USDC circulation increased by approximately 600 million in the past 7 days

according to official data, in the 7 days ending on October 23, Circle issued approximately 6.2 billion USDC, redeemed approximately 5.6 billion USDC, and the circulation increased by approximately 600 million tokens. The total circulation of USDC is 76.4 billion tokens, with a reserve of approximately 76.7 billion US dollars, including approximately 9.9 billion US dollars in cash, and the Circle Reserve Fund holds approximately 66.7 billion US dollars.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

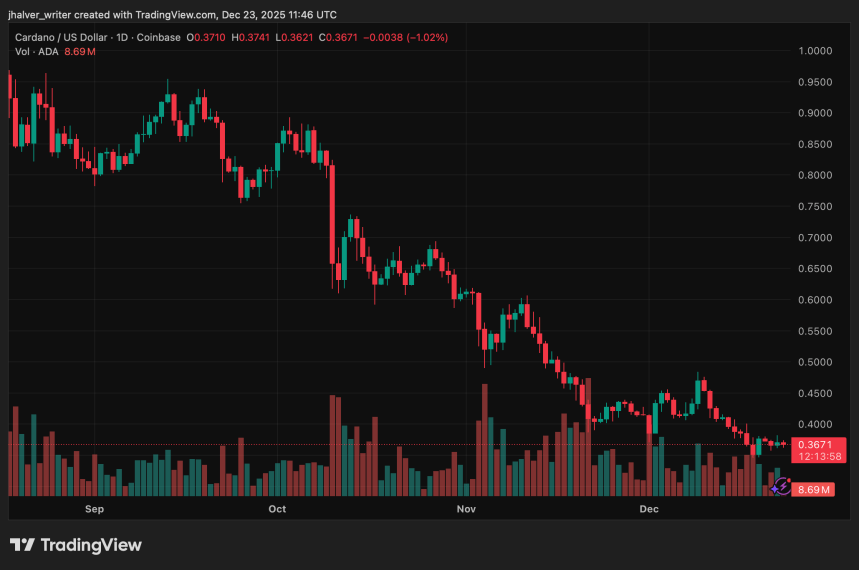

Founder Signals Long-Term Opportunity in Cardano DEXes as Price Consolidation Persists

AI Crypto Coins: ETHZilla Liquidates $74M Worth of ETH, DeepSnitch AI’s $875K Presale Takes Hold of the AI Sector

XRP Breaks $1.95 Support After 13 Months, Analyst Sees $0.90 Next

TikTok Users Claim They’ve 'Unredacted' the Epstein Files