DraftKings’ shift towards prediction markets fuels broader revenue streams

- DraftKings acquires Railbird to launch prediction markets, expanding beyond sports betting into finance, culture, and entertainment sectors. - Partnership with Polymarket aims to democratize event betting, leveraging DraftKings' mobile platform and brand for real-world outcome contracts. - Stifel and Berenberg upgrade DKNG stock to Buy, citing margin growth and strategic diversification despite security breaches and revenue shortfalls. - Renewed Fantasy Life collaboration enhances DFS content, targeting

DraftKings Inc. (NASDAQ:DKNG) is ramping up its involvement in prediction markets, marking a notable shift from its core sports betting business as fantasy football season reaches a crucial point. By acquiring Railbird Technologies—a federally approved exchange—DraftKings is set to introduce a dedicated prediction app, allowing users to buy and sell contracts based on outcomes in areas like finance, pop culture, and entertainment. This initiative, which coincides with the NFL’s Week 8 fantasy matchups, highlights DraftKings’ strategy to broaden its revenue base and adapt to changing consumer interests in digital entertainment, as reported by

The purchase of Railbird, completed after trading hours on October 21, 2025, gives

For those invested in fantasy football, timing is everything. As Week 8 games help determine playoff contenders, DraftKings’ expanded offerings could impact DFS (Daily Fantasy Sports) tactics. Experts point out that the company’s move into prediction markets may spark new approaches in DFS stacking—combining top-performing players with advantageous matchups—and identifying value picks for cash contests. While the original content did not specify Week 8 player recommendations, the overall trend of merging prediction tools with fantasy platforms points to a future driven by analytics and data-based choices.

The company’s shares have remained steady amid these strategic changes. Stifel has maintained its Buy rating and a $51 price target for

DraftKings is also enhancing its content lineup beyond DFS. Its renewed partnership with Matthew Berry’s Fantasy Life, now extended to LG Channels, is designed to deliver year-round fantasy football analysis. The partnership introduces fresh programming, on-demand content, and coverage of the NFL playoffs and the 2026 draft, appealing to fans looking for a competitive advantage, as noted by

As DraftKings tackles regulatory and operational challenges, its expansion into prediction markets reflects larger trends in the industry. The Trump administration’s supportive stance on gambling and investments like Polymarket’s $2 billion backing from Intercontinental Exchange create a promising climate for innovation. Still, achieving profitability remains a priority, with Jefferies analysts highlighting the potential for prediction markets to encourage regulatory acceptance in new states, as previously mentioned by Yahoo Finance.

---

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Gnosis Chain to Hard Fork and Recover $120M Lost in Balancer Hack

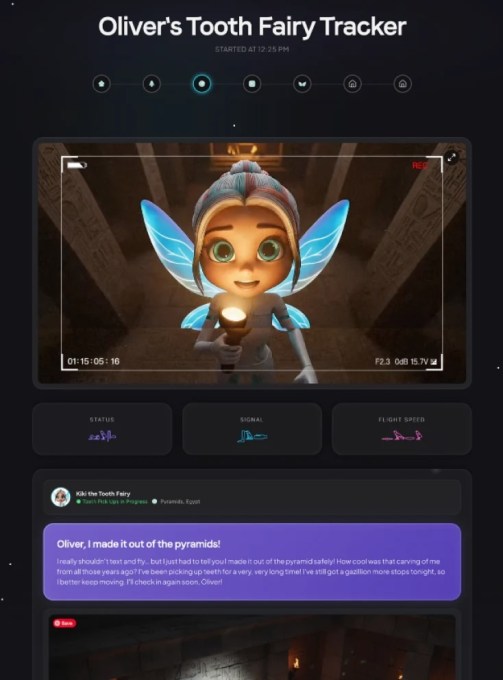

The tooth fairy just got reimagined for the tech-savvy generation

Why is Bitcoin (BTC) Still Falling? Analysts Agree on the Reason and Warn of the Upcoming Critical Day!