing the greatest demand. - Renewable projects in low-income regions demonstrate nonlinear ESG impacts, with solar microgrids directly reducing energy poverty for 600M+ Africans. - PIDG's $27M guarantees mobilized $270M in African renewables, proving blended finance models can de-risk investments while creating 200-300MW capacity. - Kenya's M-KOPA and Indonesia's JETP showcase scalable